Approaching stall speed

By Colin Twiggs

August 17, 2019 1:00 a.m. EDT (3:00 p.m. AEST)

First, please read the Disclaimer.

Important News

Dear Friends,

I have been writing the Trading Diary newsletter for almost 20 years. It has been a great success but times are changing. Advertisers have largely migrated to Google & social media and independent advertising through brokers has slowed to a trickle. We have therefore decided to change the format of the newsletter in line with these developments.

In future, market analysis will be provided by way of subscription through The Patient Investor. The format will remain the same, with regular updates focused on major markets — stocks, precious metals, commodities, interest rates and the economy — and increased coverage of sectors and industries.

While the change may seem sudden, the changes in advertising revenue have been evident for more than a year and I have been postponing the inevitable for some time.

Details of subscriptions are available at The Patient Investor and include a $1 subscription for the first month.

Thank you for your support.

Approaching stall speed

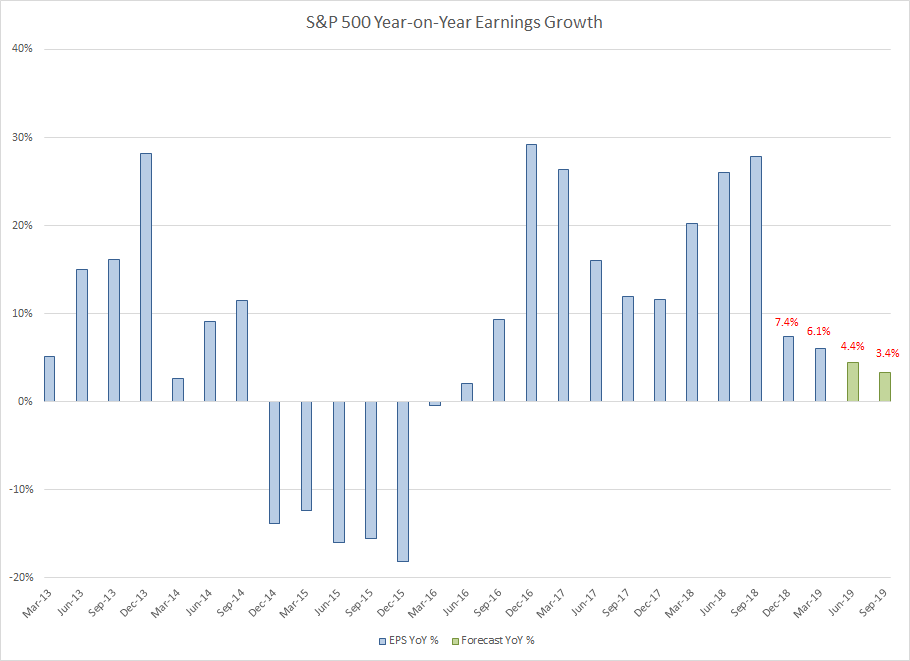

With 89.7% of companies having reported, S&P are projecting 4.4% earnings growth for June quarter 2019 compared to the second quarter in 2018. Even more interesting is their projection of 3.4% growth for the September quarter. With EPS growth boosted by a stock buyback yield of 3.5%, this warns that the economy is close to stall speed.

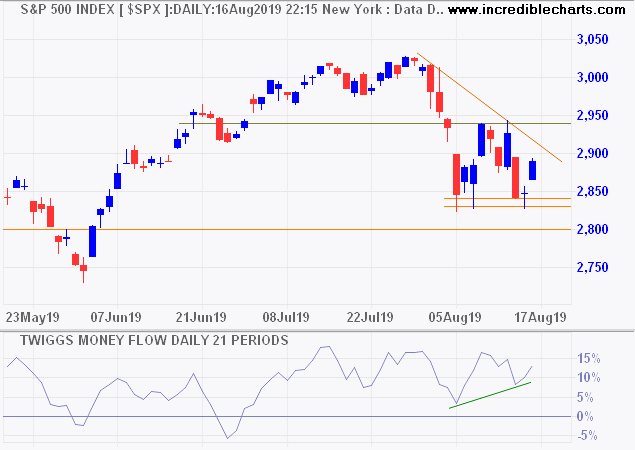

The daily chart for the S&P 500 shows support at 2830/2840, while a higher trough on 21-Day Money Flow indicates (secondary) buying pressure. I expect another test of resistance at 3030; breakout above resistance at 2940 would confirm.

The full article is available to Market Analysis subscribers.

"I can't tell you how it came to take me so many years to learn that instead of placing piking bets on what the next few quotations were going to be, my game was to anticipate what was going to happen in a big way."

~ Jesse Livermore

Latest

-

ASX

ASX 200 breaks support. -

Gold

Gold pauses after recent surge. -

Global economy

Global economy

Recession ahead. -

The long game

The long game

Why the West is losing. -

S&P 500

Buybacks are hurting growth. -

S&P 500

Rate cuts and buybacks — the emperor's new clothes. -

S&P 500

A good time to be cautious. -

PEmax

Why you should be wary of Robert Shiller's CAPE -

Portfolio

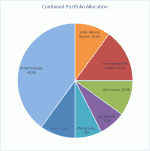

Investing in a volatile market - April 2018

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.