Dow 20,000/How to survive the next four years

By Colin Twiggs

January 28, 2017 12:00 a.m. ET (4:00 p.m. AEDT)

Disclaimer

I am not a licensed investment adviser. Please read the Disclaimer.

We are entering a time of uncertainty.

Donald Trump started his presidency with a continuation of the confrontational approach that he exhibited throughout his campaign, with scant regard to unifying the country and governing from the middle. Instead he has signed off on two controversial oil pipelines that, while they would create jobs, have met fierce opposition and are likely to polarize the nation even further.

Subtlety is not Trump's strong point. Expect a far more abrasive style than the Obama years.

Trump also signed off on constructing a wall along the border with Mexico. Again, this will create jobs and slow illegal immigration — two of his key campaign promises — while harming relations with the Southern neighbor.

Another key target is the trade deficit. The US has not run a trade surplus since 1975. Expect major revision of current trade agreements like NAFTA, which could further damage relations with Mexico, and a slew of actions against trading partners such as China and Japan who have used their foreign reserves in the past to maintain a trade surplus with the US. Floating exchange rates are meant to balance the flow of imports and exports on current account, minimizing trade surpluses/deficits over time. But this can be subverted by accumulating excessive foreign reserves to suppress appreciation of your home currency. Retaliation to US punitive actions is likely and could harm international trade if not carefully managed.

Apart from trade wars, Trump and chief strategist Steve Bannon also seem intent on provoking a war with the media, baiting the press in a recent New York Times interview:

Bannon delivered a broadside at the press.... saying, "The media should be embarrassed and humiliated and keep its mouth shut and just listen for a while." Bannon also said, "I want you to quote me on this. The media here is the opposition party. They don't understand this country. They still do not understand why Donald Trump is the president of the United States....."

Trump and Bannon's strategy may be to provoke retaliation by the media. One-sided reporting would discredit the press as an objective source of criticism of the new presidency.

On top of the Trump turmoil in the US, we have Brexit which threatens to disrupt trade between the UK and European Union. If not managed carefully, this could lead to copycat actions from other EU member states.

Increasingly aggressive steps by China and Russia are another destabilizing factor — with the two nations asserting their global power against weaker neighbors. Iran is another offender, attempting to establish a crescent of influence in the Middle East against fierce opposition by Saudi Arabia, Turkey and their Sunni partners. Also, North Korea is expanding its nuclear arsenal.

We live in dangerous times.

But these may also be times of opportunity. Trump has made some solid appointments to his team who could exert a positive influence on the global outlook. And confrontation may resolve some long-festering sores on both the economic and geo-political fronts.

How are we to know? Where can we get an unbiased view of economic prospects if confrontation is high, uncertainty a given — the new President issuing random tweets in the night as the mood takes him — and a distracted media?

There are two reliable sources of information: prices and earnings. Stock prices reflect market sentiment, the waves of human emotion that dominate short- and medium-term market behavior. And earnings will either confirm or refute market sentiment in the longer term.

As Benjamin Graham wrote:

"In the short term the stock market behaves like a voting machine, but in the long term it acts like a weighing machine".

In the short-term, stock prices may deviate from true value as future earnings and growth prospects are often unclear. But prices will adjust closer to true value as more information becomes available and views of earnings and prospects narrow over time.

We are bound to experience periods of intense volatility over the next four years as hopes and fears rise and fall. These periods represent both a threat and an opportunity. A threat if you have invested on hopes and expectations rather than on solid performance. And an opportunity if intense volatility causes prices to fall below true value.

It will pay to keep a close watch on technical signals on the major indexes. As well as earnings growth in relation to index performance.

Also, keep a close eye on long-term indicators of market risk such as the Treasury yield curve and corporate bond spreads. These often forewarn of coming reactions and will be reviewed on a regular basis in future newsletters.

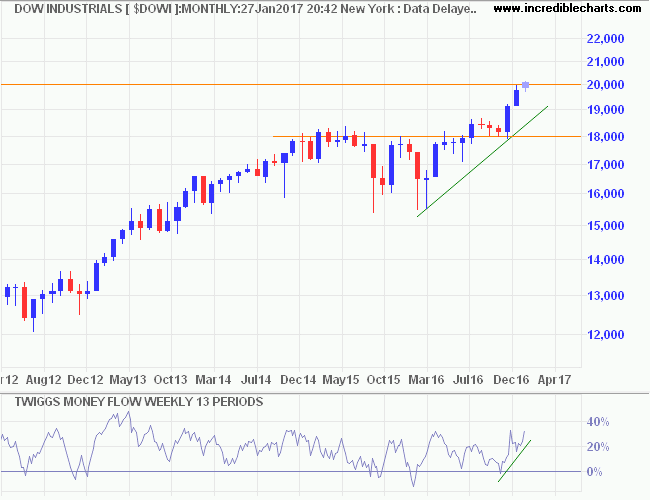

Dow breaks 20,000

The Dow Jones Industrial Average broke the important psychological barrier of 20,000 this week. The news was greeted with cheers from the media, many advisers and investors.

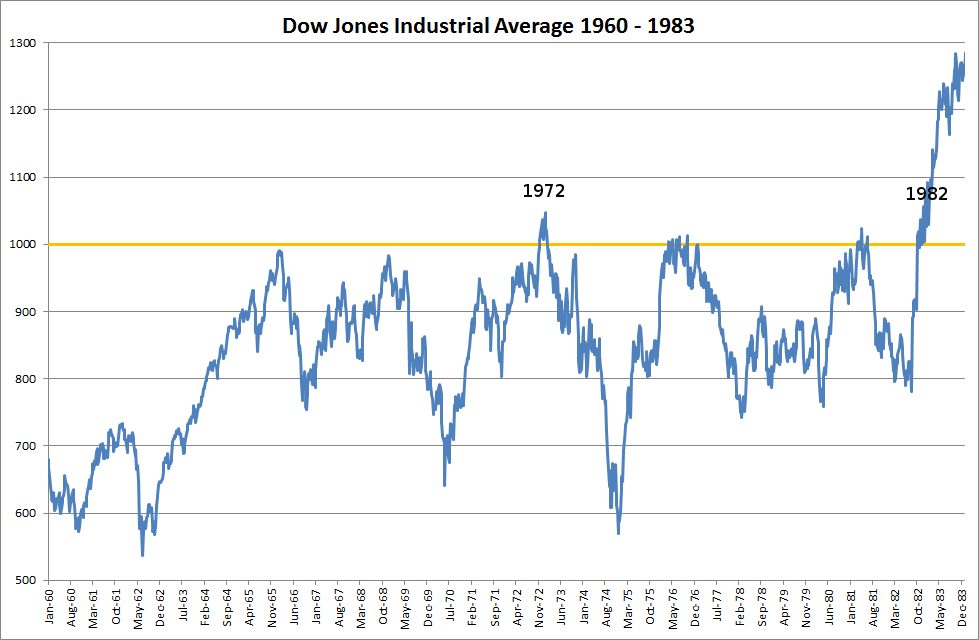

Older readers may recall a similar event when the Dow broke 1000 on November 14, 1972. Here is an excerpt from the New York Times that day:

The Dow Jones industrial average closed above the 1,000 mark yesterday for the first time in history.

It finished at 1,003.16 for a gain of 6.09 points in what many Wall Streeters consider the equivalent of the initial breaking of the four-minute mile.

"This thing has an obvious psychological effect," declared one brokerage-house partner. "It's a hell of a news item. As for the permanence of it -- well, I just don't know."

Last Friday, the Dow surpassed 1,000 during the course of a day's trading, but it fell back below the landmark figure by the end of the session.

But yesterday the market was not to be denied. The Dow finally put it all together, the peace rally, the re-election of President Nixon, the surging economy, booming corporate profits and lessening fears about inflation and taxes and controls and other uncertainties of 1973.

.....International Business Machines, Wall Street's best known glamour issue, moved up 11 1/4 points to 388, its best price of the day.

.....An office broker, watching the stock tape from his desk downtown, murmured in wonderment: "There's a sort of renewed confidence in the whole economic outlook."

The broker who questioned the permanence of the move must have had a crystal ball. Three months later, the Dow reversed below 1000, commencing a bear market that ended at 570.

Four years later, in 1976, the Dow again rallied and broke 1000. Only to retreat in another bear market that carried as low as 750. A third advance carried the Average above 1000 in 1981, before another retreat, this time to 780.

Only in 1982, a full ten years after the first breakout, did the Dow finally break clear of 1000, advancing strongly over the next few years.

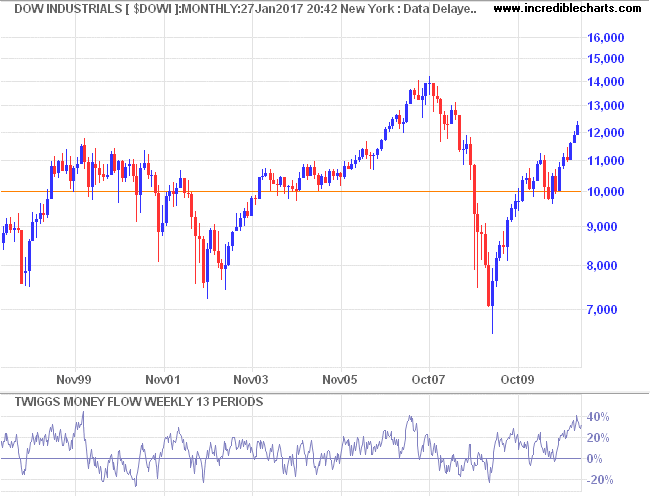

The next significant barrier for the Dow was 10,000. Breakout took place in 1999, during the Dotcom boom, with a minimum of fuss.At least one pundit at the time predicted the Dow would reach 100,000 by 2020.

Contrary to initial indications, the 10,000 level also proved a formidable barrier, with breach of support in 2001 heralding the start of a bear market that fell as low as 7200.

Recovery in 2003 appeared robust, with two secondary corrections respecting the new support level at 10,000. But the global financial crisis in 2008 saw the Dow fall to 6500. It took more than ten years after the initial breakout before we could comfortably say that the Dow had broken clear of 10,000.

The next important barrier is the current 20,000. It may be naive to think we have seen the last of it.

If past records are anything to go by, we could be in for an interesting decade.

Those who follow the part of themselves that is great become great men; those who follow the part of themselves that is small will become small men.

~ Mencius, Confucian philosopher (circa 372 - 289 B.C.)