Asian selling pressure while US finds support

By Colin Twiggs

May 25th, 2017 11:30 p.m. EDT (1:30 p.m. AEST)

First, please read the Disclaimer.

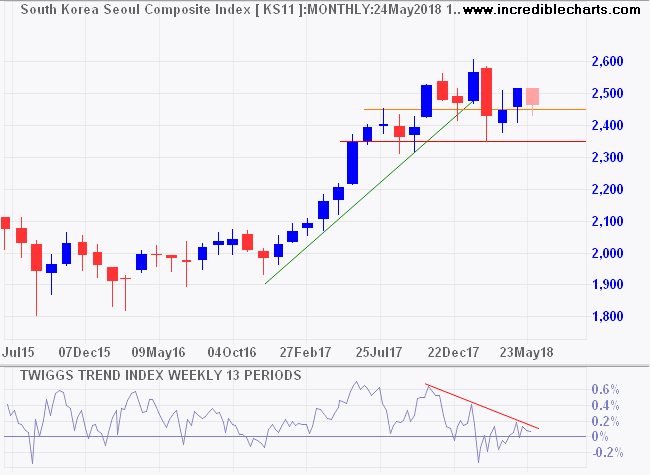

Asia faces selling pressure. The canary in the coal mine is South Korea's Seoul Composite Index which displays a strong bearish divergence on the Trend Index. Breach of 2350 would signal a primary down-trend.

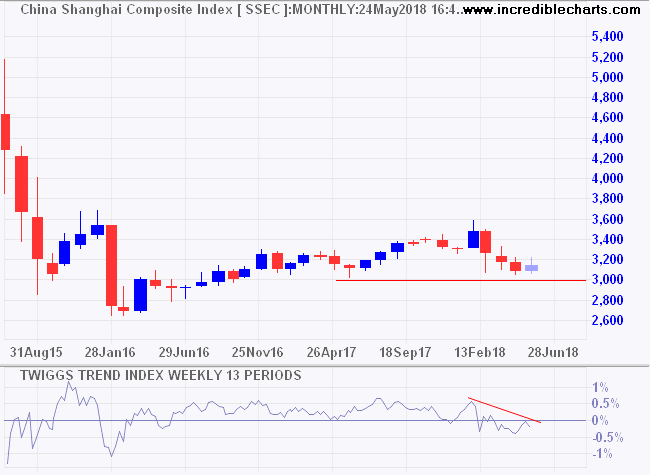

China does not fare much better, with the Shanghai Composite Index testing primary support at 3,000.

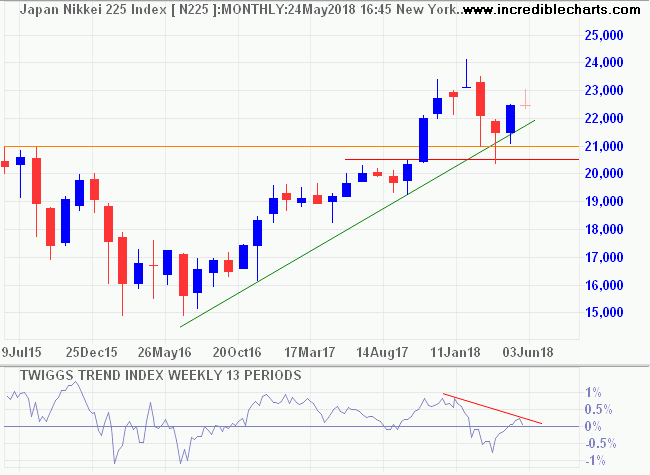

Japan also displays selling pressure, but the Nikkei 225 Index has a bigger cushion above primary support at 20,500.

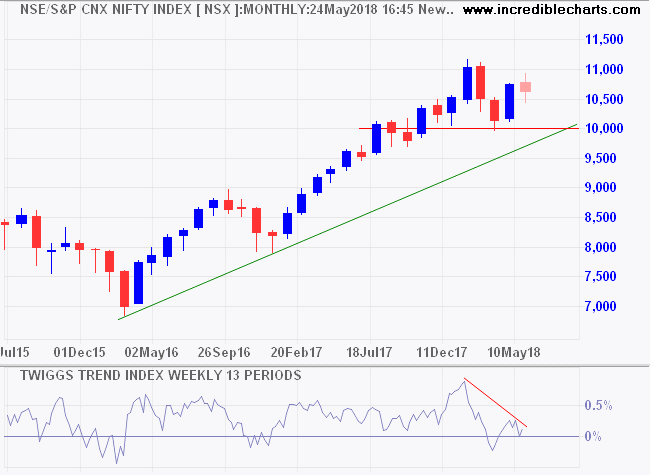

And India's Nifty has run into stiff resistance at 11,000. Reversal of the Trend Index below zero would warn of strong selling pressure and a test of primary support at 10,000.

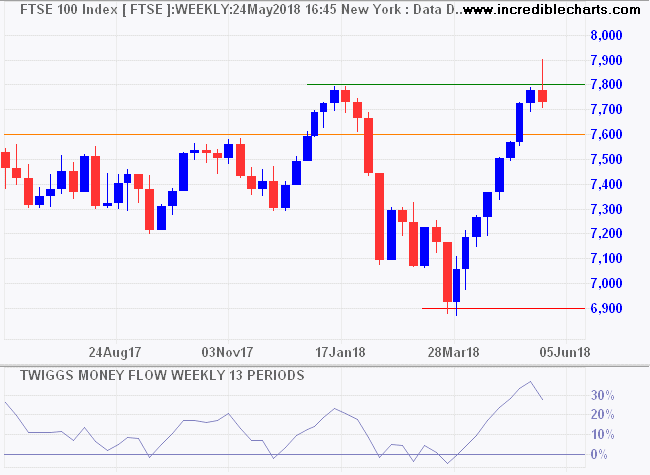

The UK is stronger, with the Footsie testing resistance at its January high of 7,800. Twiggs Money Flow troughs at zero indicate continued buying support.

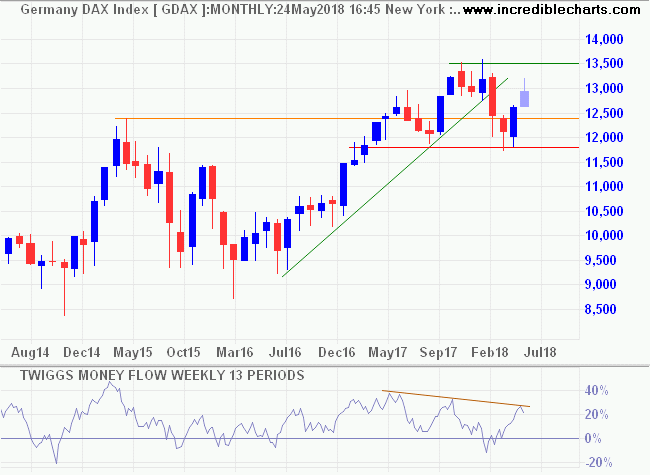

The DAX is weaker, with bearish divergence warning of selling pressure, but this still appears secondary in nature.

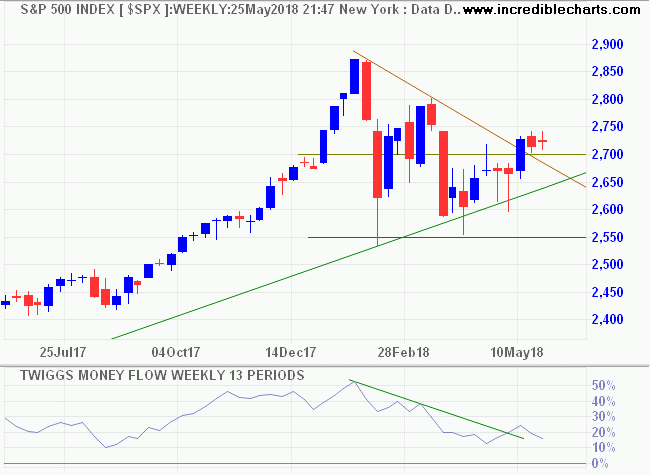

The S&P 500 broke out of its symmetrical triangle and is retracing to test support at 2700. Volatility is falling and the decline in Money Flow easing. Respect of 2700 is likely and would signal a rally to test 2850.

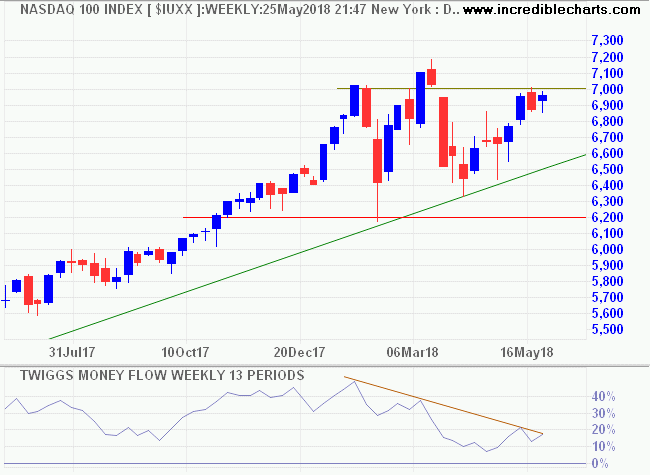

The Nasdaq 100 is stronger and breakout above 7000 would signal a fresh primary advance.

Favorable resolution of US trade negotiations with China and the impasse with North Korea would be key in the recovery spreading to the global economy.

It was the change in my own attitude that was of supreme importance to me. It taught me little by little, the essential difference between betting on fluctuations and anticipating inevitable advances and declines, between gambling and speculating.

~ Jesse Livermore

Latest

-

ASX 200

Banks hurt the ASX. -

Gold

Falling bond yields fail to tame the bears. -

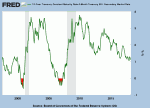

The Yield Curve

Low inflation risk keeps yield curve safe. -

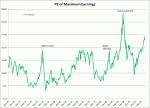

Price & Earnings

The Race to the Top -

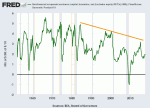

US & Global economy

Is GDP doomed to low growth? -

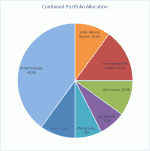

Investing in a Volatile Market

Managing downside risk.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.