Trading Diary

May 9, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

More uncertainty - The Dow formed an inside day,

closing 1% down at 10037 on normal volume.

The Nasdaq Composite also formed an inside day, down 2.7% at 1650. The secondary cycle is still in a down-trend.

The S&P 500 was down 1.75% at 1073, testing

the 1070 level.

WorldCom cut to "junk bond" rating

Moody's Investors Service cut the credit rating

on WorldCom's $32 billion of debt three levels. (more)

Wal-mart

Stocks fall as April sales

disappoint. (more)

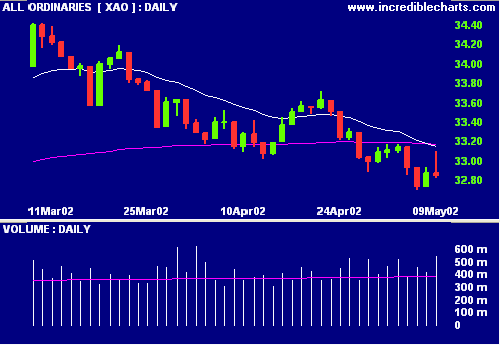

ASX Australia

The All Ords rallied strongly in the morning but

encountered heavy selling later to finish almost unchanged at

3286. Sellers are back in control. The target for the correction

is 3230 to 3240.

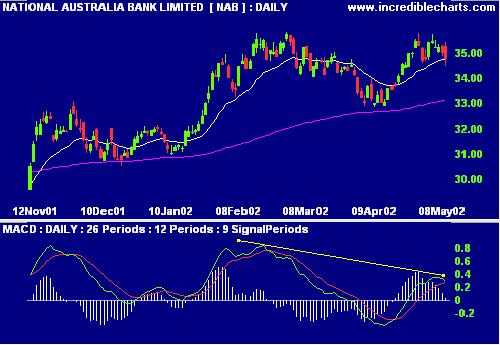

NAB [NAB]

National Australia Bank lifted its first-half profit by 11% and

extends it share buy-back plan by $1 billion.

(more)

Moving

averages look positive but MACD is bearish.

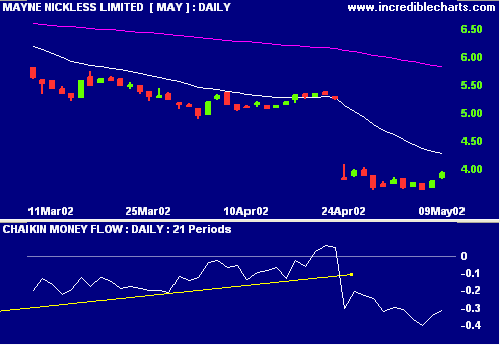

Mayne [MAY]

Mayne Group Limited rose

3.7% on speculation that the company would announce a share

buy-back. (more)

Chaikin Money Flow and MACD are still

weak.

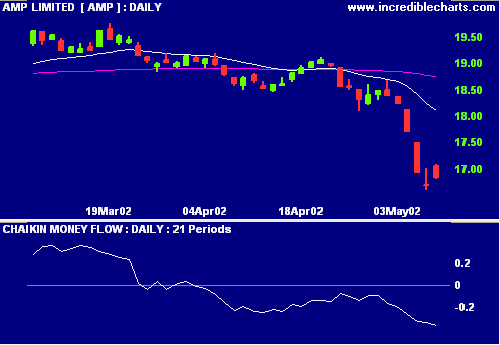

AMP [AMP]

AMP announces it is to sell

its UK-based Henderson Private Asset Management.

(more)

Moving averages (150-day and 20-day exponential

MA), Chaikin Money Flow and MACD are all bearish.

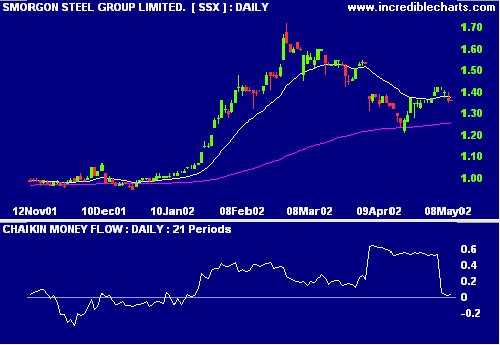

Smorgon Steel [SMS]

Trading has been halted pending an

announcement.

Chaikin Money Flow shows strong accumulation

since January followed by a sharp fall in the last week.

Conclusion

Short-term: Avoid long.

Medium-term: Wait for the All Ords to form a

base.

Long-term: Wait for the Nasdaq or S&P 500 to

form a base.

Colin Twiggs

P.S. We are trying out new Email

software. Please report if you experience any problems with the

trading diary.

Please forward this to your friends and

colleagues.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.