Nasdaq Threatens Breakout

By Colin Twiggs

May 12th, 2017 12:30 a.m. EDT (2:30 p.m. AEST)

First, please read the Disclaimer.

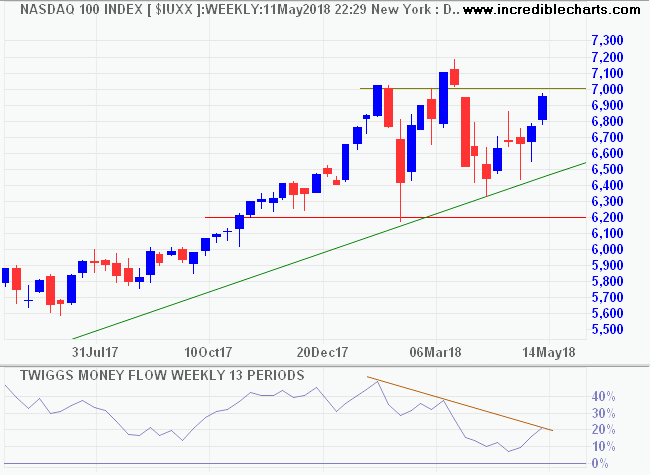

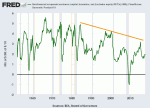

The Nasdaq 100 is testing resistance at 7000. Breakout would signal a fresh primary advance. A completed Twiggs Money Flow trough above zero would strengthen the signal.

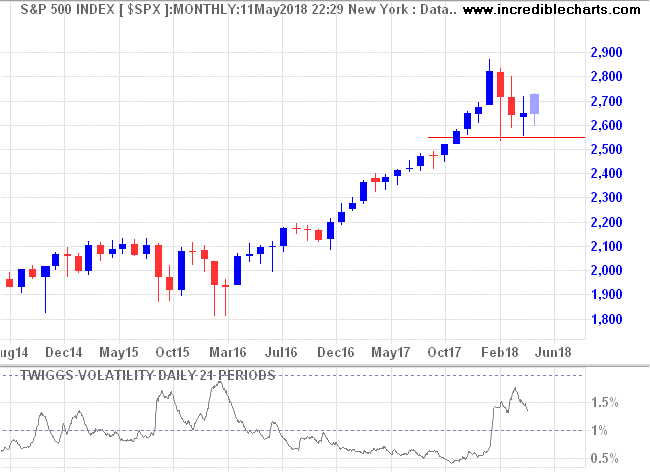

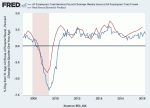

Volatility on the S&P 500 remains elevated, in the amber zone between 1% and 2%, but is falling fast. A large trough above 1.0% would warn that risk is elevated and more downside is likely to follow, while a fall below 1.0% would signal a return to business as usual.

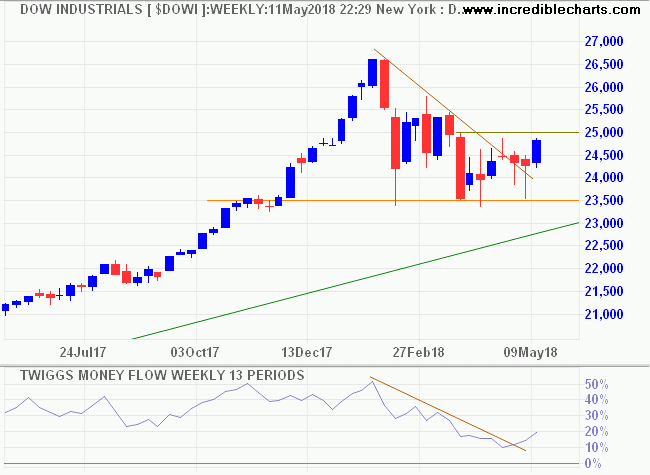

Dow Jones Industrial Average is consolidating above support at 23500. Breakout above 25000 would suggest another advance with an eventual target of 29500.

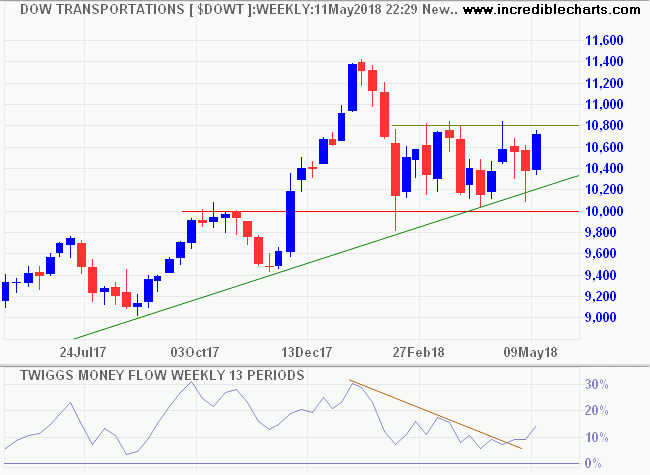

Dow Jones Transport Average shows a similar pattern, with consolidation above 10000. Breakout above 10800 is likely and would confirm a breakout on the Industrial Average.

Old man Partridge's insistence on the vital importance of being continuously bullish in a bull market doubtless made my mind dwell on the need above all other things of determining the kind of market a man is trading in. I began to realize that the big money must necessarily be in the big swing. Whatever might seem to give a big swing, initial impulse, the fact is that its continuance is not the result of manipulation by pools or artifice by financiers, but depends upon basic conditions. And no matter who opposes it, the swing must inevitably run as far and as fast and as long as the impelling forces determine.

~ Jesse Livermore

Latest

-

No Fed Squeeze in Sight

No contraction despite the Fed shrinking its balance sheet. -

ASX 200: Bi-polar economy

Exports are booming but banks and housing remain a worry. -

Gold

Aussie Gold stocks continue strong run. -

US & Global economy

Is GDP doomed to low growth? -

Investing in a Volatile Market

Managing downside risk.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.