US adds 222 thousand jobs, Australia faces headwinds

By Colin Twiggs

July 7, 2017 11:30 p.m. EDT (1:30 p.m. AEST)

Disclaimer

Please read the Disclaimer. I am not a licensed investment adviser.

From the Wall Street Journal:

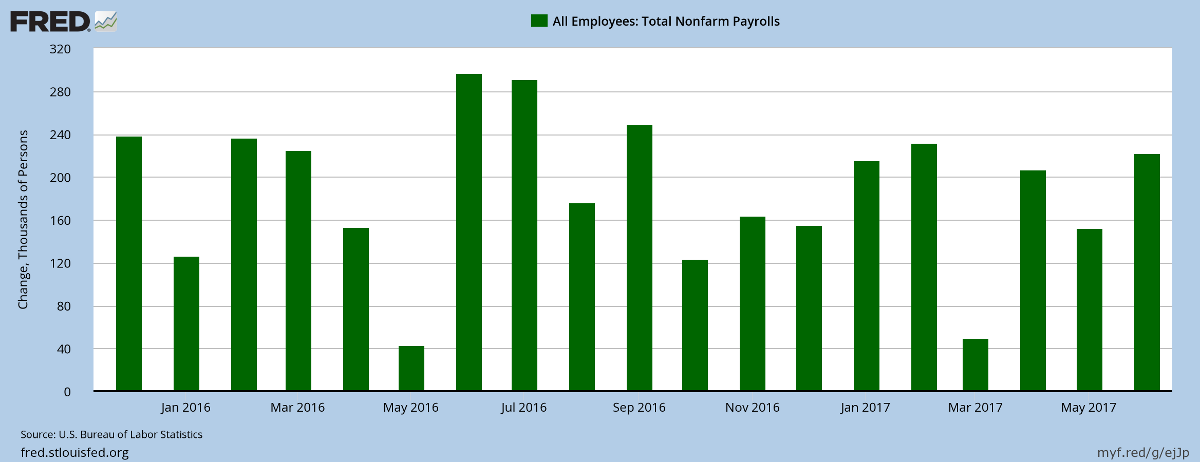

U.S. employers picked up their pace of hiring in June. Nonfarm payrolls rose by a seasonally adjusted 222,000 from the prior month, the Labor Department said. The unemployment rate ticked up to 4.4% from 4.3% the prior month as more people joined the workforce.....

Source: St Louis Fed & BLS

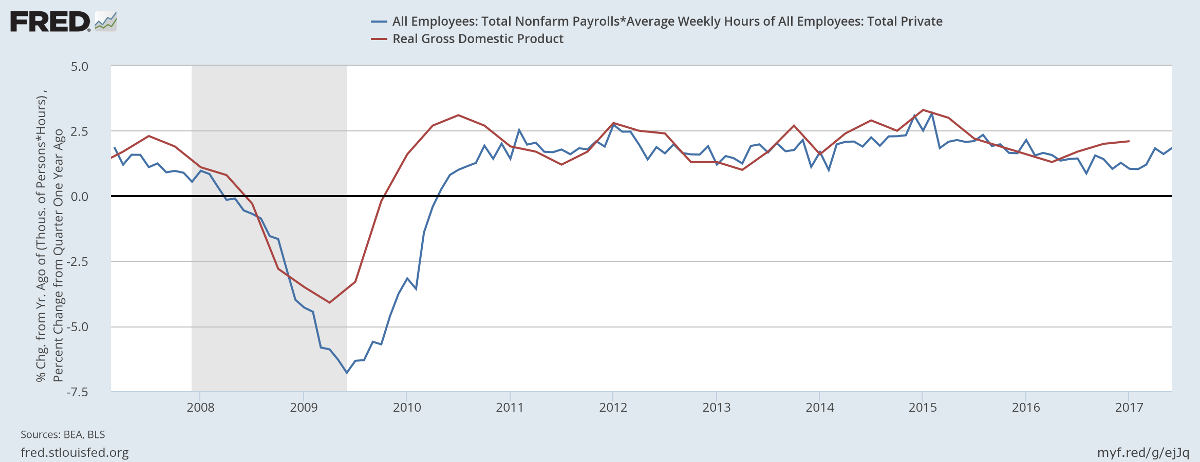

Forecast real GDP for the current quarter — total payrolls * hours worked — is rising, showing an improving economy.

Source: St Louis Fed, BLS & BEA

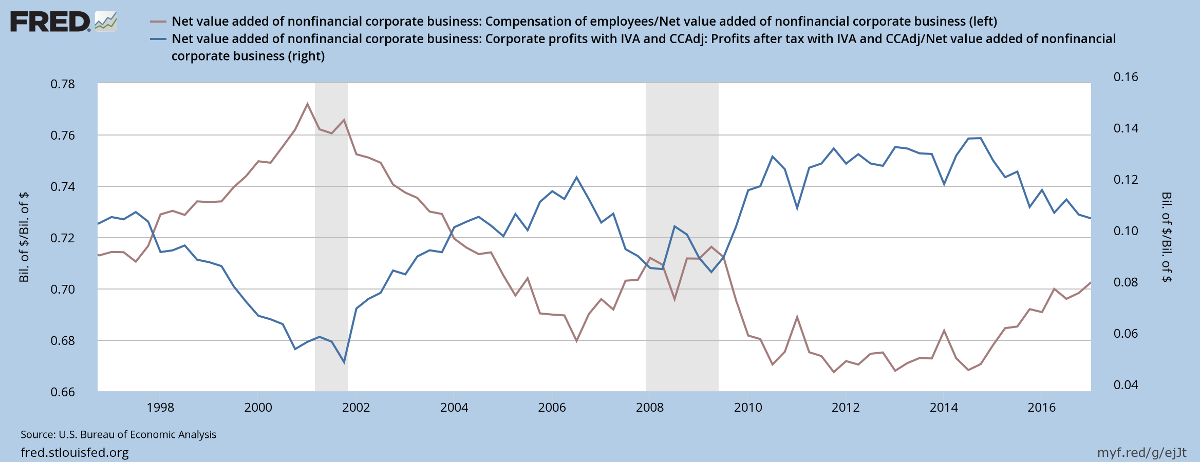

Declining corporate profits as a percentage of net value added (RHS) is typical of mid-cycle growth, while employee compensation (% of net value added) is rising at a modest pace. Peaks in employee compensation are normally accompanied by troughs in corporate profits.....and followed by a recession.

Source: St Louis Fed & BEA

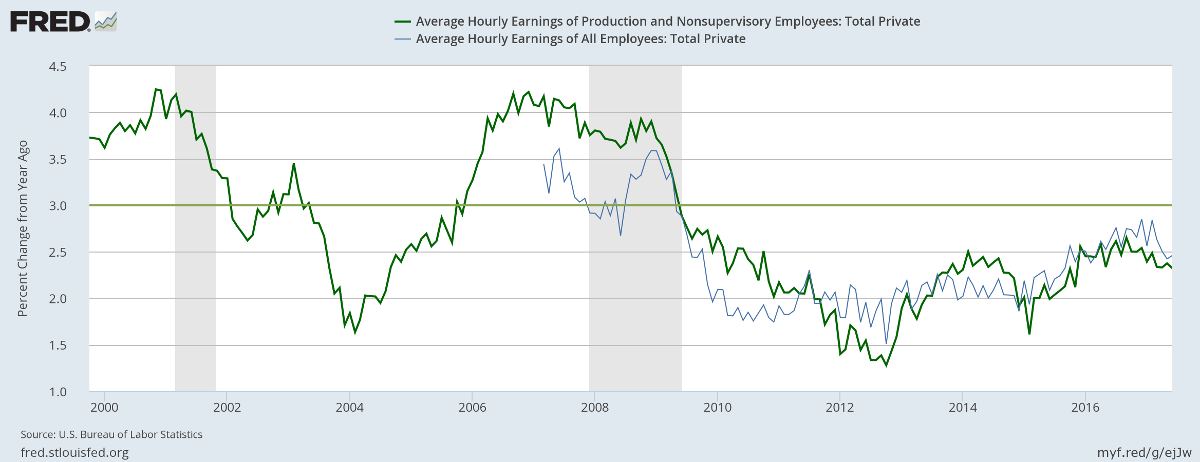

Average wage rate growth, both for production/non-supervisory and all employees, remains below 2.5% per year. Absence of wage rate pressure suggests that the Fed will be in no hurry to hike interest rates to curb inflationary pressure.

Source: St Louis Fed & BLS

Which should mean further growth ahead.

Australia

Australian wage rate growth, on the other hand, is declining.

Source: RBA & ABS

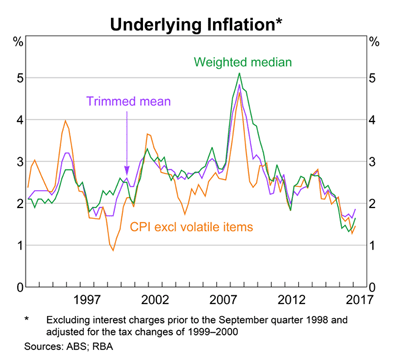

As is inflation.

Source: RBA & ABS

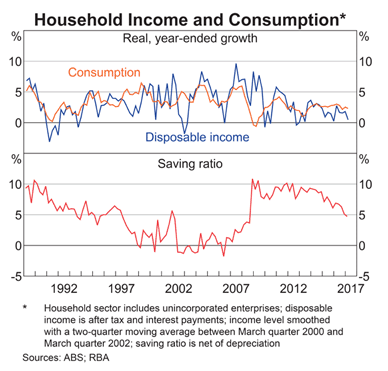

Growth in Household Disposable Income and Consumption.

Source: RBA & ABS

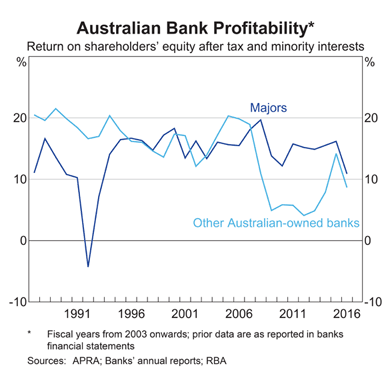

And Banks return on shareholders equity.

Source: RBA & APRA

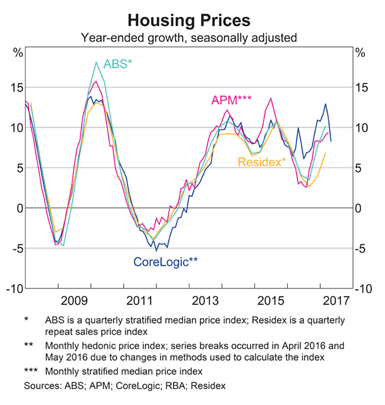

But not Housing.

Source: RBA, ABS, APM, CoreLogic & Residex

At least not yet.

Falling house prices would complete the feedback loop, shrinking household incomes, consumption and banks ROE.

Much success can be attributed to inactivity. Most investors cannot resist the temptation to constantly buy and sell.

~ Warren Buffett