Nasdaq Confidence Recovering

By Colin Twiggs

April 20, 2017 8:30 p.m. EDT (10:30 a.m. AEST)

First, please read the Disclaimer.

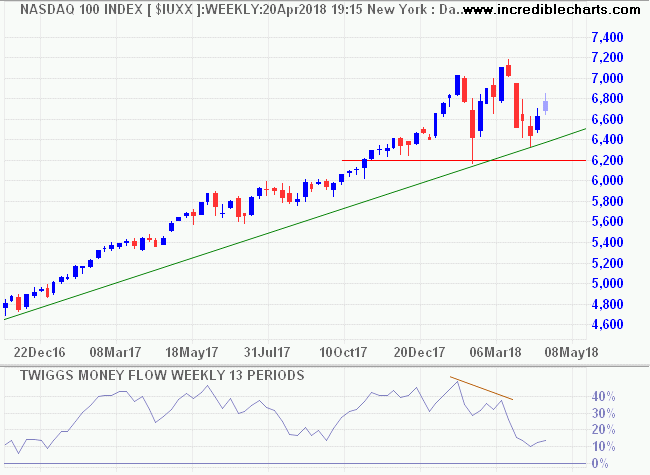

The Nasdaq 100 respected its long-term rising trendline and is headed for another test of 7000. Breakout above 7000 would signal another advance. Twiggs Money Flow shows a bearish divergence but this appears secondary in nature as Money Flow has so far respected the zero line, warning of a correction rather than a reversal.

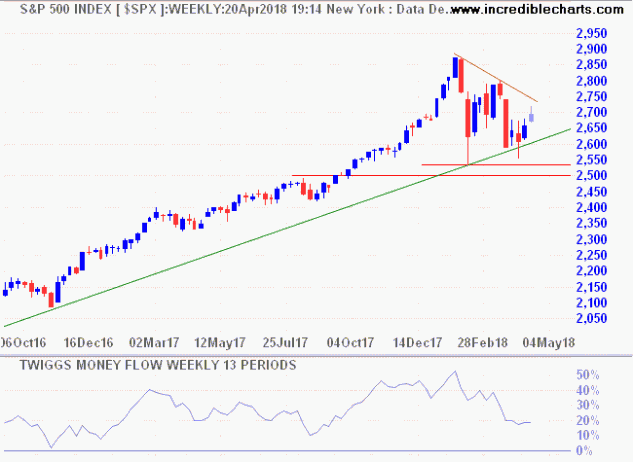

The S&P 500 rally is weaker than the Nasdaq but Twiggs Money Flow is stronger. Recovery above 2800 would indicate another test of 3000.

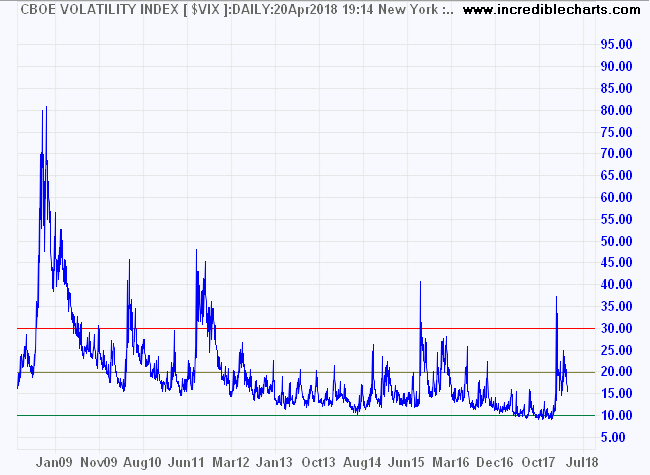

The CBOE Volatility Index for the S&P 500 (VIX) retreated below 20, suggesting that market risk is easing. Twiggs Volatility Index (21-Day) on the S&P 500, however, remains above 1% and would indicate long-term market risk is elevated if the next trough respects the 1% level.

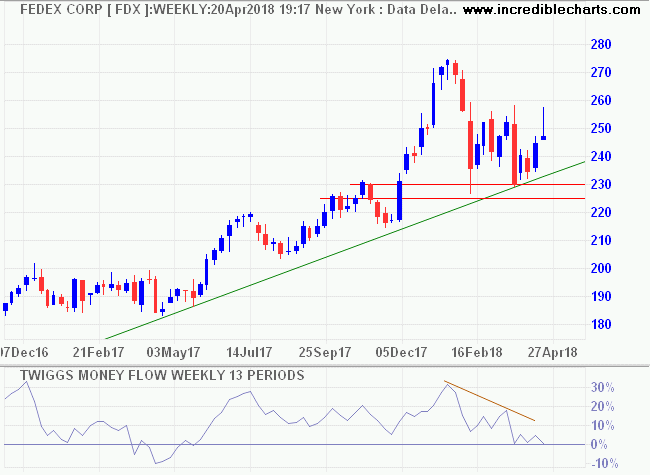

Bellwether transport stock Fedex has also undergone a sell-off but respected primary support at 225/230, with the primary up-trend intact. Recovery above 260 would be a bullish sign for the economy, suggesting that activity is increasing.

At the end of the day, prices are driven by earnings. The reporting season has just started for Q1 2018 and according to S&P "Of the 25 issues (505 in the index) with full operating comparative data 18 beat, 6 missed, and 1 met their estimates; 14 of 24 (66.7%) beat on sales." An acceptable start to the season.

It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I've known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine—that is, they made no real money out of it. Men who can both be right and sit tight are uncommon.

~ Jesse Livermore in Reminiscences of a Stock Operator

Latest

-

ASX 200

Miners versus Banks. -

Gold and the Dollar

Rising crude is bullish for gold. -

East to West

Headed for war? -

Trade War

Does China have the 'financial arsenic' to ruin the US? -

Investing in a Volatile Market

Odds favor a recovery but there is still significant downside risk. -

Avoiding the Hubris Trap

Even the most professional management teams are at risk.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.