Risk averse rather than fearful

By Colin Twiggs

December 14, 2018 8:30 p.m. ET (12:30 a.m. AEDT)

First, please read the Disclaimer.

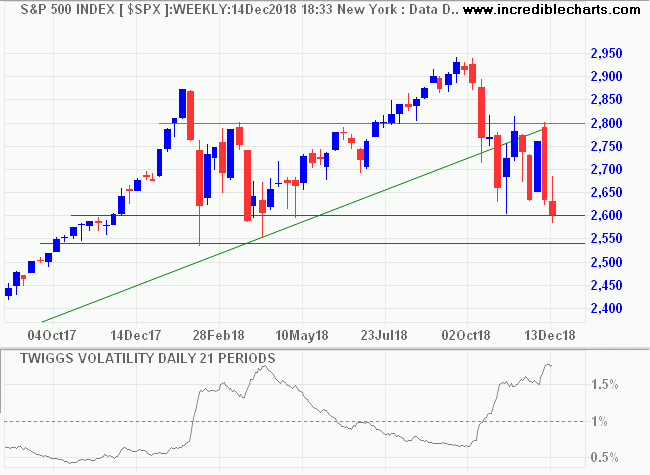

The S&P 500 is again testing the band of primary support between 2600 and 2550. Follow-through below this level would warn of a bear market. Volatility (21-day) is in the amber zone between 1% and 2%. A real test of market resilience will be the next sizable rally or advance. If declining volatility remains above 1%, that would warn of an imminent market sell-off.

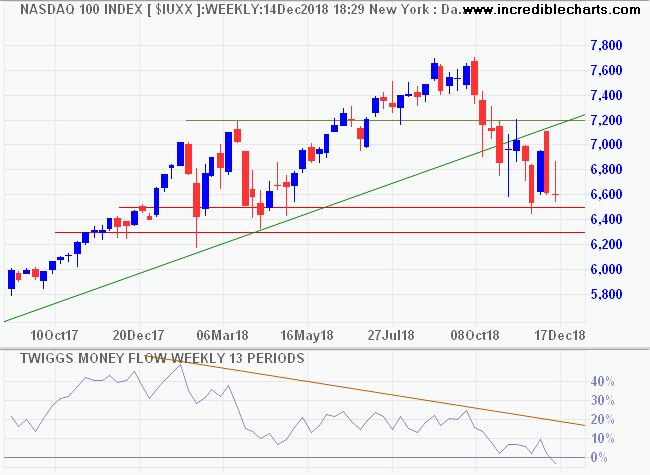

The Nasdaq 100 is in a similar position, with declining Money Flow warning of medium-term selling pressure.

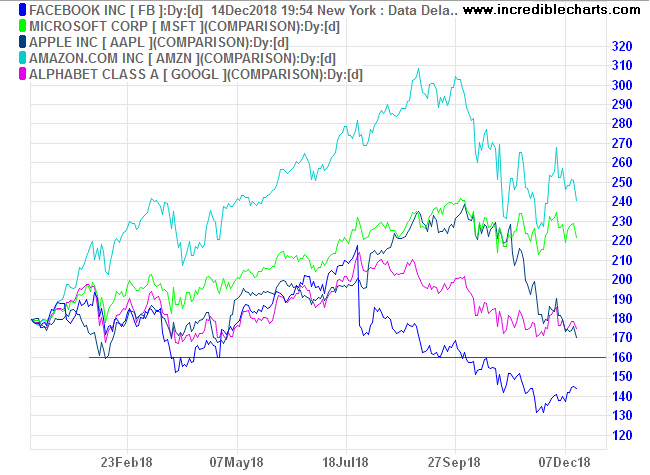

Of the big five tech stocks, only Microsoft looks strong. Facebook is in a primary down-trend but Apple and Google are testing primary support. Apple's exposure to China is obviously a concern. China accounts for roughly 25% of Apple's global market but Apple estimates that it is responsible for 4.8 million jobs in China which gives them some negotiating clout.

If two more of the big five broke primary support, that would in my opinion signal a bear market.

Asia

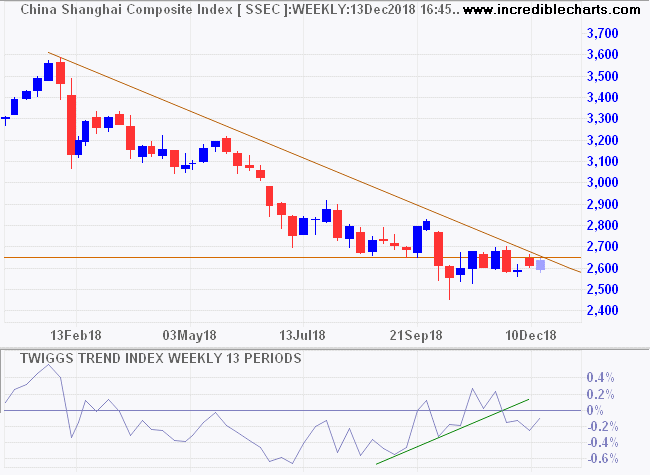

The Shanghai Composite Index is consolidating in a narrow band below 2700. Downward breakout is likely and would signal another decline, with a target of 2300.

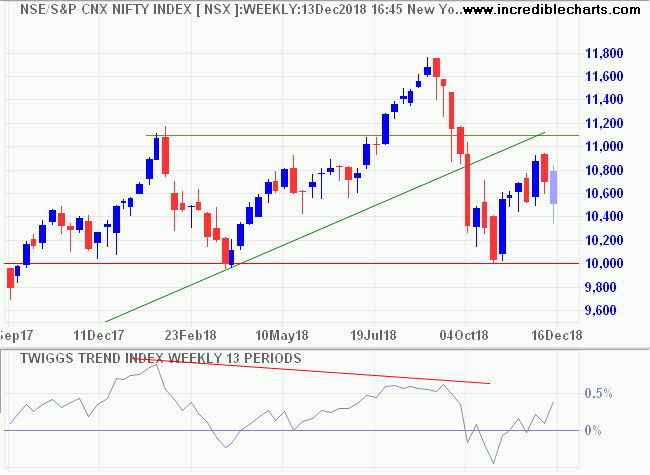

India's Nifty is testing resistance at 11,000. Respect would be bearish, warning of another test of primary support at 10,000. Declining peaks on the Trend Index warn of long-term selling pressure.

Europe

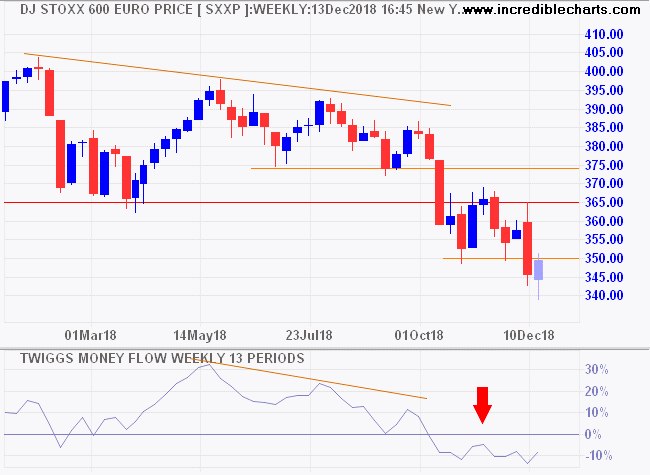

Dow Jones Euro Stoxx is in a primary down-trend. Follow-through below 350 confirms a bear market, warn of a decline to test 305/310.

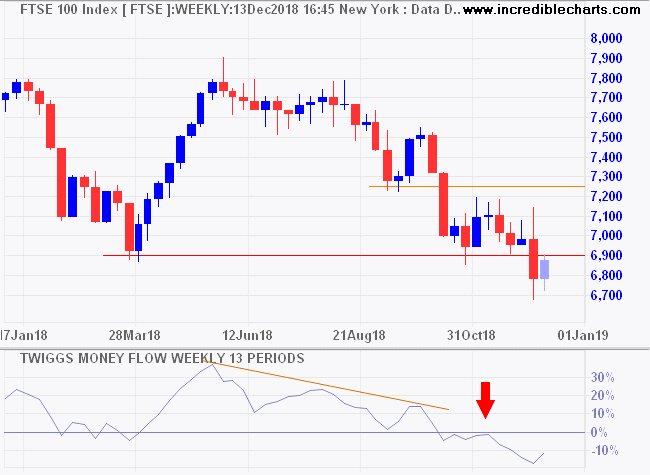

The Footsie also broke primary support at 6900. Retracement is testing the new resistance level but respect of 7000 is likely and would confirm a bear market, with a target between 5600 and 6000.

There is a high level of uncertainty in global markets at present. Europe has Brexit and Italy. The US has investigations into Donald Trump's election campaign. China has the threat of a trade war with the US. But my sense is that the market has become risk averse rather than fearful. There is no sign of panic selling as yet. But investors are clearly on the defensive and prepared to sell off vulnerable stocks.

Adopt the pace of nature: her secret is patience.

~ Ralph Waldo Emerson

Latest

-

ASX 200

ASX 200 breaks support. -

Gold

Rallies despite strong Dollar. -

Making Rational Decisions

If it's flooded, forget it. -

Yield Curve

Does the yield curve warn of a recession?

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.