Buckley's chance

By Colin Twiggs

November 2, 2018 9:30 p.m. EDT (12:30 p.m. AEST)

First, please read the Disclaimer.

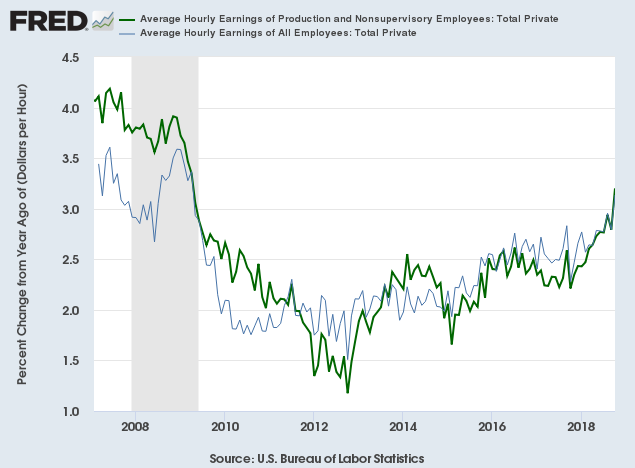

Average hourly wage rates are rising, with Production & NonSupervisory Employees growing at an annual rate of 3.20% and All Employees at 3.14%.

This is a clear warning to the Fed that underlying inflationary pressures are rising. There is Buckley's chance that they will ease off on rate hikes.

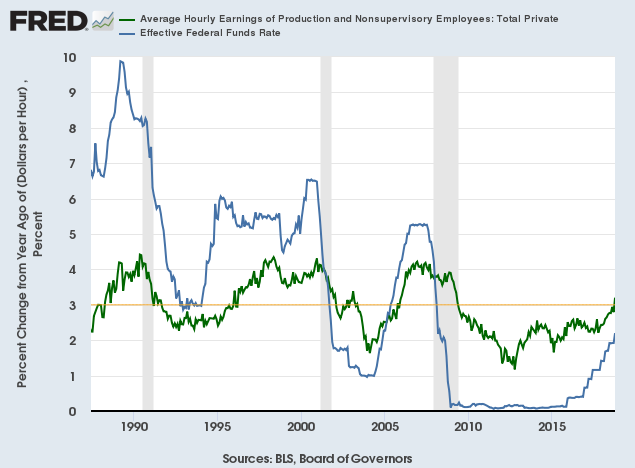

The Fed adopts a restrictive stance whenever hourly wage rate growth exceeds 3%, illustrated below by a high or rising Fed Funds Rate.

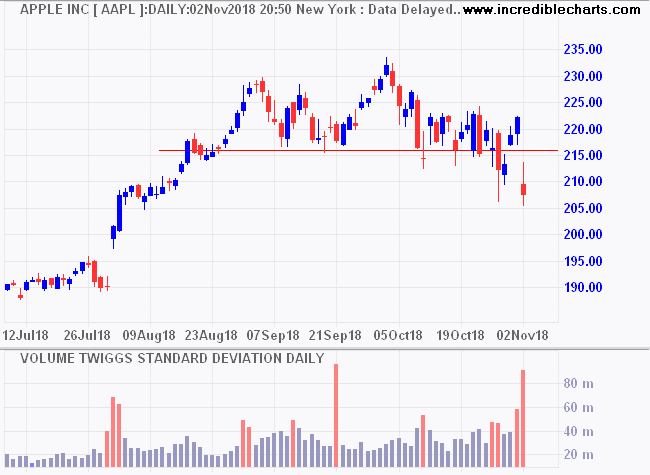

The market is adopting a wait-and-see attitude ahead of Tuesday's mid-term elections. Stocks like Apple (AAPL) have been sold down on strong volume despite good earnings results: earnings per share of $2.91 and revenue of $62.9 billion for Q4-18, compared to consensus estimates of $2.79 and $61.5 billion.

Optimism over a possible trade deal with China may not last the week.

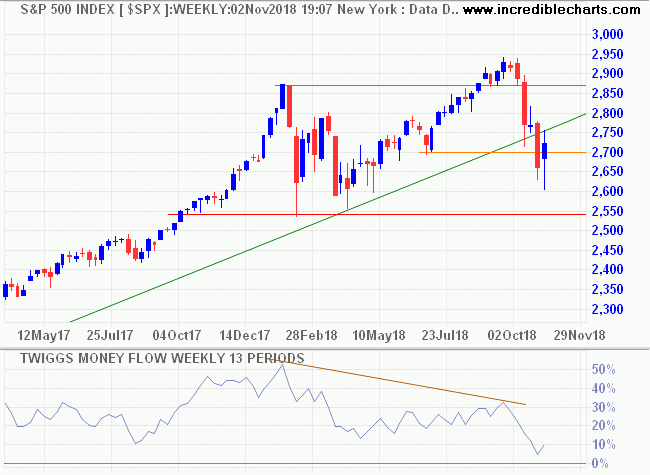

A harami-like candle on the S&P 500 reflects indecision, while bearish divergence on Twiggs Money Flow warns of long-term selling pressure. Breach of 2550 is still unlikely but would warn of a primary down-trend.

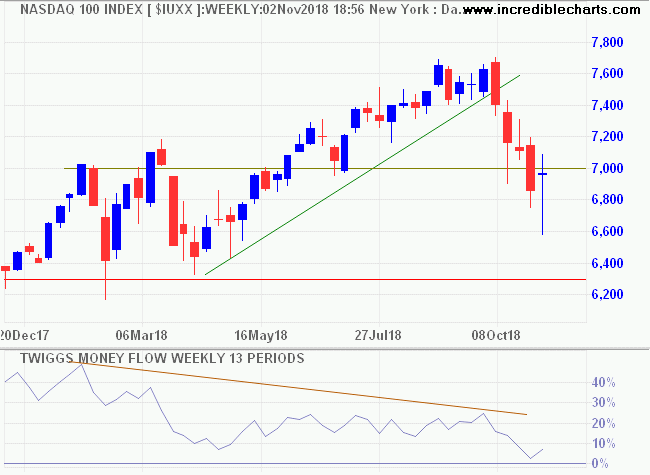

The Nasdaq 100 tells a similar story, with primary support at 6300.

They say there are two sides to everything. But there is only one side to the stock market; and it is not the bull side or the bear side, but the right side. It took me longer to get that general principle fixed firmly in my mind than it did most of the more technical phases of the game of stock speculation.

~ Jesse Livermore

Latest

-

Stock Screens

Stock Screens

Mark Minervini's trend Template. -

ASX 200

Support, but bank decline continues. -

Gold

Crude oil reversal undermines rally. -

Interest Rates & Inflation

President Trump should look in the mirror. -

Bonds

How will a bond bear market affect stocks? -

Yield Curve

Does the yield curve warn of a recession?

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.