Trading Diary

May 31, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow rallied above 10000 before falling back

to close almost unchanged at 9925 on above-average

volume.

The secondary down-trend continues but has to break through the 9800 (and arguably 9500) support levels to start a primary bear-trend.

The secondary down-trend continues but has to break through the 9800 (and arguably 9500) support levels to start a primary bear-trend.

The Nasdaq Composite fell 1% to close at

1615.

The primary and secondary trends are down.

The S&P 500 mimicked the Dow, closing up

slightly at 1067.

The primary and secondary trends are down.

Adelphia fails to communicate

The broadband

telecommunications and cable network company has been de-listed

by Nasdaq for failing to submit SEC financial statements, after

concerns about off-balance sheet debt. (more)

Factory orders rise

Factory orders rose by 1.2%

in April according to US Commerce Dept. (more)

ASX Australia

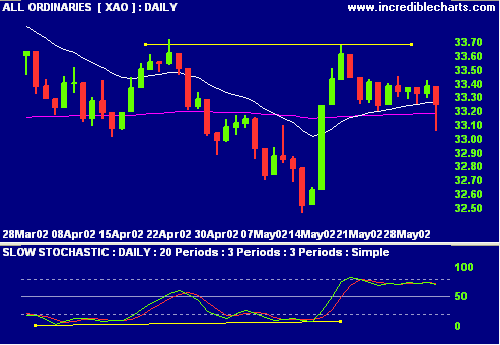

The All Ords recovered after a sharp fall to

close down 14 points at 3325. Volume was high after changes to

MSCI index stock weightings.

The primary trend is up, secondary trend - down.

A break above 3370 would complete an

inverted head and shoulders pattern.

Chaikin Money Flow continues to signal

accumulation.

Slow Stochastic (20,3,3) has crossed back below

its signal line.

Dollar rises

The Australian dollar responded positively

to a statement by RBA governor Ian Macfarlane that interest

rates must rise. (more)

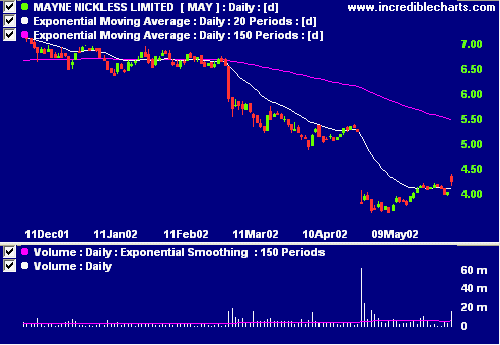

Mayne stock rise [MAY]

The market reacted

favorably to news that Mayne is to focus on its core health

operations. (more)

Relative Strength (price ratio: xao) and MACD

are weak but Chaikin MF has crossed to positive territory,

signaling accumulation.

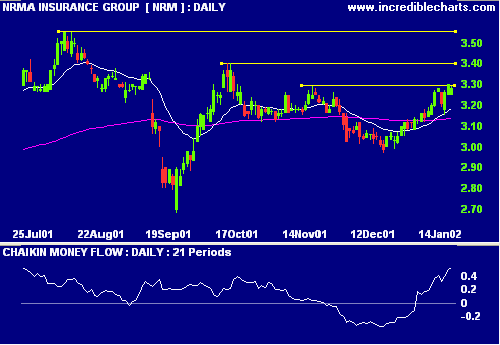

NRMA [IAG]

The board of NRMA is divided over proposed fee

increases to members. (more)

Chaikin MF shows strong accumulation, while

MACD and Relative Strength (price ratio: xao) are

neutral. Overhead resistance at 3.30, 3.40 and 3.55 will

make progress difficult.

Conclusion

Short-term: Avoid long - Stochastic is below

its signal line. Maintain tight stop-losses.

Medium-term: Wait for the All Ords to signal a

reversal.

Long-term: Wait for a bull-trend on the Nasdaq

or S&P 500 (primary cycle).

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.