Trading Diary

June 27, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow rallied 1.6% to close at 9269 on strong

volume.

This is a bear market, with primary and secondary cycles trending down.

This is a bear market, with primary and secondary cycles trending down.

The Nasdaq Composite dipped after a strong

opening but recovered to 1459, posting a 2% gain.

The primary and secondary cycles are in a down-trend.

The S&P 500 rallied 17 points to close at

990.

Primary and secondary cycles trend downwards.

Pfizer.

The world's biggest drug-maker plans a $US 10 billion share

buy-back over the next 10 years.

(more)

Nike

Nike Inc. reports a 28%

increase in fourth-quarter profits due to better inventory

control. (more)

Growth rate up to 6.1%

First quarter GDP grew at

an annualized rate of 6.1%, topping previous estimates of

5.6%. (more)

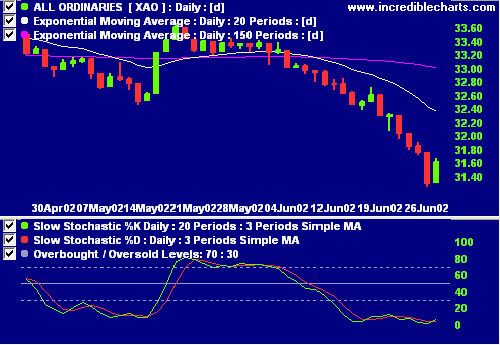

ASX Australia

The All Ordinaries recovered 31 points to close

at 3161 on above-average volume, completing a hook

reversal.

Primary and secondary cycles are in a bear

trend.

Slow Stochastic (20,3,3) has moved above its

signal line.

Chaikin Money Flow signals distribution.

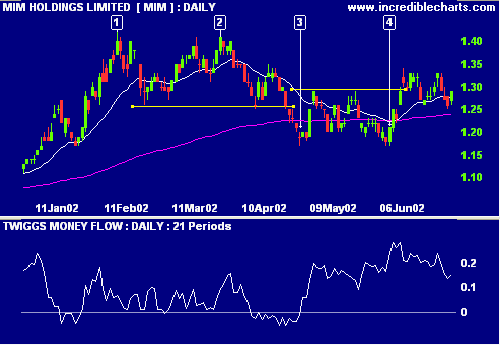

MIM Holdings [MIM]

Back Issues

MIM expands its gold and copper interests,

acquiring the remaining 49% stake in the Ernest Henry

mine. (more)

Relative Strength (price ratio: xao) is improving, Chaikin

Money Flow signals accumulation and the MACD shows a bullish

divergence.

Note the double top at [1] and [2] and the double bottom at [3]

and [4], both failing to reach their targets.

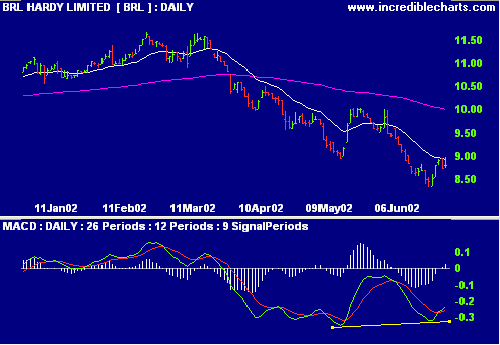

BRL Hardy [BRL]

BRL's US joint venture, Pacific Wine Partners, has more than doubled last year's earnings performance in only 5 months. (more)

BRL's US joint venture, Pacific Wine Partners, has more than doubled last year's earnings performance in only 5 months. (more)

Relative Strength (price ratio: xao) and

Chaikin Money Flow are weak, while MACD signals a bullish

divergence.

Conclusion

Short-term: Avoid long and short - the Slow Stochastic has

moved above its signal line.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.