Investing in Volatile Markets

By Colin Twiggs

April 13, 2017 9:30 p.m. EDT (11:30 a.m. AEST)

First, please read the Disclaimer.

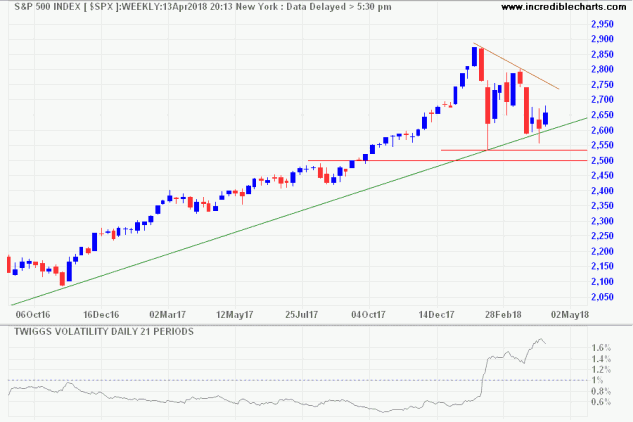

The S&P 500 again respected primary support at 2550. Twiggs Volatility Index is retreating but a trough that forms above 1.0% would warn that market risk remains elevated.

I explained recently to my clients that the odds are at least 2 to 1 that the S&P 500 will recover and go on to make new highs later in the year.

But there is still a significant risk (one-third to one quarter) that tensions will continue to escalate and the S&P 500 breaks primary support to commence a primary down-trend.

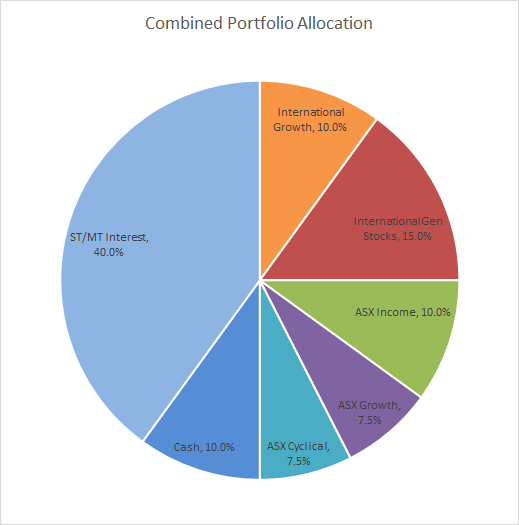

If you are risk-averse, as my clients tend to be, it makes sense to adjust your portfolio allocation to cope with either scenario. What I call "having one foot each side of the fence" or "having a bet each way" in racing parlance.

Gen Stocks are what I call "generational stocks" such as Apple (AAPL), Google (GOOGL), Amazon (AMZN), etc. ASX Income are stocks that yield strong dividends and franking credits.

If you have 50% of your investment portfolio in cash and short-to-medium-term interest-bearing securities (I collectively refer to this as "cash investments") and 50% in equities, you are well-positioned to take advantage of either scenario.

If the market does fall — the less-likely scenario — you are well-positioned to convert some of your cash investments to take advantage of lower prices when the dust has settled after the crash. If the market rises, as expected, then you have enough exposure to benefit from the continued bull market. In that case, your only downside is the difference in yields between cash and equities.

Bear in mind that:

- This only addresses clients' equity portfolios and does not take account of their other assets;

- The allocation is generic and does not take account of your personal circumstances; and

- The allocation is addressed at Australian investors.

Although the equity allocation is split equally between Australian and International (mainly US) stocks this does not infer that I rate them as equal market risk. Australian equities includes an allocation to Cyclicals which, in the present situation, could best be described as "counter-cyclical" as this largely consists of gold stocks which tend to rise as the market falls. My "Trump Insurance" as I called it in an earlier newsletter.

J.P. Morgan once had a friend who was so worried about his stock holdings that he could not sleep at night. The friend asked, "What should I do about my stocks?" Morgan replied, "Sell down to your sleeping point."

~ Burton Malkiel

Latest

-

ASX 200

Miners versus banks. -

Gold, Crude, the Dollar and Donald Trump

Gold, the Dollar and the impact of trade wars. -

East to West

Headed for war? -

Trade War

Does China have the 'financial arsenic' to ruin the US?

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.