Price & Earnings: The Race to the Top

By Colin Twiggs

May 19th, 2017 3:30 a.m. EDT (5:30 p.m. AEST)

First, please read the Disclaimer.

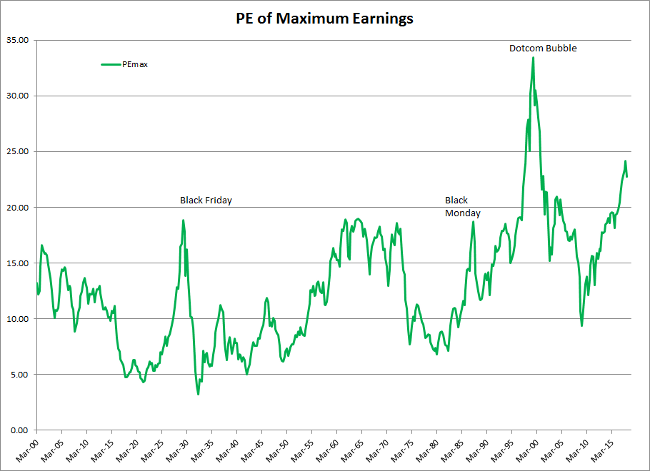

Now that 93% of S&P 500 stocks have reported first quarter earnings we can look at price-earnings valuation with a fair degree of confidence. My favorite is what I call PEMax, which compares Price to Maximum Annual Earnings for current and past years. This removes distortions caused by periods when earnings fall faster than price, by focusing on earnings potential rather than necessarily the most recent earnings performance.

Valuations are still high, but PEMax has pulled back to 22.78 from 24.16 in the last quarter. Valuations remain at their highest over the last 100 years at any time other than during the Dotcom bubble. Even during the 1929 Wall Street crash (Black Friday) and Black Monday of October 1987, PEMax was below 20.

While that warns us to be cautious, as valuations are high, it does not warn of an imminent down-turn. Markets react more to earnings than to prices as the chart below illustrates.

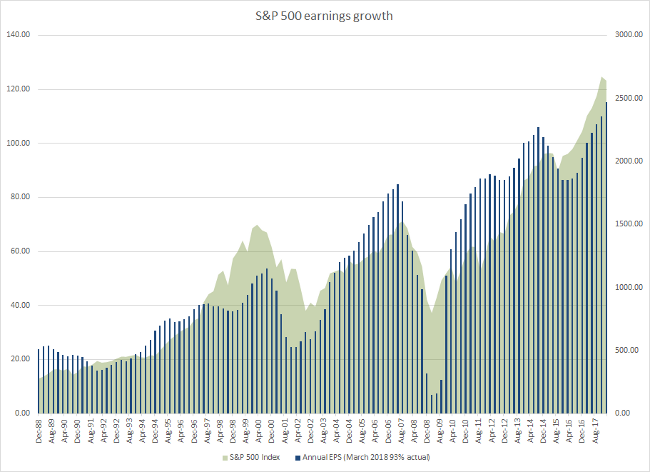

The last two market down-turns were both precipitated by falling earnings — the blue columns on the above chart — rather than valuations.

While it is concerning that prices have run ahead of EPS — as they did during the late 1990s — consolidation over the past quarter should allow earnings room to catch up.

Observation, experience, memory and mathematics these are what the successful trader must depend on. He must not only observe accurately but remember at all times what he has observed. He cannot bet on the unreasonable or on the unexpected, however strong his personal convictions may be about man's unreasonableness or however certain he may feel that the unexpected happens very frequently. He must bet always on probabilities that is, try to anticipate them....

~ Jesse Livermore

Latest

-

ASX 200

The tug-of-war continues. -

Gold

Gold stocks retreat. -

S&P 500

Volatility falling. -

China

Seeing red. -

US & Global economy

Is GDP doomed to low growth? -

Investing in a Volatile Market

Managing downside risk.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.