Forward P/E turns back up

By Colin Twiggs

February 25, 2017 12:20 a.m. ET (4:20 p.m. AEDT)

Disclaimer

Please read the Disclaimer. I am not a licensed investment adviser.

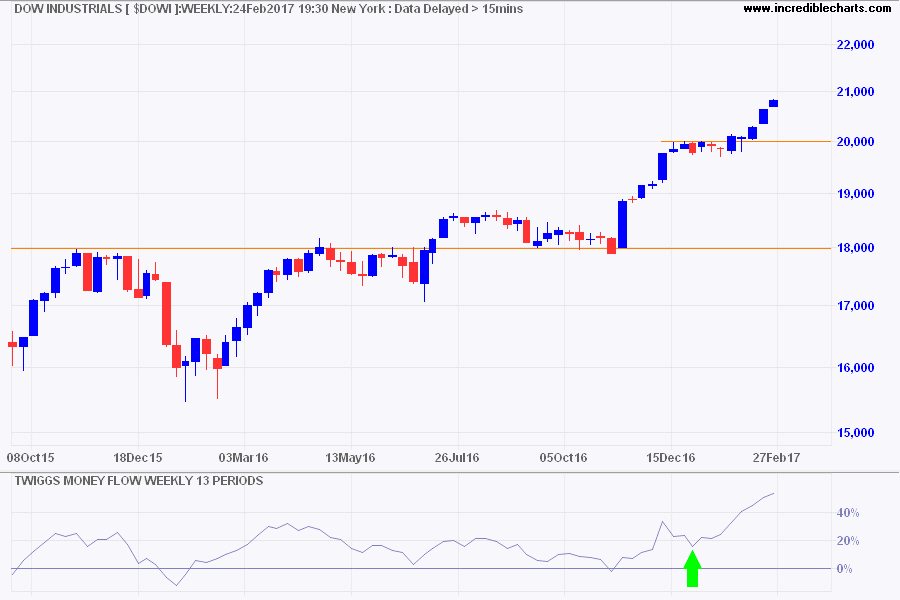

Dow Jones Industrials

Dow Jones Industrial Average continues to climb, heading for a target of 21000. Rising troughs on Twiggs Money Flow signal strong buying pressure.

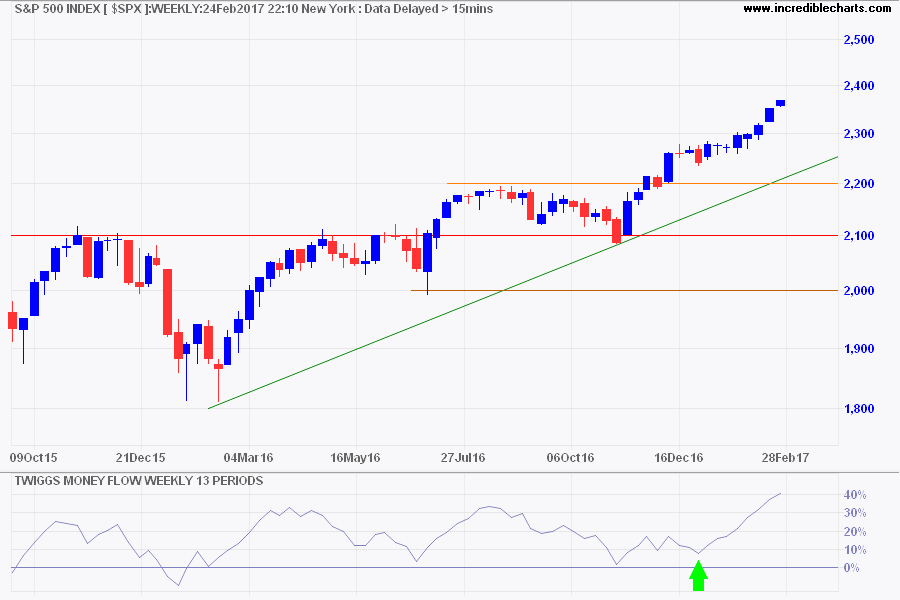

The S&P 500 follows a similar path.

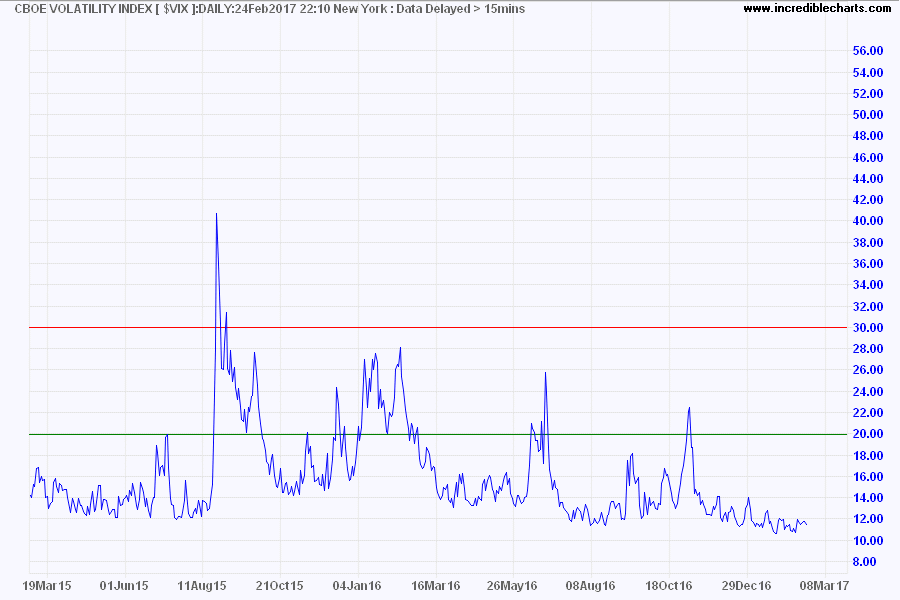

With the CBOE Volatility Index (VIX) close to historic lows around 10 percent.

However, at least one investment manager, Bob Doll, is growing more cautious:

"...we think the easy gains for equities are in the rearview mirror and we are growing less positive toward the stock market. We do not believe the current bull market has ended, but the pace and magnitude of the gains we have seen over the past year are unlikely to persist."

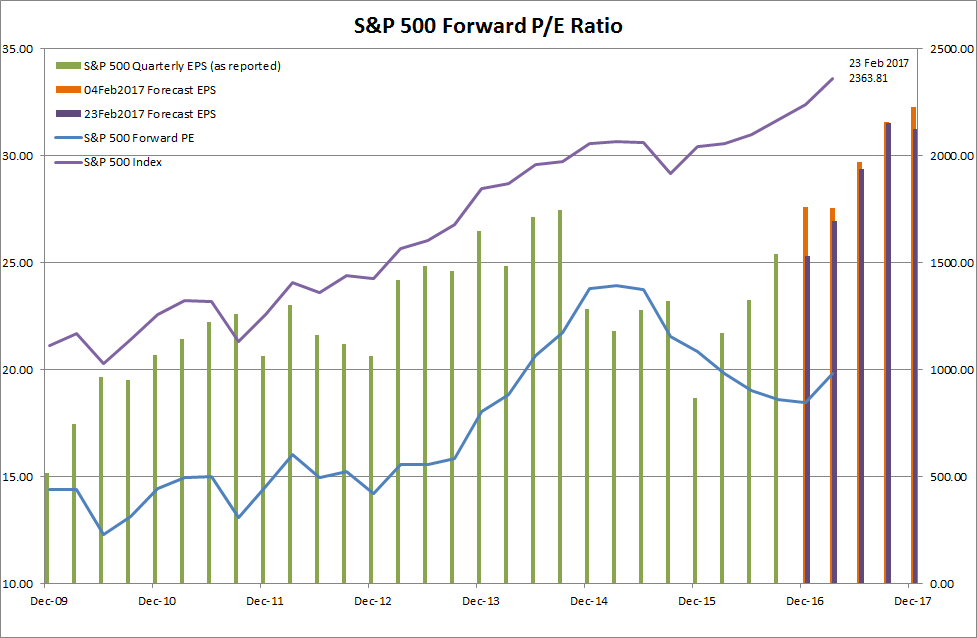

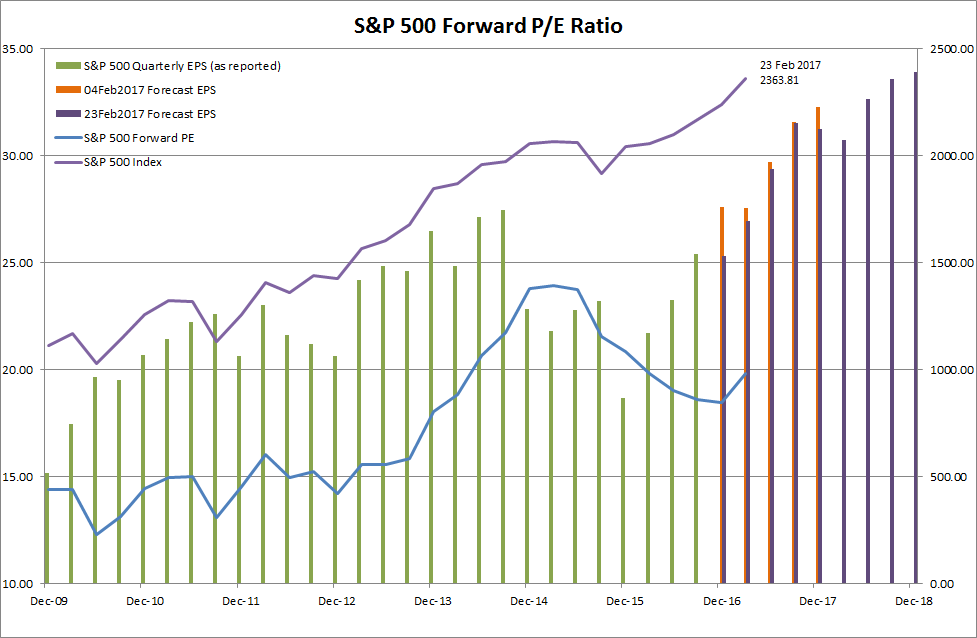

Forward P/E Ratio

Bob Doll's view is reinforced by recent developments with the S&P 500 Forward Price-Earnings Ratio. I remarked at the beginning of February that the Forward P/E had dropped below 20, signaling a time to invest.

Actual earnings results, however, have come in below earlier estimates — shown by the difference between the first of the purple (latest estimate) and orange bars (04Feb2017) on the chart below.

In the mean time the S&P 500 index has continued to climb, driving the Forward P/E up towards 20.

This is not yet cause for alarm. We are only one month away from the end of the quarter, when Forward P/E is again expected to dip as the next quarter's earnings (Q1 2018) are taken into account.

But there are two events that would be cause for concern:

- If the index continues to grow at a faster pace than earnings; and/or

- If forward earnings estimates continue to be revised downward, revealing over-optimistic expectations.

Either of the above could cause Forward P/E to rise above 20, reflecting over-priced stocks.

Be fearful when others are greedy and greedy only when others are fearful.

~ Warren Buffett