Low inflation and a stronger dollar indicate weak gold

By Colin Twiggs

October 26th, 2015 3:00 a.m. EDT (6:00 p.m. AEDT)

Advice herein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no reader should act on the basis of any information contained herein without first having consulted a suitably qualified financial advisor.

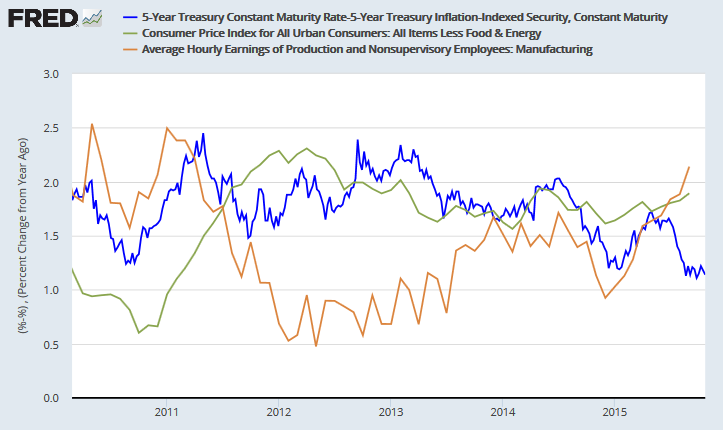

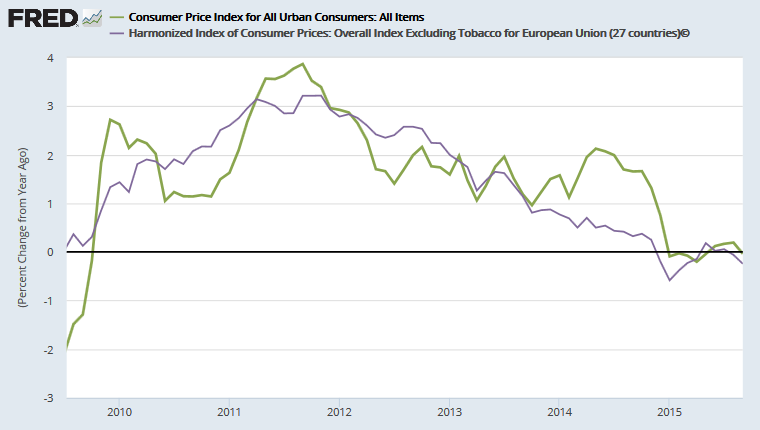

Growth in hourly manufacturing earnings has climbed above the Fed target of 2.0 percent, while core CPI continues to track near the target. But the 5-year breakeven rate (5-year Treasury minus TIPS yield) is close to 1.0 percent. The market expects inflation to fall over the next few years.

The reasoning is straight-forward: the end of the infrastructure boom in China and slowing economic growth means low energy and commodity prices for the foreseeable future. Slow credit growth in the West will also act as a brake on aggregate demand, maintaining downward pressure on CPI.

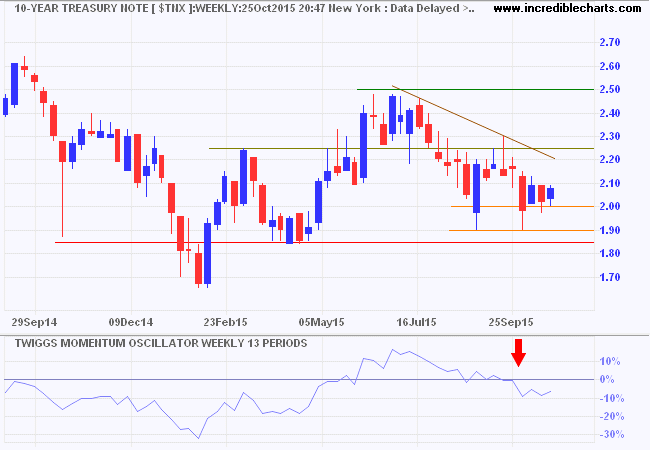

Long-term interest rates are low, with 10-year Treasury yields testing support at 2.0 percent. Declining 13-week Twiggs Momentum, below zero, suggests further weakness.

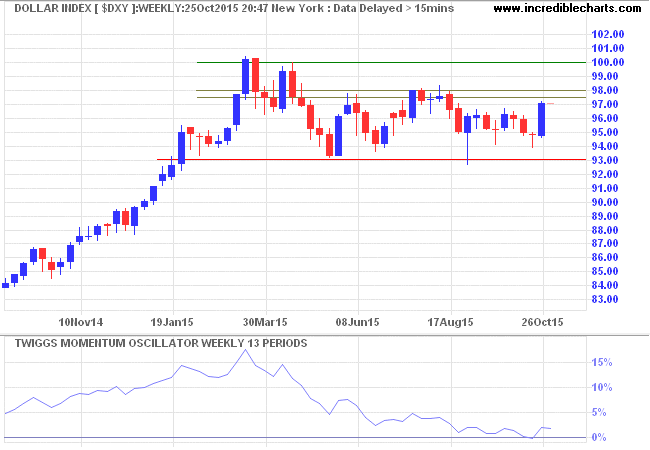

The Dollar Index rallied off support at 93. A higher trough indicates buying pressure. Breakout above 98 would suggest another advance.

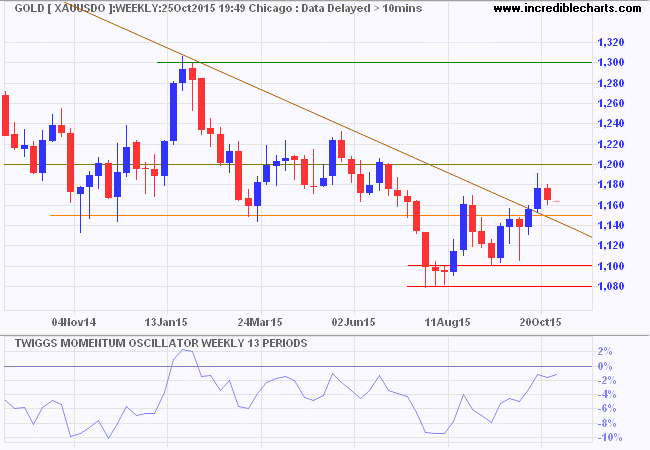

Gold

A strong dollar and low inflation would weaken demand for gold. Spot gold is testing medium-term support at $1150/ounce. Breach would warn of a test of the primary level at $1100. 13-Week Twiggs Momentum is rising, but a peak below zero would signal continuation of the primary down-trend.

* Target calculation: 1200 - ( 1400 - 1200 ) = 1000

Fanaticism consists in redoubling your efforts when you have forgotten your aim.

~ George Santayana