Trading Diary

March 13, 2002

USA

Another inside day, indicating continued uncertainty, with

the Dow closing down more than 1% at 10501 on normal

volume, but continuing to hold above the 10300 support

level.

The Nasdaq Composite index retreated 1.85% to 1862 with chip stocks being sold down.

The Nasdaq Composite index retreated 1.85% to 1862 with chip stocks being sold down.

The S&P 500 retreated 1% to 1154, below the important

1170/1180 resistance level.

Triple witching hour this Friday

Contracts for stock index futures, stock index options and

stock options simultaneously expire on the third Friday of

March, June, September and December. The last hour of trading

is highly volatile as traders attempt to close out their

positions.

Chip stocks down

Australia - ASX

The All Ords retreated further to close at 3396 on low volume.

The Slow Stochastic is below its signal line.

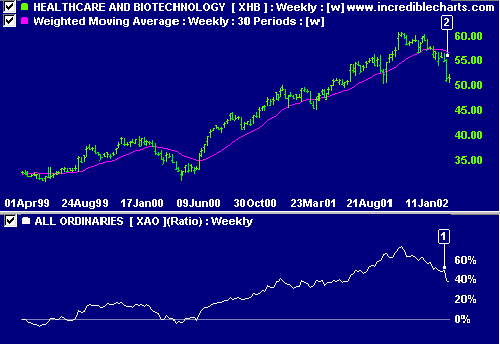

Sectors: Health & Biotechnology

The XHB index appears to be entering a

Stage 4 decline, with declining relative strength

[1] and the last 6 weeks trading below the 30-week

weighted moving average [2]. Tighten up stops in this sector.

Austar [AUN]

WMC [WMC]

Conclusion

Short-term: Avoid new positions until the Slow Stochastic and

MACD signal a resumption of the rally.

Medium-term: Wait for a new high on the All Ords.

Long-term: Look for a secondary cycle reversal on the Nasdaq or

S&P 500 - if they break above their January highs.

Colin Twiggs

P.S. We are trying out new Email software. Please report

if you experience any problems with the trading diary.

Please forward this to your friends and colleagues.

Back Issues

Click here to access the Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.