S&P 500 Bull Market on Track/

ASX 200 Narrow Line

By Colin Twiggs

August 18, 2017 10:30 p.m. EDT (12:30 p.m. AEST)

Please note changes to the Disclaimer

Colin Twiggs is a director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

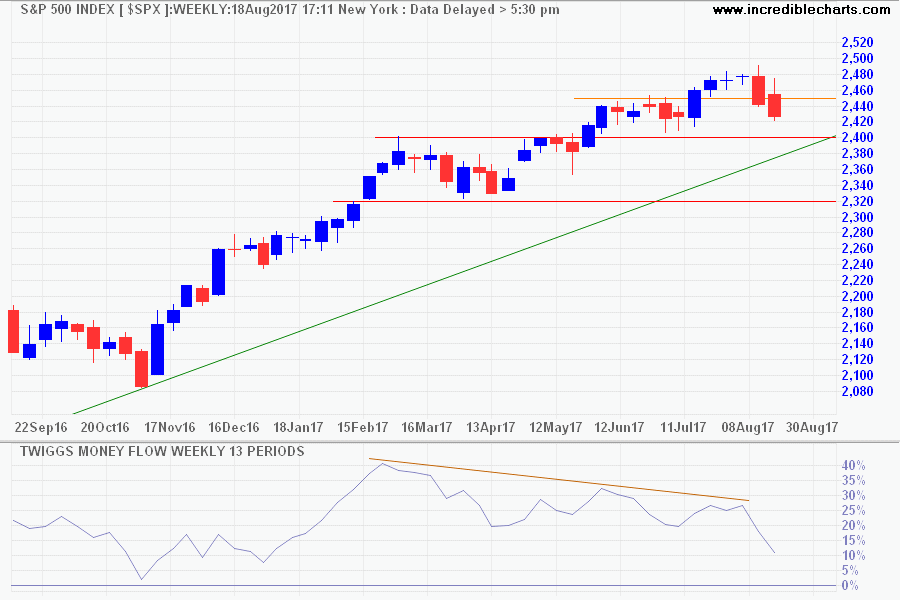

The S&P 500 is undergoing a secondary correction that is likely to test the long-term rising trendline and support at 2400. Bearish divergence on Twiggs Money Flow warns of selling pressure but this seems secondary in nature. The bull market remains on track for further gains.

Target 2400 + ( 2400 - 2300 ) = 2500

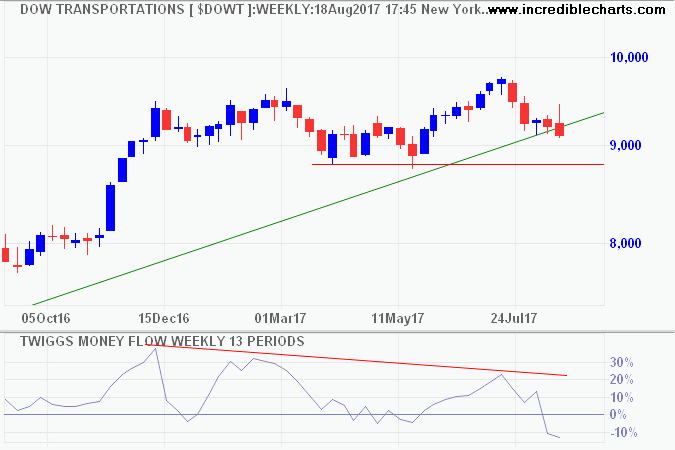

The Dow Jones Transportations Average is also undergoing a correction. Bearish divergence with Twiggs Money Flow dipping below zero warns of stronger selling pressure. Expect a test of primary support at 8800.

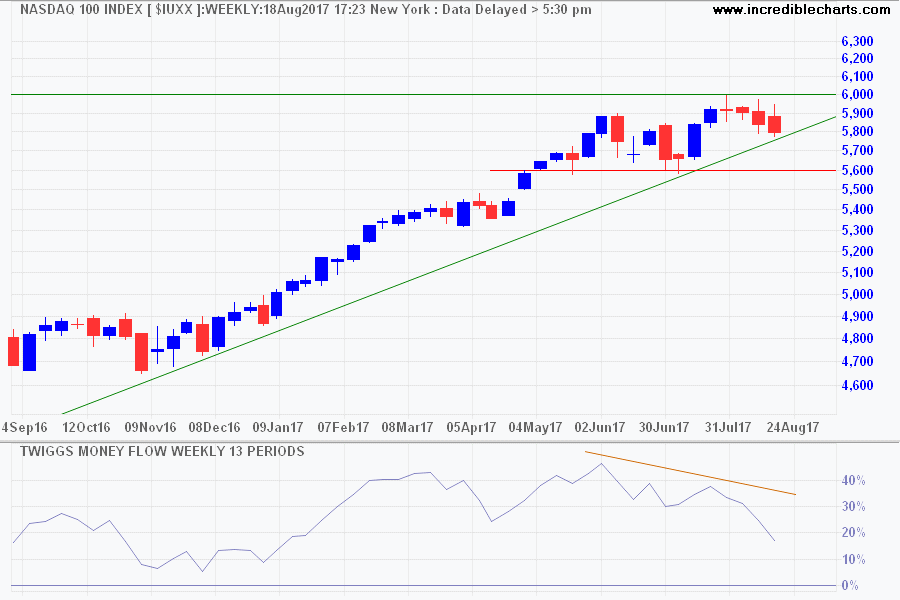

The Nasdaq 100 is retreating from resistance at 6000. Bearish divergence warns of secondary selling pressure. Breach of primary support at 5600 is considered unlikely.

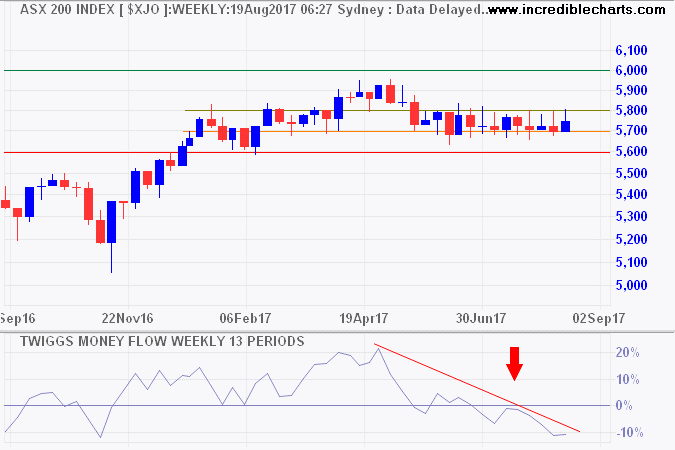

Australia: ASX 200 Narrow Line

The ASX 200 continues to consolidate in a narrow line between 5650 and 5800. Declining Twiggs Money Flow warns of selling pressure and breach of support at 5650 would signal a primary down-trend. Follow-through below 5600 would confirm. Breakout above 5800 is unlikely but would test resistance at 6000.

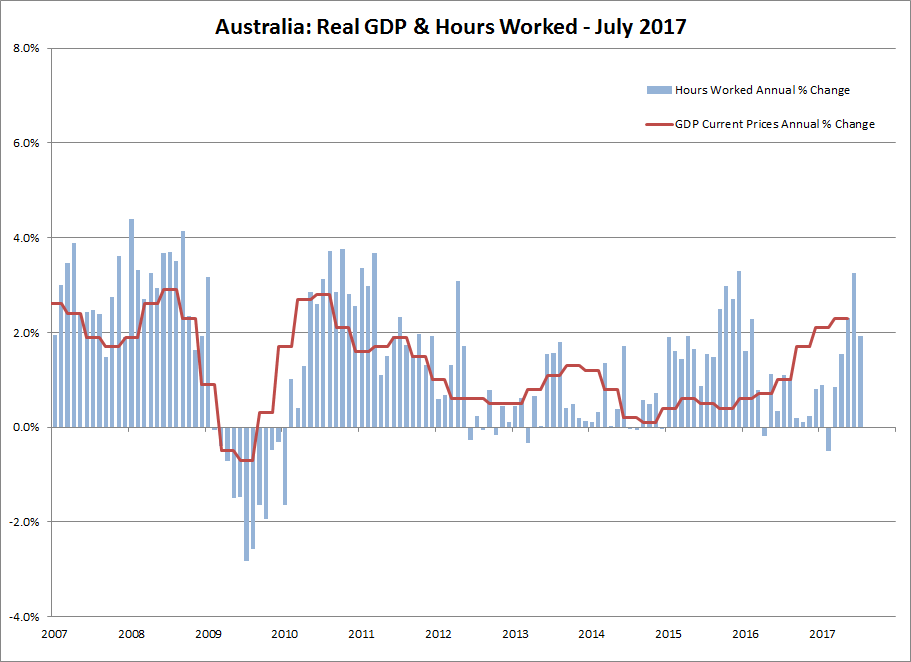

Monthly hours worked are up 1.9% over the last 12 months. Marginally below real GDP but not something to be concerned about unless growth continues to fall.

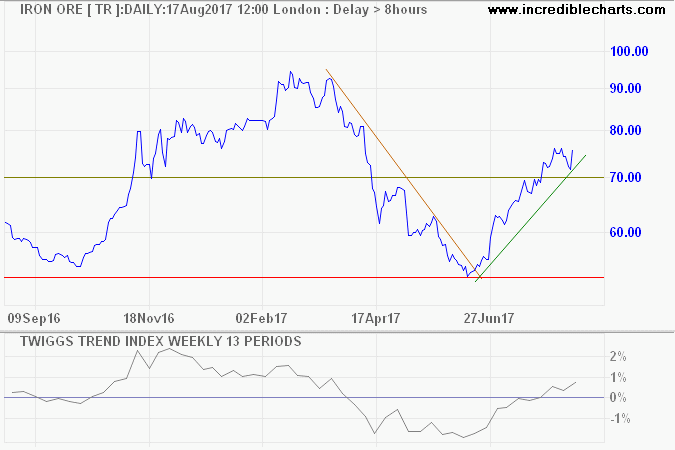

Iron ore continues its extended bear market rally, suggesting that the next correction is likely to find support above the primary level at 53.

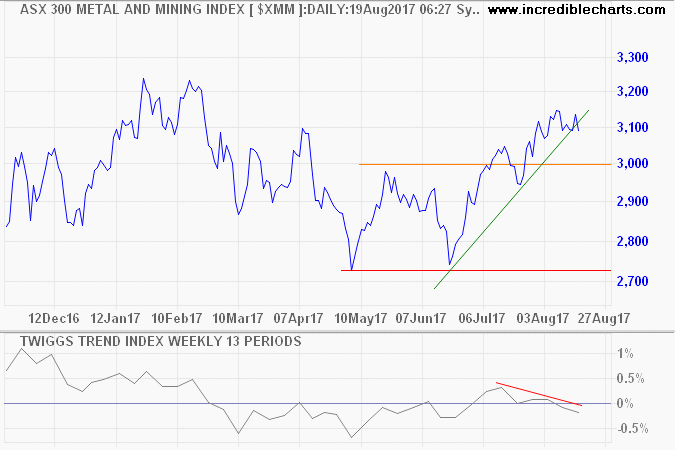

ASX 300 Metals & Mining is also likely to find support above 2750. Respect of support at 3000 would signal a strong up-trend.

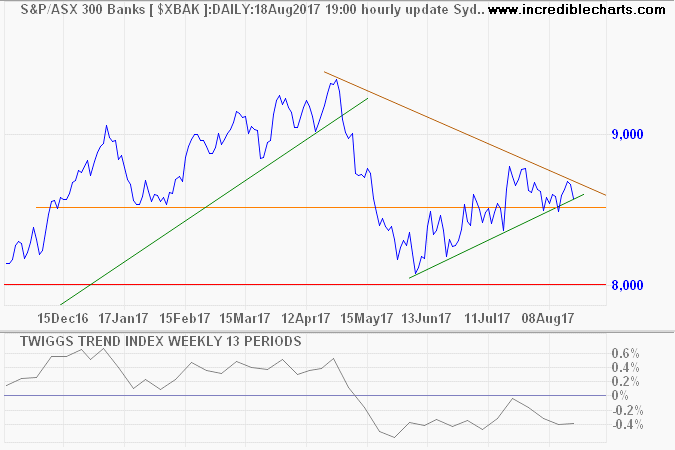

The ASX 300 Banks index continues to warn of selling pressure, with declining Twiggs Trend Index and Money Flow below zero. Breach of support at 8500 would signal another test of primary support at 8000.

It has often been said that power corrupts. But it is perhaps equally important to realize that weakness, too, corrupts. Power corrupts the few, while weakness corrupts the many. Hatred, malice, rudeness, intolerance, and suspicion are the faults of weakness. The resentment of the weak does not spring from any injustice done to them but from their sense of inadequacy and impotence. We cannot win the weak by sharing our wealth with them. They feel our generosity as oppression.

~ Eric Hoffer