S&P 500 Bull Market Continues/

ASX Improves

By Colin Twiggs

August 25, 2017 10:30 p.m. EDT (12:30 p.m. AEST)

Please note changes to the Disclaimer

Colin Twiggs is a director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

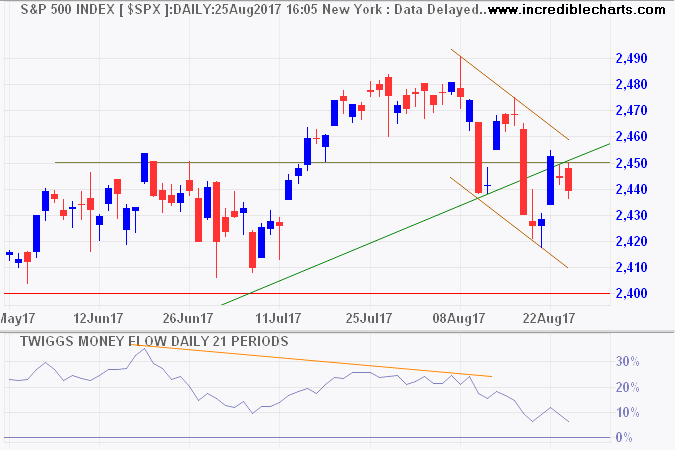

The S&P 500 continues with a secondary correction that is likely to test the long-term rising trendline and support at 2400. Bearish divergence on Twiggs Money Flow warns of selling pressure but this seems secondary in nature.

Target 2400 + ( 2400 - 2300 ) = 2500

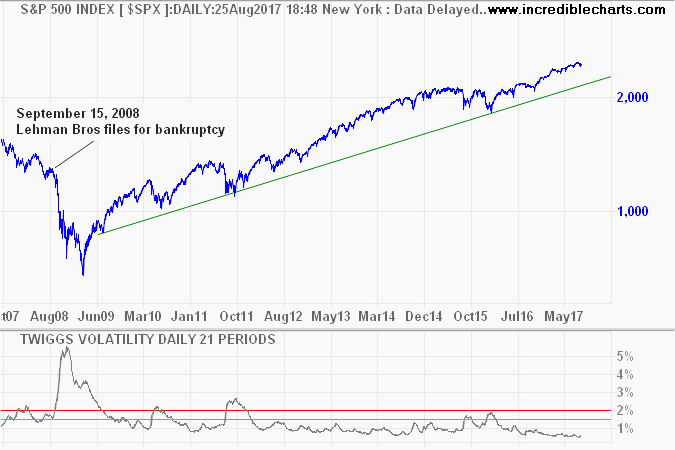

Twiggs Volatility (21-day), at 0.63% for the S&P 500, is way below the 1.5% warning level for elevated market risk.

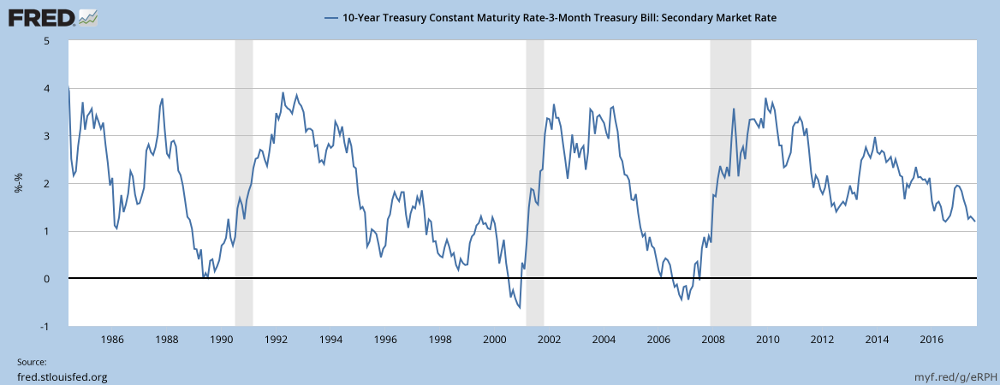

The yield curve is flattening, with the 10-year minus 3-month Treasury Yield Differential close to 1.0%. But this is still well above the 0.5% early-warning level (a negative yield curve, where the Yield Differential falls below zero, is normally followed by a recession within 6 to 12 months).

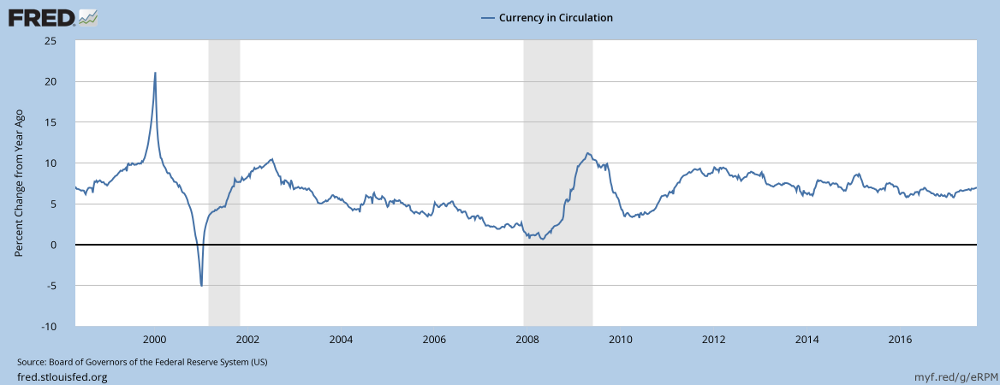

Fed monetary policy remains accommodative, with currency in circulation expanding at a healthy annual rate of 6.9%.

The bull market remains on track for further gains.

Australia: ASX Improves

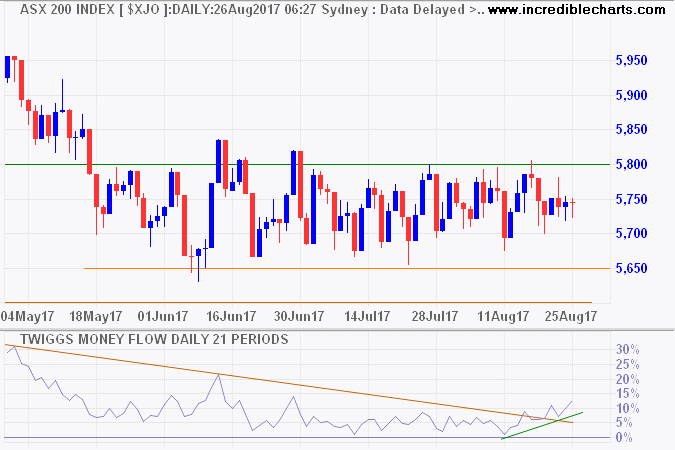

The ASX 200 continues to consolidate in a narrow line between 5650 and 5800. Rising Twiggs Money Flow (21-day) warns of short-term buying pressure. Expect a test of resistance at 5800. Breakout would signal a primary advance, testing 6000, but breach of support at 5650 remains as likely and would warn of a primary down-trend.

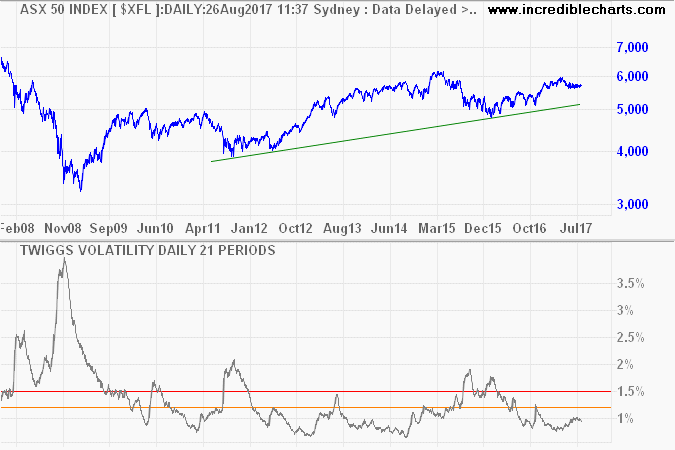

The large cap ASX 50 is historically less volatile than its S&P 500 counter-part. While the Australian index has some smaller stocks (IPL market cap $5.7 bn compared to lowest-weight S&P 500 NWS of $10 bn in AUD) the higher dividend yield tends to compensate. That difference has reversed recently but Twiggs Volatility (21-day) on the ASX 50 is also falling, reaching 0.92% this week.

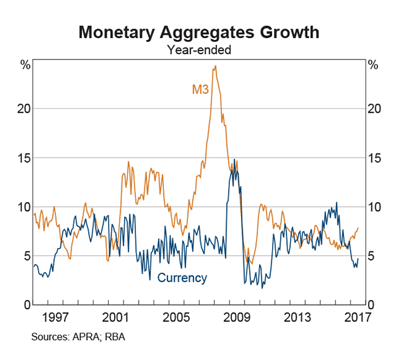

Currency growth remains weak (below 5% per year), indicating that the economy still faces headwinds.

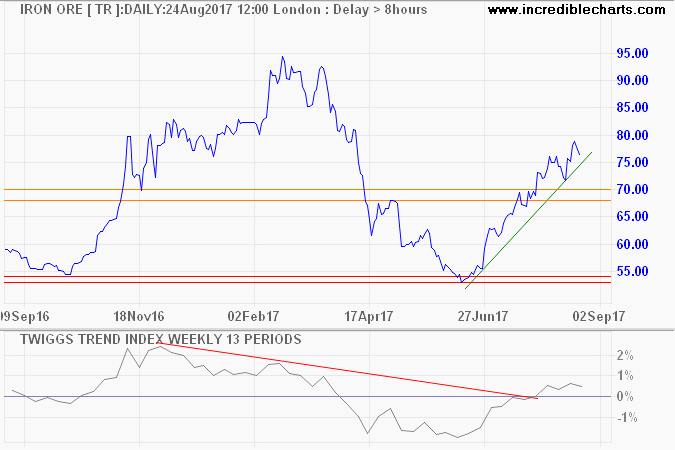

Iron ore continues its extended bear market rally. The next correction is likely to find support above the primary level at 53.

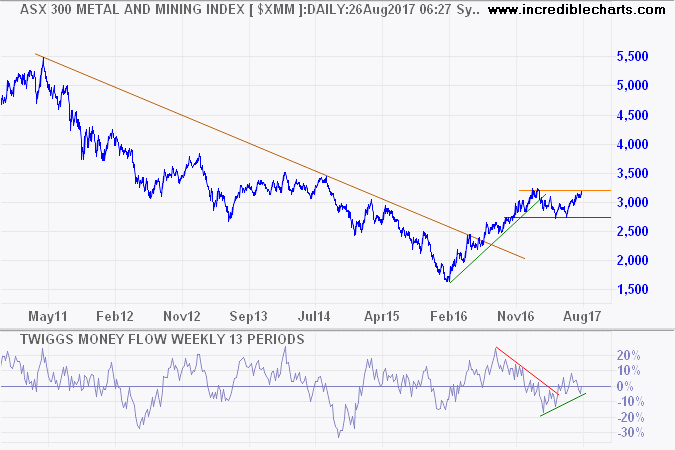

ASX 300 Metals & Mining is testing resistance at its January/February highs. Breakout above 3240 would signal a primary advance. Expect some profit-taking but reversal below primary support at 2730 is now unlikely.

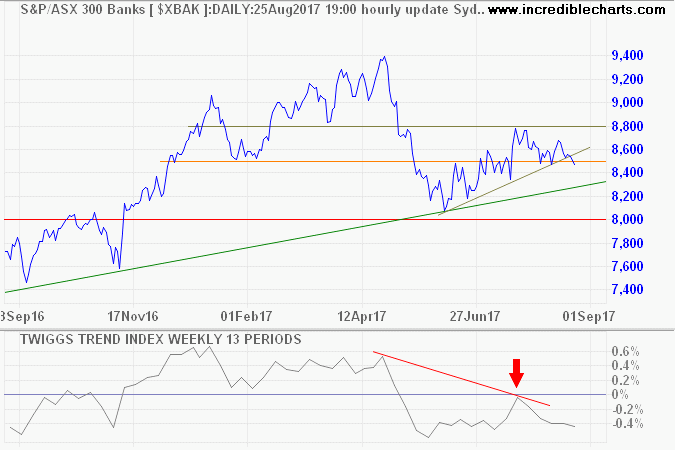

The ASX 300 Banks index breached support at 8500, however, and continues to drag on the broad market index. Declining Twiggs Money Flow warns of selling pressure. Follow-through below 8400 would confirm another test of primary support at 8000.

Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.

~ Sir John Templeton