Trading Diary

July 3, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow again tested the 9000 support level

before rallying to close 0.5% up at 9054 on above-average

volume.

This is a bear market, with primary and secondary cycles trending down.

This is a bear market, with primary and secondary cycles trending down.

The Nasdaq Composite gained 1.6% to close at

1380.

The primary and secondary cycles are in a down-trend.

The S&P 500 rose 5 points to 953.

Primary and secondary cycles trend downwards.

IDT bids for WorldCom

Smaller telecom player IDT makes a $US 5

billion bid for MCI and other assets of WorldCom. (more)

Home Depot

The retailer's shares surge 9% as a heat wave boosts sales of

air-conditioners. (more)

Gold

I spoke with Rod Holden from the Gold Report

yesterday. He is still bullish on gold and believes that it will

rally strongly in 2 to 3 months.

Vivendi Universal names new CEO

Jean-Rene Fourtou says his first task is to avoid a "liquidity

crisis". (more)

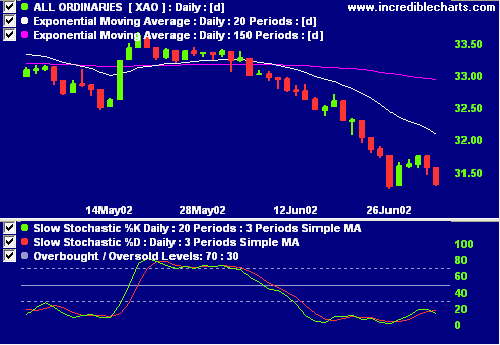

ASX Australia

The All Ordinaries finished 26 points lower at 3133 on average

volume.

Primary and secondary cycles are in a bear trend.

Slow Stochastic (20,3,3) has moved back below its signal

line.

Exponentially-smoothed Money Flow is

below zero, signaling distribution.

Dollar dips below 56 US cents

The dip was sparked by speculation that NAB is preparing to

acquire troubled UK bank, Abbey National. (more)

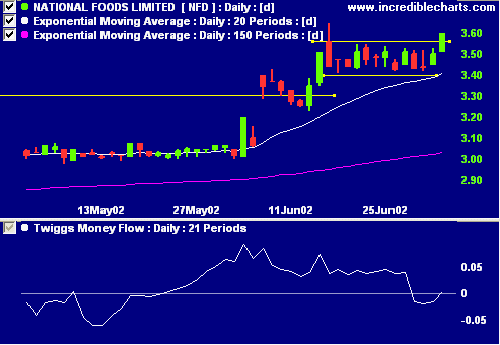

National Foods [NFD]

Speculation that New Zealand-based Fonterra

is preparing for a takeover bid pushed NFD to a record

close. (more)

Relative Strength (price ratio: xao) and

MACD are bullish while exponentially-smoothed Money Flow is improving.

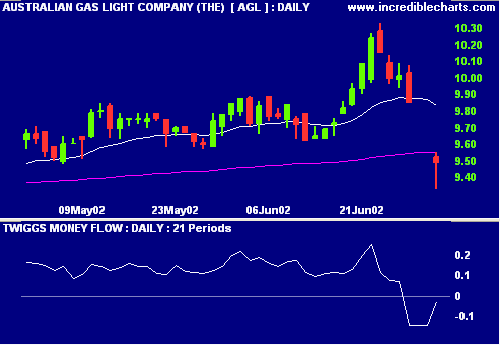

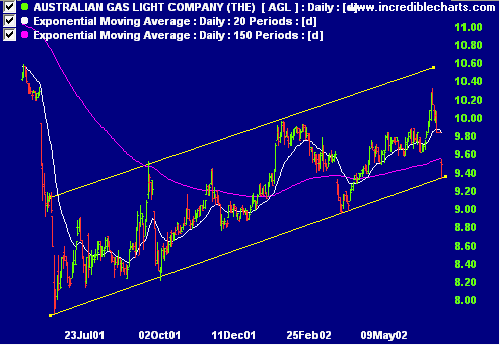

Australian Gas Light [AGL]

Back Issues

AGL fell sharply on resumption of trading

but made a partial recovery, closing near the day's high.

The candlestick

hammer signals a reversal.

A reader sent me a chart of AGL depicting channel lines. I am not a big user of channel lines myself but I must admit that they have worked very well on AGL over the last 12 months.

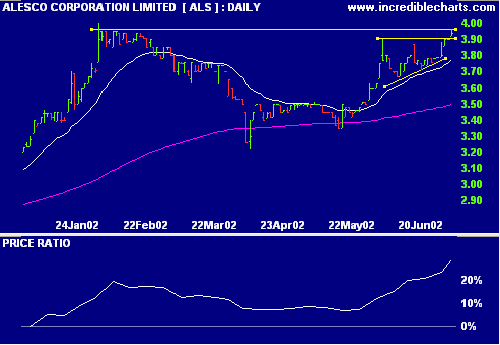

Alesco [ALS]

ALS has broken through resistance at $3.90 and is testing further resistance levels at $3.95 to $4.00. Relative Strength (price ratio: xao) and exponentially-smoothed Money Flow are strong, while MACD is bullish. Caution: volumes are low.

ALS has broken through resistance at $3.90 and is testing further resistance levels at $3.95 to $4.00. Relative Strength (price ratio: xao) and exponentially-smoothed Money Flow are strong, while MACD is bullish. Caution: volumes are low.

Conclusion

Short-term: Short - the Slow Stochastic and MACD are

below their signal lines.

Medium-term: Wait for the All Ords to

signal a reversal.

Long-term: Wait for a bull-trend on the

Nasdaq or S&P 500 (primary cycle).

Colin Twiggs

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.