Trump destroys the logjam

By Colin Twiggs

November 11, 2016 10:30 p.m. ET (2:30 p.m. AEDT)

Disclaimer

I am not a licensed investment adviser.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers, viewers and course attendees (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. I expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

United States

Donald Trump has destroyed the logjam in US politics and we should be prepared for a wild ride over the next few months as markets struggle with uncertain outcomes.

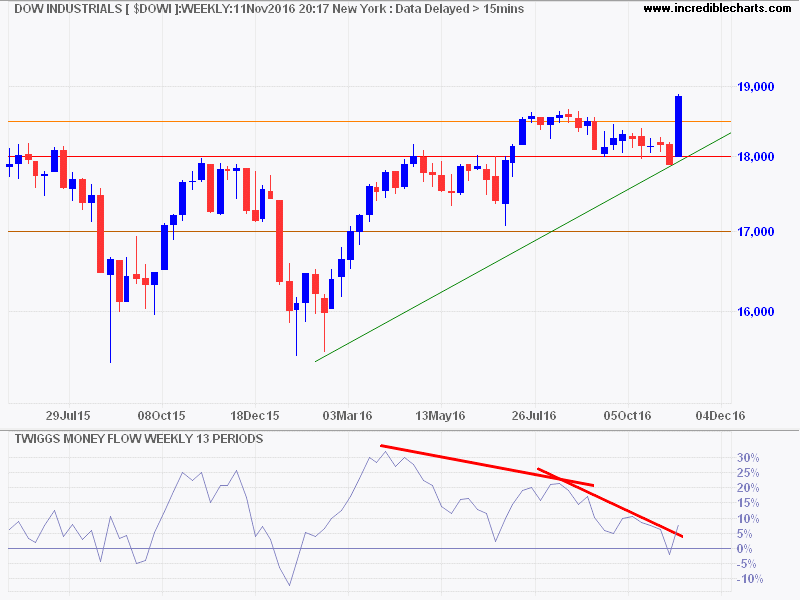

Dow Jones Industrial Average broke resistance at 18500, signaling a fresh primary advance. A Twiggs Money Flow trough above zero would negate the bearish divergence. Recovery above 18500 is unlikely but would signal another primary advance. Target for the advance is 19500*.

* Target medium-term: 18000 + ( 18500 - 17000 ) = 19500

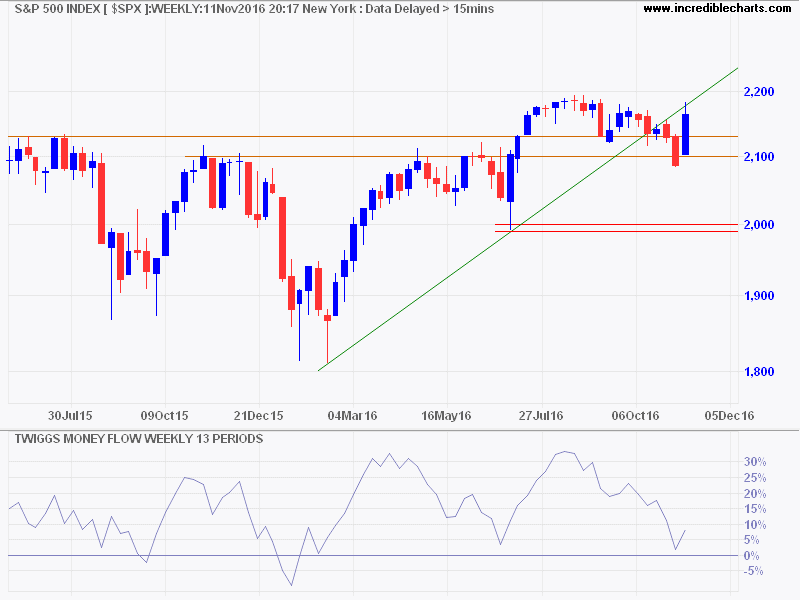

The S&P 500 has not yet broken resistance at 2200. Breakout would complete the inverted scallop pattern, signaling an advance to 2300. A Twiggs Money Flow trough above zero would confirm long-term buying pressure.

* Target medium-term: 2100 + ( 2200 - 2000 ) = 2300

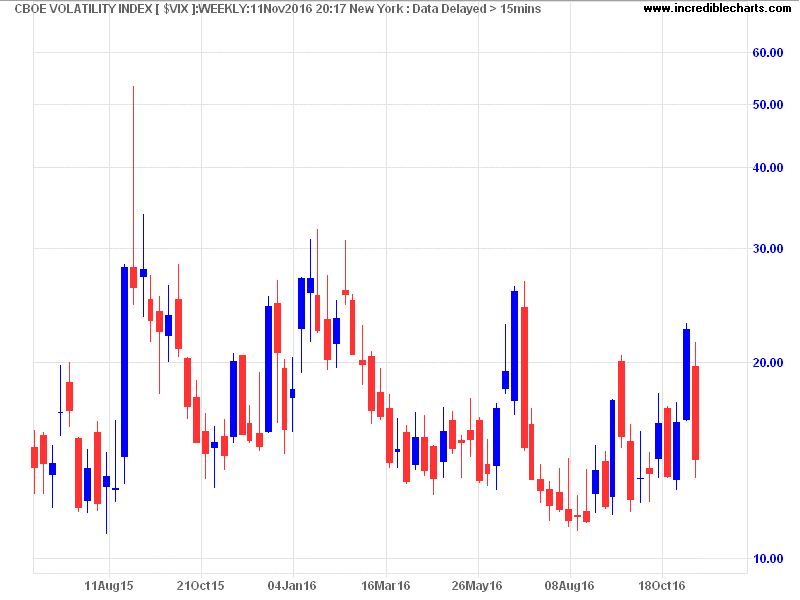

The VIX retreated to 14, indicating a bullish risk outlook.

Global

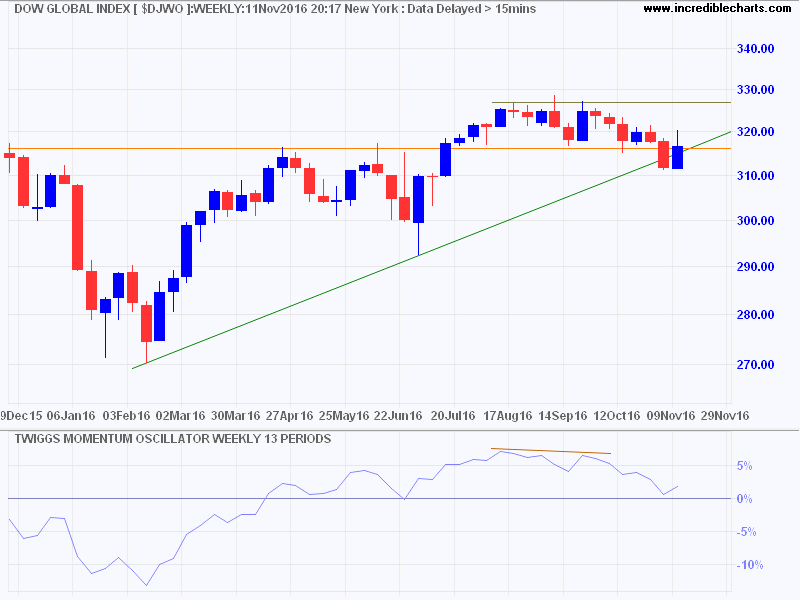

Dow Jones Global Index recovered above support at 316, suggesting the recent breach could be a bear trap. A 13-week Momentum trough above zero would signal another primary advance. Follow-through above 320 would strengthen the signal.

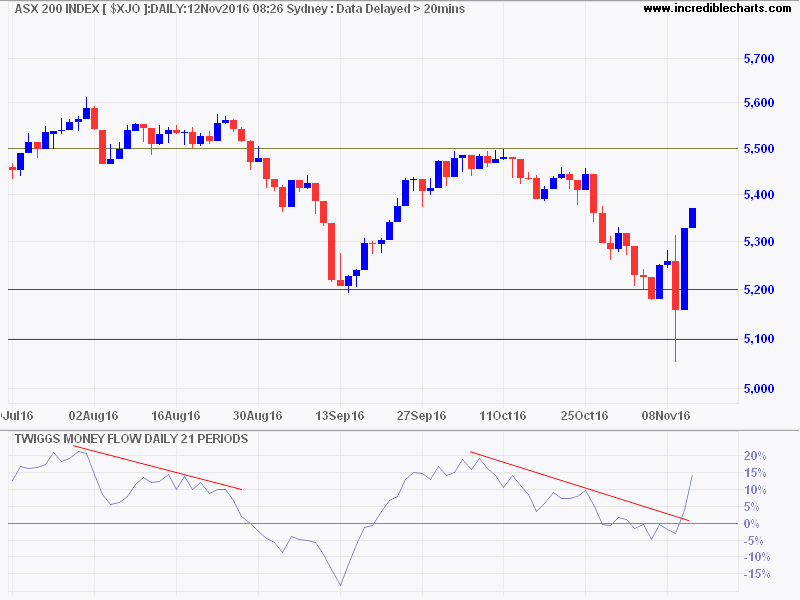

Australia

The ASX 200 rallied strongly, above the former primary support level of 5200. In terms of Dow Theory, the primary down-trend is intact but we need to beware of a bear trap. Recovery above 5500 is still in doubt but would strengthen the bull signal.

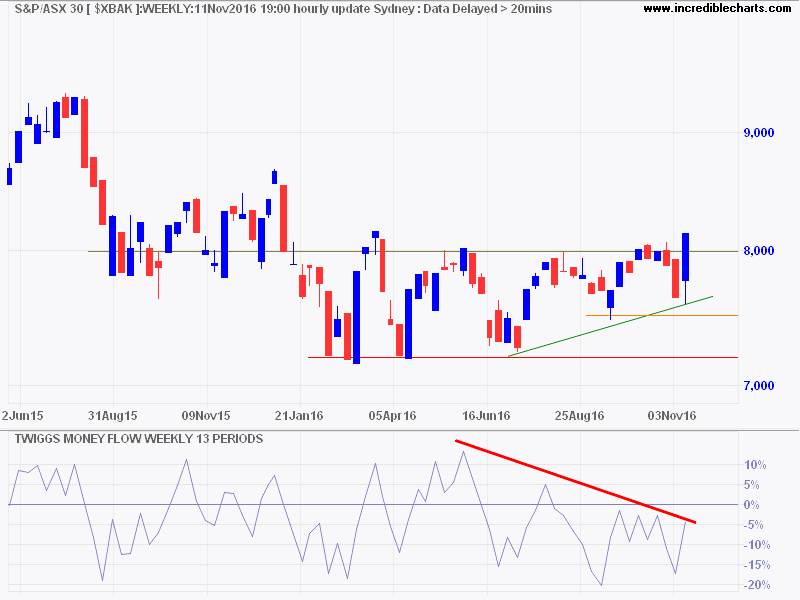

ASX 300 Banks Index displays a breakout above 8000 but I would wait for retracement to test the new support level. Respect would confirm a primary up-trend, with a target of 8800*. Recovery of Twiggs Money Flow above zero would strengthen the signal.

* Target medium-term: 8000 + ( 8000 - 7200 ) = 8800

Our aim is not to do away with corporations; on the contrary, these big aggregations are an inevitable development of modern industrialism, and the effort to destroy them would be futile unless accomplished in ways that would work the utmost mischief to the entire body politic. We can do nothing of good in the way of regulating and supervising these corporations until we fix clearly in our minds that we are not attacking the corporations, but endeavoring to do away with any evil in them. We are not hostile to them; we are merely determined that they shall be so handled as to subserve the public good. We draw the line against misconduct, not against wealth.

~ President Theodore Roosevelt (1902)