Robust US employment but global bear market warning

By Colin Twiggs

February 1, 2019 8:00 p.m. ET (12:00 a.m. AEDT)

First, please read the Disclaimer.

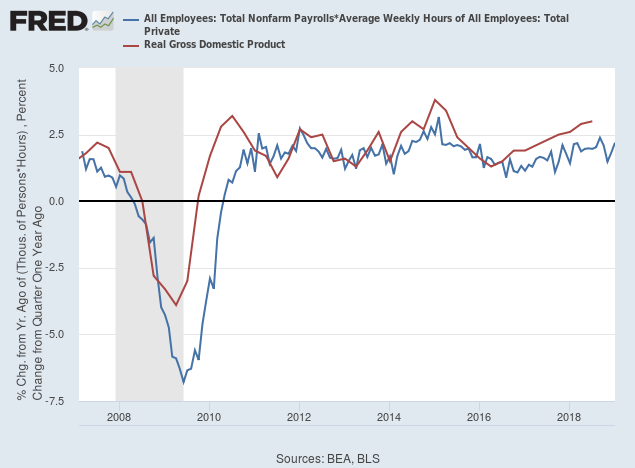

The US economy remains robust, with hours worked (non-farm) ticking up 2.2% in January, despite the government shutdown. Real GDP growth is expected to follow a similar path.

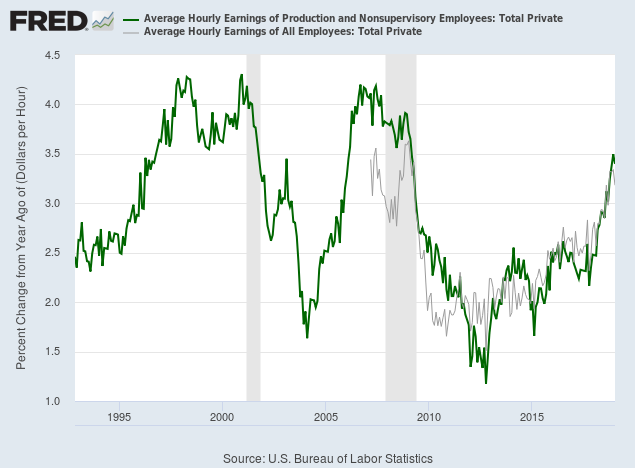

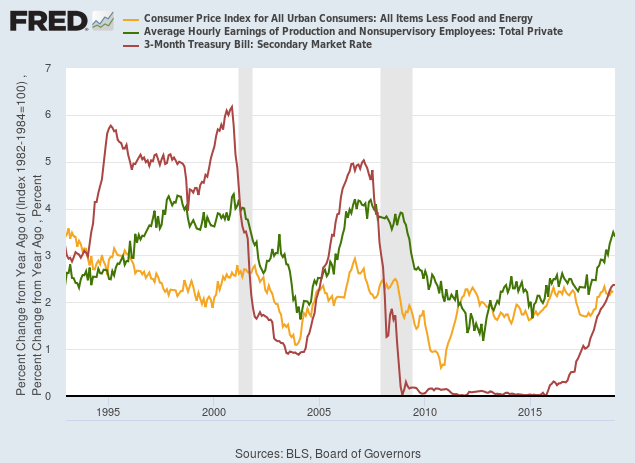

Average hourly earnings growth increased to 3.4% p.a. for production and non-supervisory employees (3.2% for all employees). The Fed has limited wiggle room to hold back on further rate hikes if underlying inflationary pressures continue to rise.

History shows that the Fed lifts short-term interest rates more in response to hourly wage rates than core CPI.

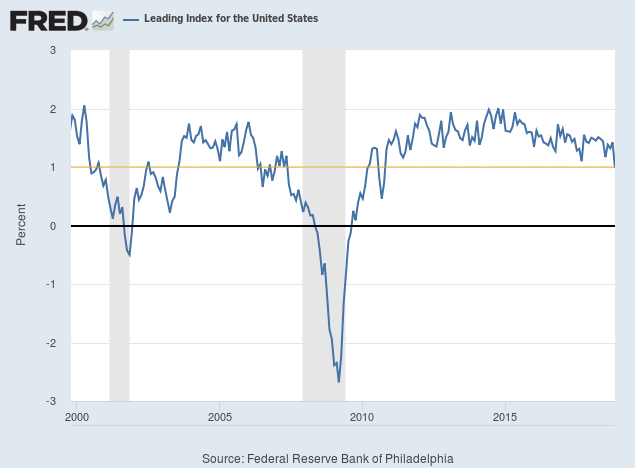

The Leading Index from the Philadelphia Fed ticked down below 1% (0.98%) for November 2018. While not yet cause for concern, it does warn that the economy is slowing. Further falls, to below 0.5%, would warn of a recession.

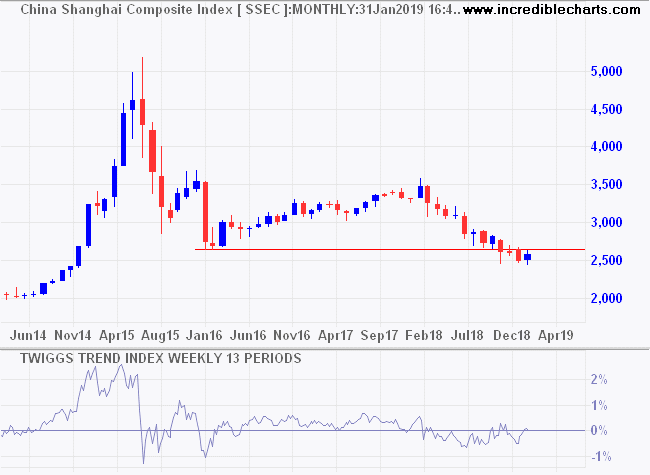

Markets are anticipating a slow-down, triggered by falling demand in China more than in the US.

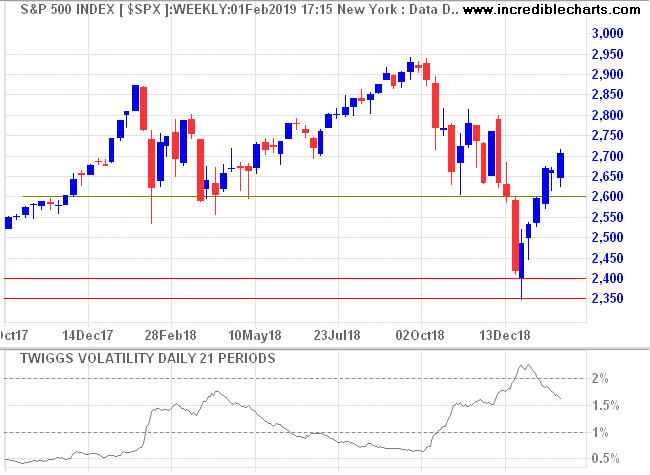

S&P 500 volatility remains high and a large (Twiggs Volatility 21-day) trough above 1.0% (not zero as stated in last week's newsletter) on the current rally would signal a bear market. Retreat below 2600 would strengthen the signal.

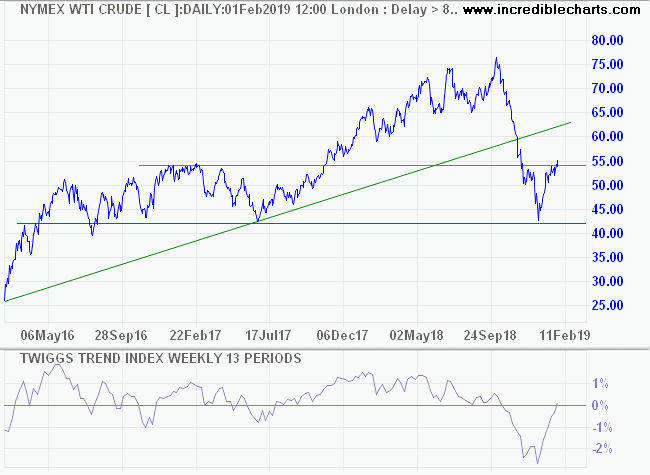

Crude prices have plummeted, anticipatiing falling global (mainly Chinese) demand. Another test of primary support at $42/barrel is likely.

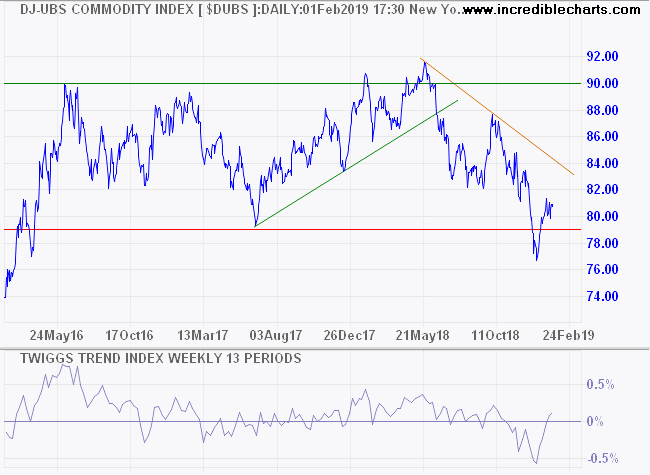

Dow Jones-UBS Commodity Index breached primary support at 79, signaling a primary decline with a target of 70.

China's Shanghai Composite Index is in a bear market. Respect of resistance at 2700 would confirm.

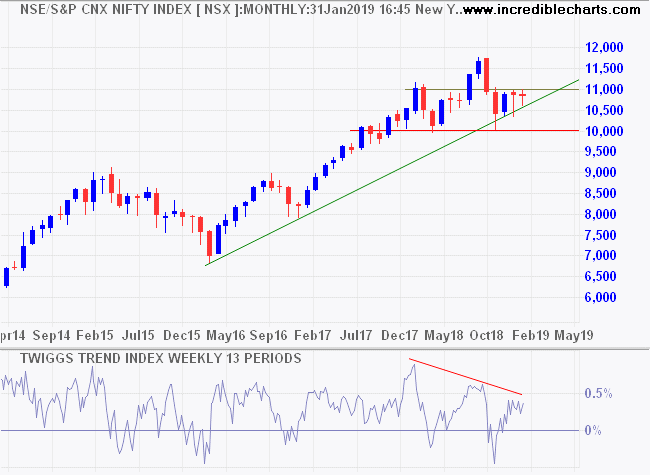

Bearish divergence on India's Nifty also warns of selling pressure. Retreat below 10,000 would complete a classic head-and-shoulders top but don't anticipate the signal.

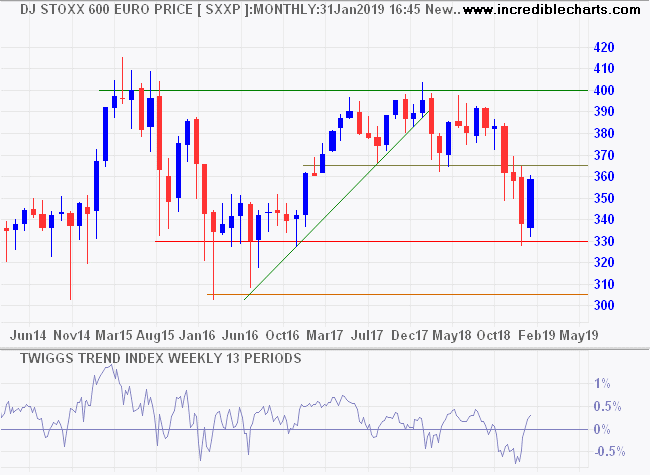

DJ Stoxx Euro 600 rallied but is likely to respect resistance at 365/370, confirming a bear market.

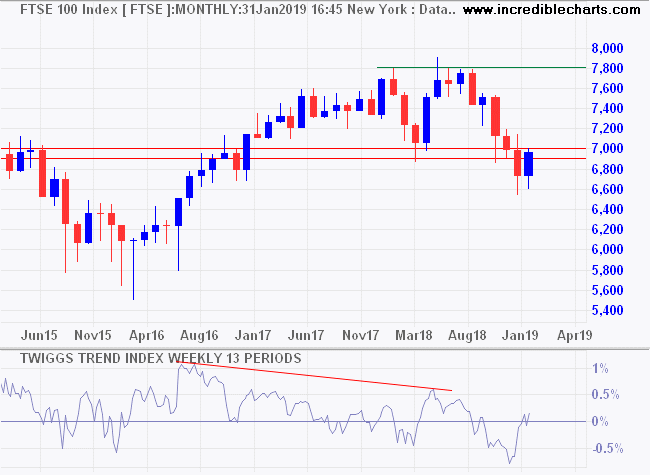

The UK's Footsie also rallied but is likely to respect resistance at 7000. Declining Trend Index peaks indicate selling pressure, warning of a bear market.

My conclusion is the same as last week. This is a bear market. Recovery hinges on an unlikely resolution of the US-China 'trade dispute'.

Concessions to adversaries only end in self reproach, and the more strictly they are avoided the greater will be the chance of security. ~ Thucydides (460 - 400 B.C.)

Latest

-

ASX 200

Financials test key support ahead of Hayne Report. -

Gold

Gold

Gold and the Dollar direction. -

US-China

US-China

Deal or No Deal -

Australian Economy

Quietly falling apart -

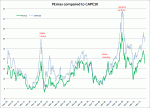

PEmax

why you should be wary of Robert Shiller's CAPE -

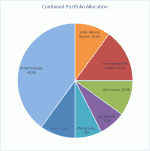

Portfolio

Investing in a volatile market - April 2018 -

Yield Curve

Does the yield curve warn of a recession? - September 2018

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.