Trading Diary

August 13, 2002

The primary cycle trend is downwards. A rally above 8806 will signal a reversal, while a correction below 8000 will signal continuation.

The Chartcraft NYSE Bullish % Indicator has given a bull alert signal, with a reading of 32% (August 12).

The Nasdaq Composite retreated 2.9% to close at 1269, reversing

the follow-through from the 9th.

The primary cycle is in a down-trend. The failure to reach the

1355 resistance level is a bearish sign.

The S&P 500 declined 19 points to close at 884.

The primary cycle trends downwards. A break above 912 will

signal a reversal.

The Federal Reserve left the overnight bank lending rate unchanged at 1.75% but changed its bias, towards greater risk of economic weakness and lower risk of inflation. (more)

Flat third-quarter results from the largest maker of semiconductor-manufacturing equipment. (more)

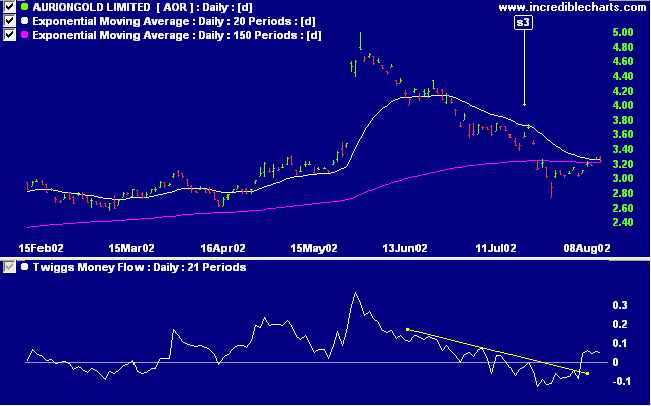

AOR report a net profit of $ 63.2 million, up from $ 47.7 million last year. (more)

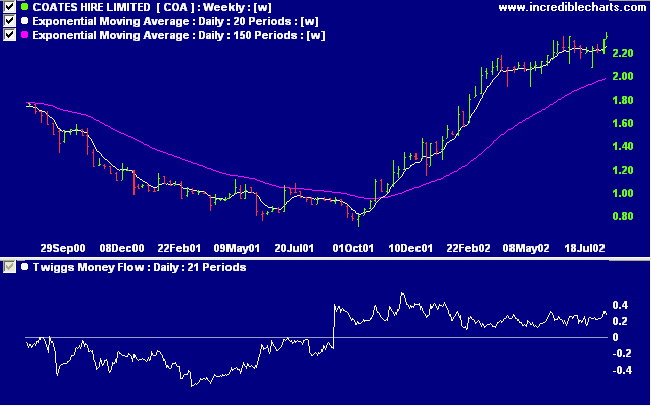

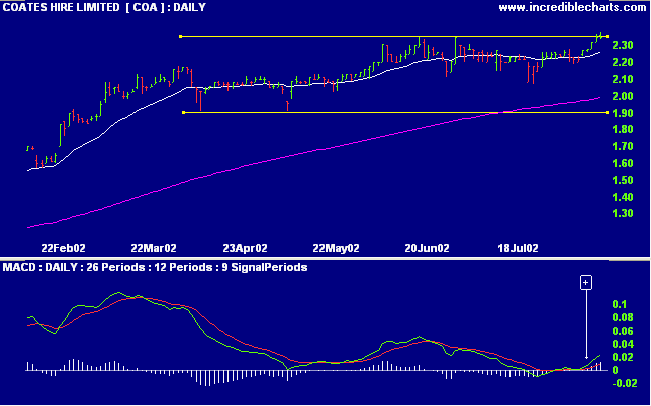

COA has made a new 2-year high, after a recent period of consolidation. The day's close was weak and volume uninspiring, so wait for further confirmation. Relative strength (price ratio: xao) is rising, while Twiggs money flow has shown exceptional accumulation since mid-2001 and MACD is bullish.

Begin with the end in mind.

- Stephen Covey.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.