Falling retail sales and freight activity: Cause for concern?

By Colin Twiggs

August 19th, 2015 5:00 p.m. AEST (3:00 a.m. EDT)

Advice herein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no reader should act on the basis of any information contained herein without first having consulted a suitably qualified financial advisor.

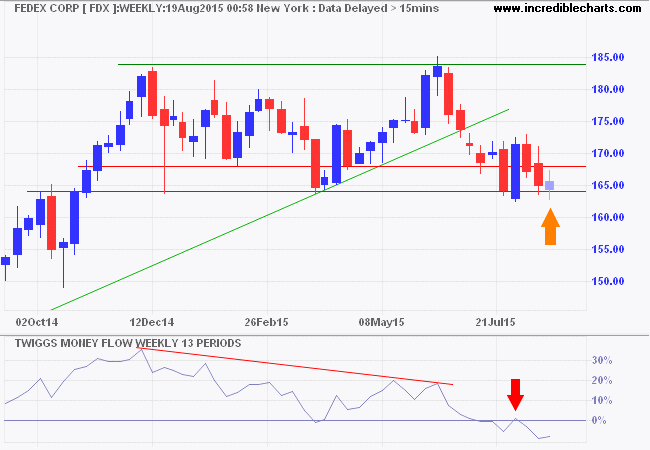

The rally in bellwether transport stock Fedex was short-lived and it is once again testing primary support at $164. Declining 13-week Twiggs Momentum, below zero, warns of a primary down-trend. Breach of support would confirm, suggesting a broad slow-down in US economic activity.

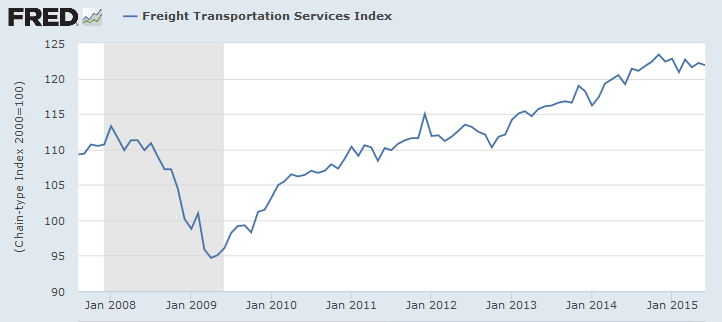

The Freight Transportation Services Index reinforces this, declining since late 2014.

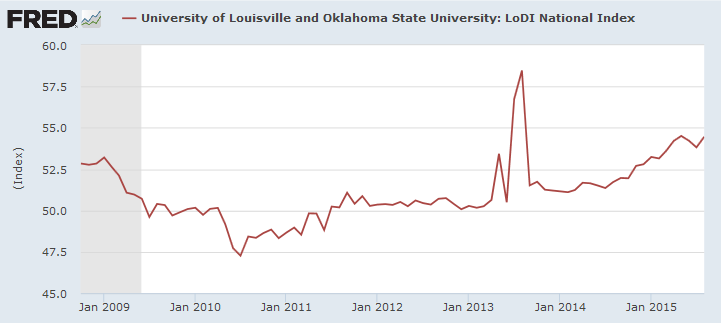

But the LoDI Index contradicts, continuing its climb.

The LoDI Index uses linear regression analysis to combine cargo volume data from rail, barge, air, and truck transit, along with various economic factors. The resulting indicator is designed to predict upcoming changes in the level of logistics and distribution activity in the US and is represented by a value between 1 and 100. An index at or above 50 represents a healthy level of activity in the industry.

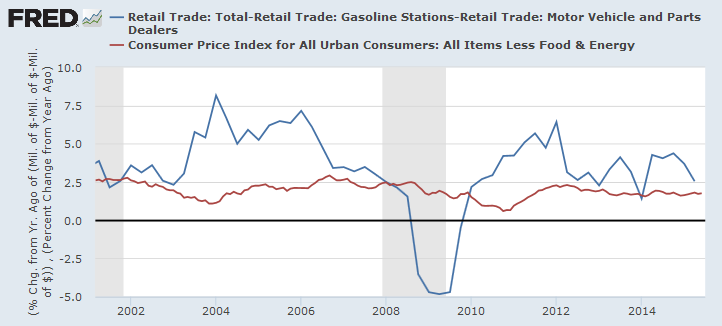

Growth in retail trade (excluding Motor Vehicles, Gasoline and Spares) also declined for the last two quarters but remains above core CPI.

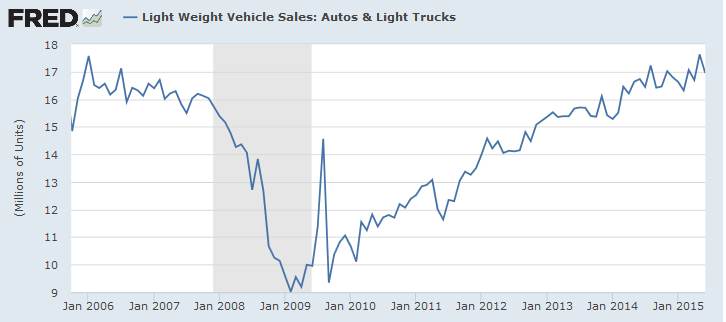

On a positive note, however, light motor vehicle sales are climbing.

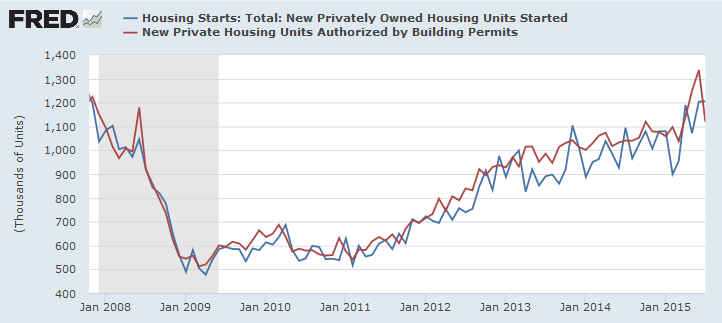

New building permits for private housing retreated in July but the trend remains upwards and new housing starts are increasing.

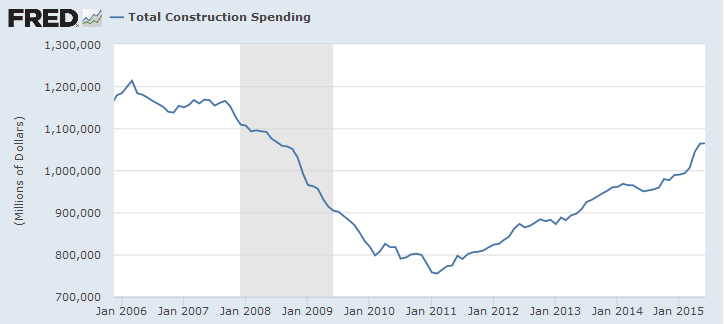

Overall construction spending is also rising.

Solid growth in spending on durables suggests further employment increases. This makes me reasonably confident that retail sales and freight/transport activity will recover. All the same, it would pay to keep a weather eye on Fedex and the transport indices.

Financial markets are supposed to swing like a pendulum: They may fluctuate wildly in response to exogenous shocks, but eventually they are supposed to come to rest at an equilibrium point and that point is supposed to be the same irrespective of the interim fluctuations. Instead, as I told Congress, financial markets behaved more like a wrecking ball, swinging from country to country and knocking over the weaker ones....It is difficult to escape the conclusion that the international financial system itself constituted the main ingredient in the meltdown process.

~ George Soros on the 1997 Asian Financial Crisis

Disclaimer

Research & Investment Pty Ltd is a Corporate Authorized Representative (AR Number 384 397) of Andika Pty Ltd which holds an Australian Financial Services Licence (AFSL 297069).

The information on this web site and in the newsletters is general in nature and does not consider your personal circumstances. Please contact your professional financial adviser for advice tailored to your needs.

Research & Investment Pty Ltd ("R&I") has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites and newsletters. Our research is based upon information known to us or which was obtained from sources which we believe to be reliable and accurate.

No guarantee as to the capital value of investments, nor future returns are made by R&I. Neither R&I nor its employees make any representation, warranty or guarantee that the information provided is complete, accurate, current or reliable.

You are under no obligation to use these services and should always compare financial services/products to find one which best meets your personal objectives, financial situation or needs.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information. If the law prohibits the exclusion of such liability, such liability shall be limited, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Important Warning About Simulated Results

Research & Investment (R&I) specialise in developing, testing and researching investment strategies and systems. Within the R&I web site and newsletters, you will find information about investment strategies and their performance. It is important that you understand that results from R&I research are simulated and not actual results.

No representation is made that any investor will or is likely to achieve profits or losses similar to those shown.

Simulated performance results are generally prepared with the benefit of hindsight and do not involve financial risk. No modeling can completely account for the impact of financial risk in actual investment. Account size, brokerage and slippage may also diverge from simulated results. Numerous other factors related to the markets in general or to the implementation of any specific investment system cannot be fully accounted for in the preparation of simulated performance results and may adversely affect actual investment results.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information offered by R&I whether or not caused by any negligent act or omission.