S&P 500: More of the same

By Colin Twiggs

February 17, 2017 1:00 a.m. EST (5:00 p.m. AEDT)

Please read the Disclaimer.

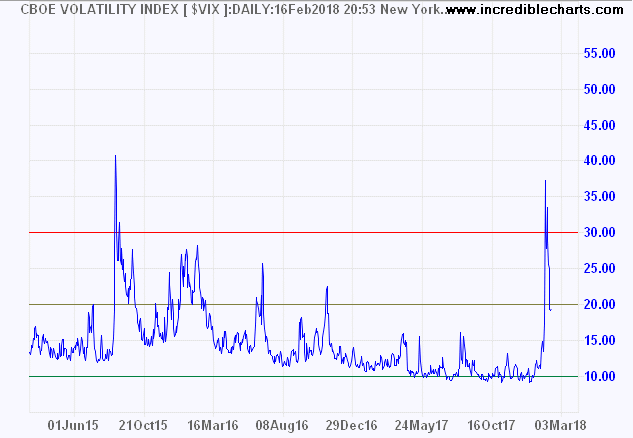

Volatility for the S&P 500, as measured by the VIX, retreated below 20, suggesting that the worst has passed.

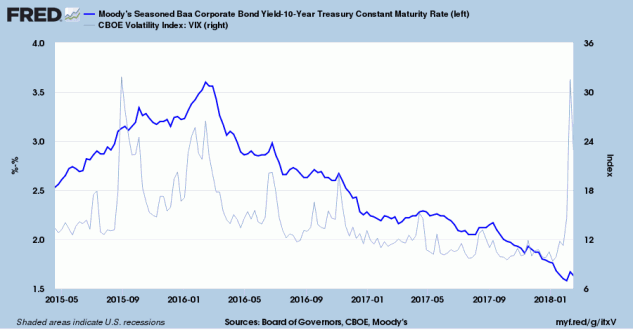

Corporate bond spreads (Lowest investment grade Baa minus 10-year Treasury yield) reflect no rise in lending risk premiums.

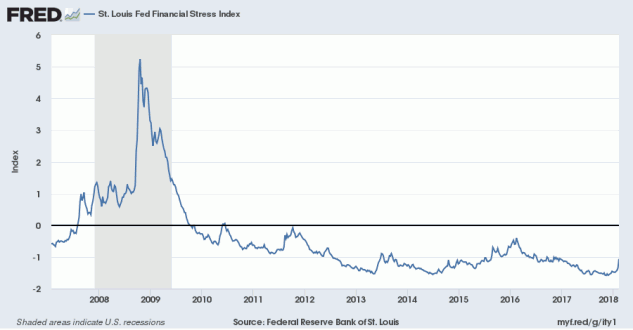

The composite Financial Stress Index from St Louis Fed shows a slight increase in financial stress levels but remains below -1.0, indicative of a bull market.

According to Standard & Poors, 248 of component stocks in the S&P 500 have reported earnings for the December quarter, with 191 beating estimates and only 34 misses. Their revised estimate for the index of $33.47 operating earnings per share is an increase of 20% over the preceding December quarter and an 18.5% increase over the highest previous December quarter (2013).

Logically, the S&P 500 should recover in the next week or so and continue its multi-year advance. But the market is governed by emotion in the short- to medium-term, not logic.

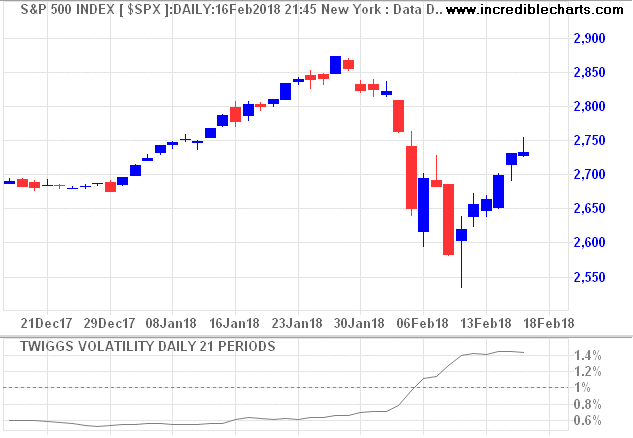

Short daily, overapping candles reflect a measure of caution. Investors are now more wary than they were in January. The S&P is likely to recover, but expect another test of support at 2550/2600 first. Respect of support would bolster confidence and encourage buyers to return. Breach of support is unlikely but would cause another spike in volatility.

Twiggs Volatility (21-day), reflecting the medium-term outlook, remains elevated. Retreat below 1% would indicate that bullish conditions have resumed, while respect of 1% would warn that risk remains elevated.

The intelligent investor is a realist who sells to optimists and buys from pessimists.

~ Benjamin Graham

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.