S&P 500 outstrips earnings

First, please read the Disclaimer.

The S&P 500 is way over-priced based on all three earnings multiples.

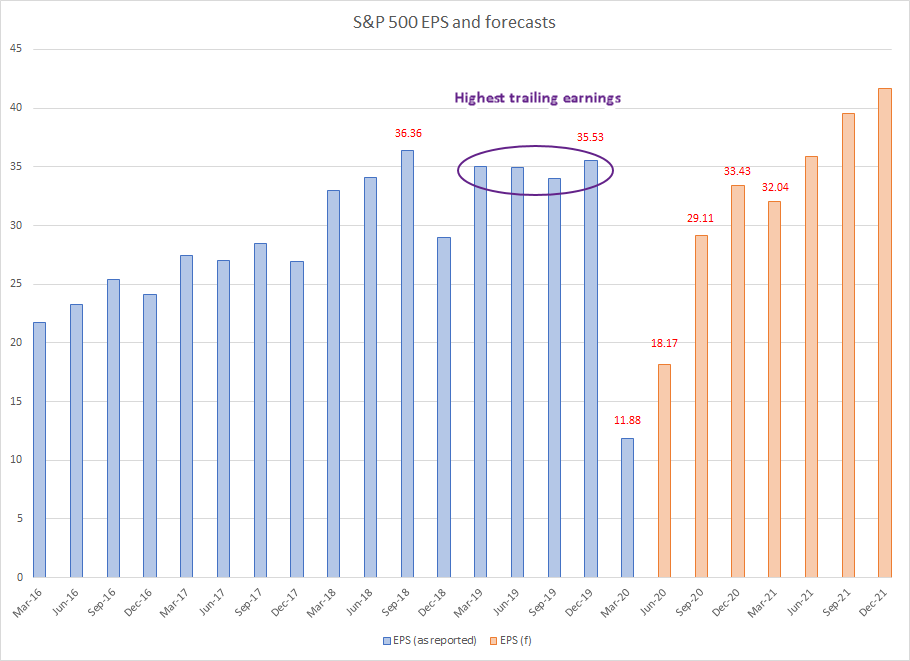

75% of companies in the S&P 500 have already reported earnings, so we have a good idea as to what overall earnings will be for the second quarter.

Based on the latest index price of 3349.16, trailing PE comes in at a whopping 33.6 times. But this is distorted by the current sharp fall in earnings and may not reflect future earnings potential.

Forward PE at 25.7, based on S&P earnings forecasts for the next four quarters (ending June 2021), is more reasonable but some quarters are still distorted by the current recession.

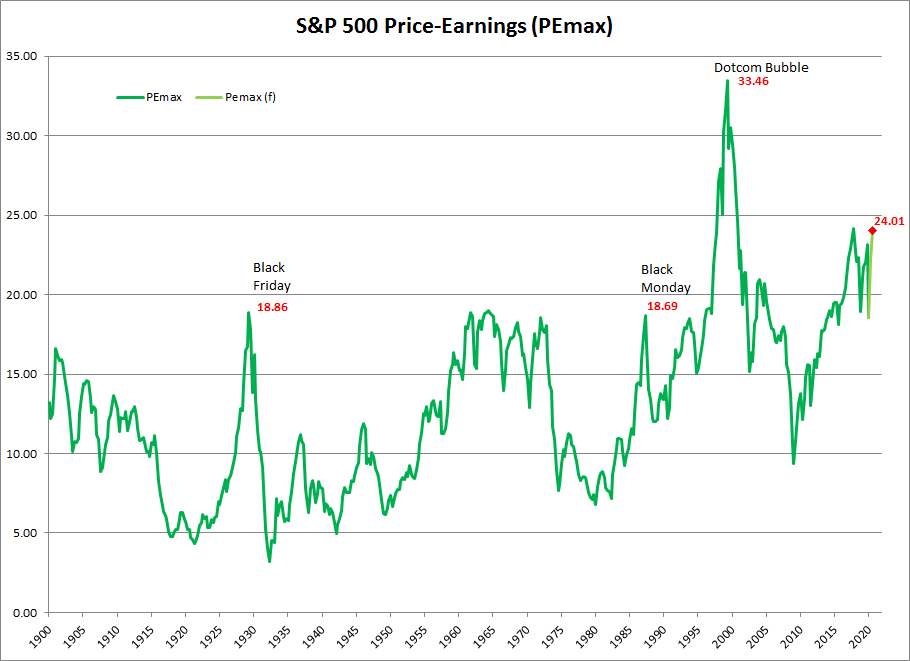

PEmax, on the other hand, uses highest trailing earnings (the highest preceding four quarters are circled above). This removes distortions caused by short-term earnings fluctuations and better reflects long-term earnings potential.

At 24.01 PEmax is close to December 2017 (24.16), the second highest peak in the last 120 years. Exceeded only by the Dotcom bubble. The current reading is almost 30% higher than Black Friday (18.86) in October 1929 and Black Monday (18.69) in October 1987.

While PEmax may climb even higher in the next few months, the level is a clear warning to investors to stay overweight in cash and underweight stocks.

"Freedom is never more than one generation away from extinction. We didn't pass it to our children in the bloodstream. It must be fought for, protected, and handed on for them to do the same."

~ Ronald Reagan

Updates for Market Analysis Subscribers

Please take advantage of our $1 special offer for the first month. Cancel at any time.

- Jobs rise but no V-shaped recovery

- Commodities: Technical outlook

- ASX banks warn of severe recession

- Gold up-trend accelerates

- S&P 500 PEmax at 24

- Relative strength: Gold, stocks & commodities

- Australia: It's the demand side, stupid

- International Growth: Performance at 30 June 2020

- Australian Growth: Performance at 30 June 2020

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.