Trading Diary

July 26, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow made further gains, closing up 0.95% at

8264. The 8000 level is again acting as support. Primary and

secondary cycles trend downwards.

The Chartcraft NYSE Bullish % Indicator has a reading of 24% (July 25). See Bullish % Index for more details.

The Nasdaq Composite formed a second inside day, rising 1.8% to close at 1262. Primary and secondary cycles are in a down-trend.

The S&P 500 closed up 14 points at 852.

Primary and secondary cycles trend downwards.

Consumer confidence

The final University of Michigan figure for July came in at

88.1, a lot higher than 86.5 from the preliminary survey.

(more)

GE Capital

Following accounting concerns, Chairman Denis Nayden is ousted by

parent General Electric Co. and GE Capital is split into four

units. (more)

Gold

Gold fell through the key $US 310 support level with spot gold at

$US 303.5 and August futures at $US 303.3. (more)

Bear market - no end in sight

Analyst Paul F Desmond says that "panic selling" has not been

followed by sufficient "panic buying" for this to be the end of

the bear market. (more)

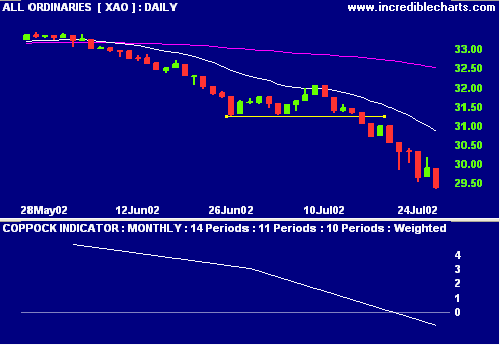

ASX Australia

The All Ordinaries fell 50 points to close at 2941 on strong

volume.

Trading Diary

The primary cycle and secondary cycles trend down. The next

support level is 2828, from September 2001

Slow Stochastic (20,3,3) and MACD (26,12,9) are below their

signal lines. Exponentially-smoothed money flow signals

distribution.

The

Coppock indicator is likely to finish the month below zero,

for the first time since 1995.

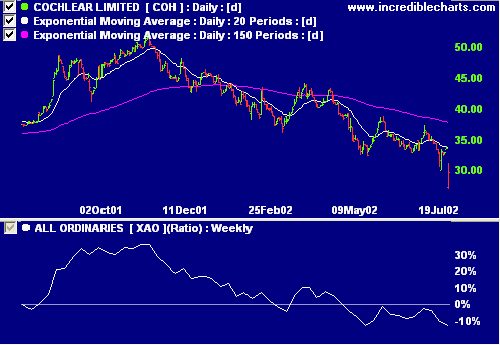

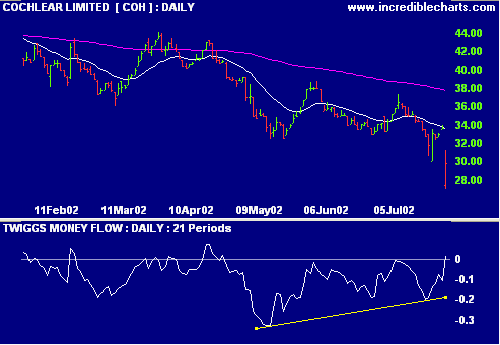

Cochlear ache [COH]

Cochlear shares tumble after the US Food and Drug

Administration warns of 25 cases where patients with an

inner-ear implant contracted meningitis, including 9 deaths.

(more)

Relative strength (price ratio: xao) and MACD are declining

while, surprisingly, exponentially-smoothed money flow signals

a bullish divergence.

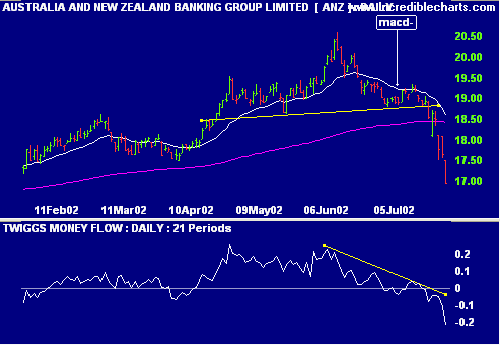

Bad debt concerns weaken bank stocks [ANZ]

Bank stocks have declined since ANZ disclosed its exposure to

troubled UK Marconi group. (more)

ANZ is approaching the target of 16.80 from a completed head

and shoulders pattern. Relative strength (price ratio: xao),

MACD and exponentially-smoothed money flow are all declining.

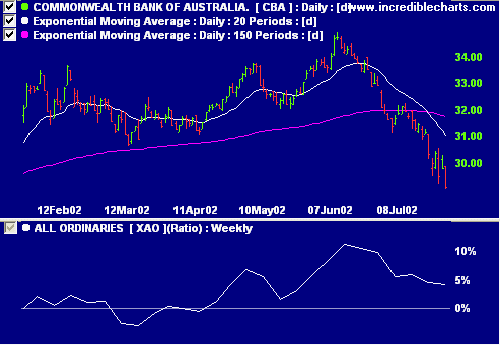

Commonwealth Bank [CBA] is also declining, with falling

relative strength (price ratio: xao), MACD and

exponentially-smoothed money flow.

Sector Analysis

Stage changes are highlighted in bold.

Stage changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is rising)

- Materials [XMJ] - stage 4

- Industrials [XNJ] - stage 4 (RS is rising)

- Consumer Discretionary [XDJ] - stage 4

- Consumer Staples [XSJ] - stage 4 (RS is rising)

- Health Care [XHJ] - stage 4

- Property Trusts [XPJ] - stage 3 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4

- Information Technology [XIJ] - stage 4

- Telecom Services [XTJ] - stage 1 (RS is rising)

- Utilities [XUJ] - stage 1 (RS is rising)

Sectors: Relative Strength

A stock screen of equities using % Price Move (1 month: +10%) is dominated by:

A stock screen of equities using % Price Move (1 month: +10%) is dominated by:

- Application Software

- Diversified Financial Services

- Diversified Metals & Mining

- Gold

- Internet Software & Services

- Oil & Gas Exploration & Production

- Real Estate Management & Development

Conclusion

Short-term: Enter short in selected areas. The Slow

Stochastic and MACD are below their respective signal lines.

Keep stops tight.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

I think it would be a good idea.

- Mahatma Ghandi, when asked what he thought of Western civilization.

I think it would be a good idea.

- Mahatma Ghandi, when asked what he thought of Western civilization.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.