Trading Diary

May 13, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow is experiencing huge volatility around

the 10000 level - up 1.7% today, to 10109 on normal

volume.

The Nasdaq Composite climbed 3.2% to 1652, still in a secondary cycle down-trend.

The S&P 500 returned to the 1070 level, up

1.8% at 1074.

Sears makes cash acquisition

Sears Roebuck acquires specialty catalog

retailer, Lands End for $US 1.9 billion cash, sending a positive

signal to the market. (more)

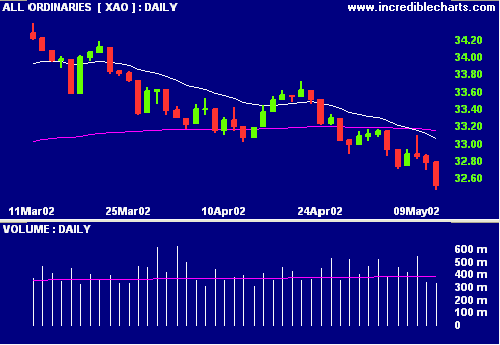

ASX Australia

The All Ords dropped sharply to 3252 on lower

volume, approaching the target of 3230 to 3240.

Inside information

generally available to the public

The market appears

to receive news of profit downgrades or upgrades well before

the official announcement. (more)

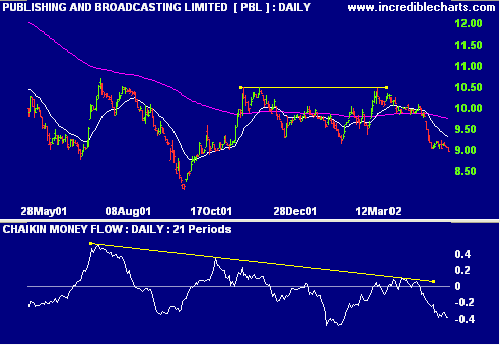

Publishing and Broadcasting Limited [PBL]

Standard and Poors downgraded

its rating outlook on PBL - performance depends on "a recovery in

advertising demand". (more)

MACD and Chaikin Money Flow both show bearish

divergences.

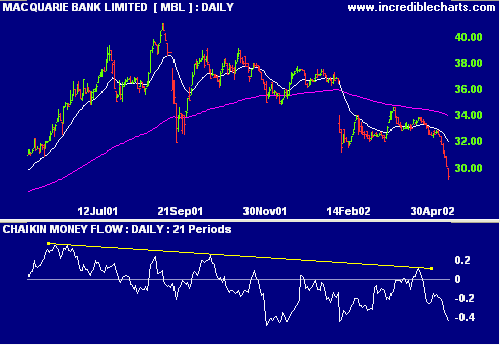

Macquarie Bank [MBL]

The market reflects concerns

over MBL annual results, to be released on Thursday. The bank is

shifting its long-term emphasis to building reliable annuity

income streams. (more)

MACD and Chaikin Money Flow show strong

distribution over the last year.

Conclusion

Short-term: Avoid long.

Medium-term: Wait for the All Ords to form a

base.

Long-term: Wait for the Nasdaq or S&P 500 to

form a base.

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.