East to West: Broken China

By Colin Twiggs

June 15, 2017 11:00 p.m. EDT (1:00 p.m. AEST)

First, please read the Disclaimer.

Asia

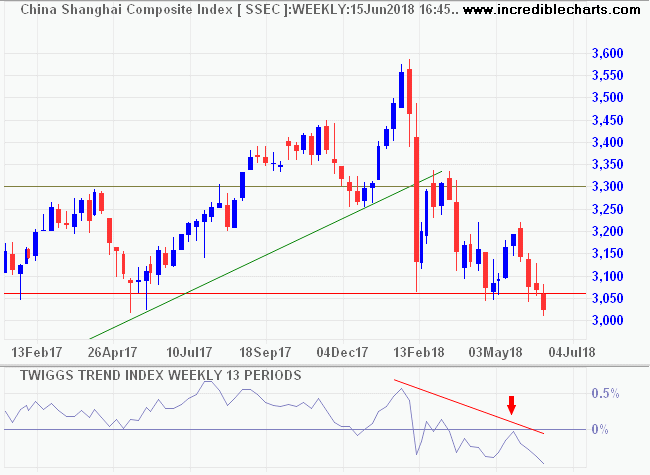

China's Shanghai Composite Index broke through primary support at 3060, warning of a primary down-trend. A Trend Index peak below zero indicates strong selling pressure. China faces the double threat of rising US interest rates and trade sanctions from the Trump administration.

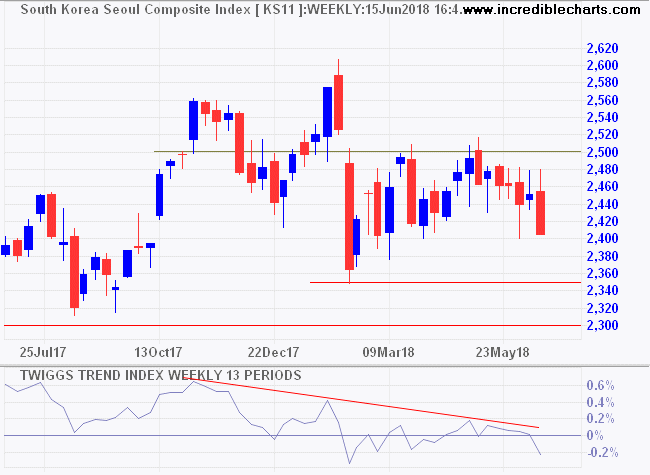

South Korea's Seoul Composite Index did not respond well to Trump's Singapore summit with Kim Jong Un. A declining Trend Index warns of selling pressure. Expect another test of primary support at 2350.

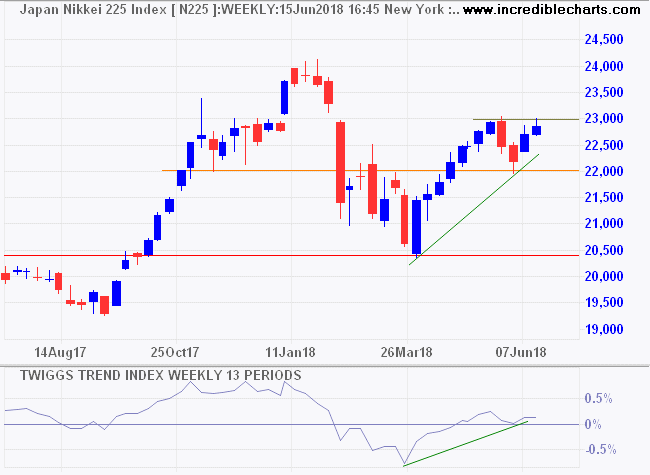

Japan responded better and Nikkei 225 breakout above 23,000 would indicate a test of resistance at the January high of 24,000.

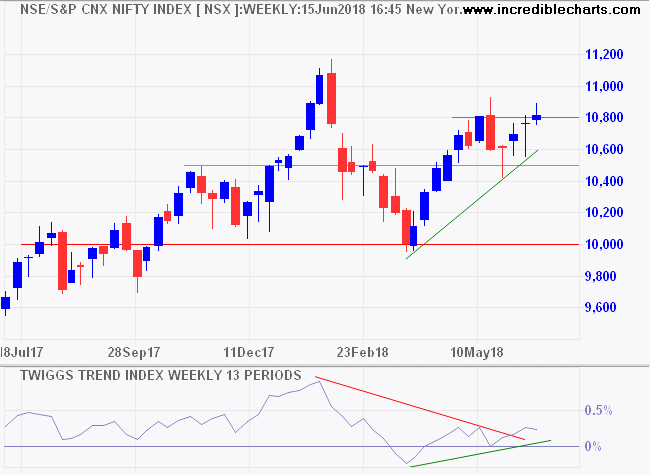

India too is recovering. Breakout of the Nifty above 10,800 signals a test of the January high at 11,200.

Europe

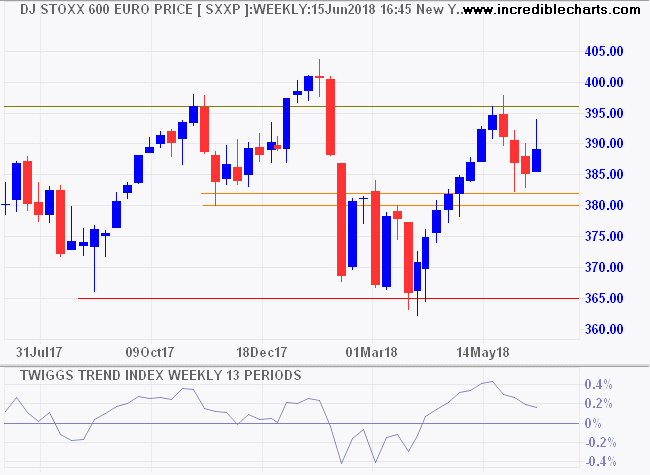

Europe has its share of problems, with uncertainty over Brexit and Italy as well as trade tariffs from Trump. Further consolidation of Dow Jones Euro Stoxx 600 Index between 365 and 400 is likely.

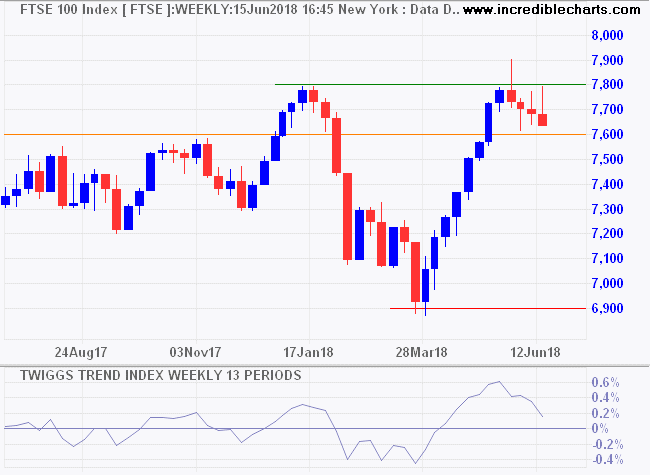

The Footsie continues to test its new support level at 7600. Respect would suggest another advance, with a target of 8000, while breach would signal longer consolidation between 7000 and 7800. A Trend Index trough above zero would be a bullish sign, indicating buying pressure.

North America

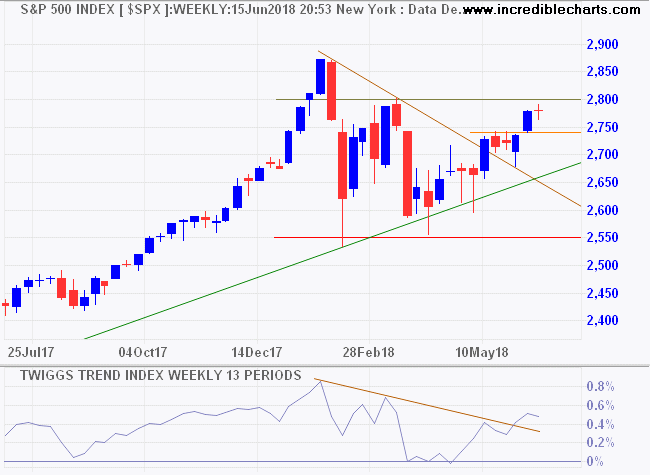

The S&P 500 has grown a little hesitant over the last week but narrow consolidation below resistance at 2800 is still bullish. Breakout would signal an advance to 3000.

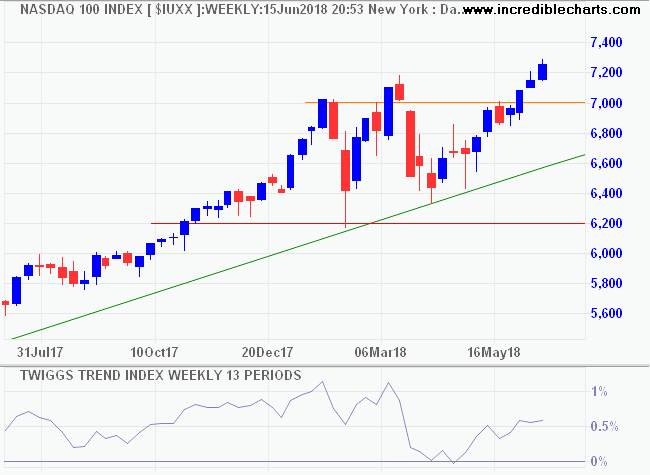

Technology stocks show more resillience, with the Nasdaq 100 closing at a new weekly high of 7250. A Trend Index trough at zero signals buying pressure. Target for the advance is 7750.

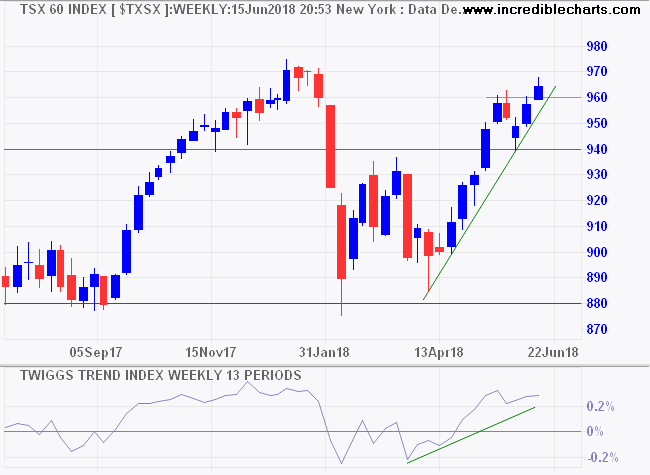

Canada's TSX 60 is also bullish, headed for a test of its January high at 975.

Right, as the world goes, is only in question between equals in power, while the strong do what they can and the weak suffer what they must.

~ Thucydides, History of the Peloponnesian War (circa 400 BC)

Latest

-

S&P 500

Volatility back in the green zone. -

ASX 200

ASX strengthens despite banks and iron prices -

Gold and the Dollar

Aussie gold stocks rally as the greenback strengthens. -

Banks & Economy

Zombie banks or zombie economies? -

Price & Earnings

The Race to the Top -

US & Global economy

Is GDP doomed to low growth? -

Investing in a Volatile Market

Managing downside risk.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.