A currency war has begun....

By Colin Twiggs

August 13th, 2015 6:00 p.m. AEST (4:00 a.m. EDT)

Advice herein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no reader should act on the basis of any information contained herein without first having consulted a suitably qualified financial advisor.

The Federal Reserve, Bank of England, European Central Bank and Bank of Japan all expanded their balance sheets (commonly referred to as quantitative easing or QE for short) post-2008 to counteract a contracting money supply and prevent a deflationary spiral. These actions also have the beneficial effect of weakening the currency and improving international competitiveness.

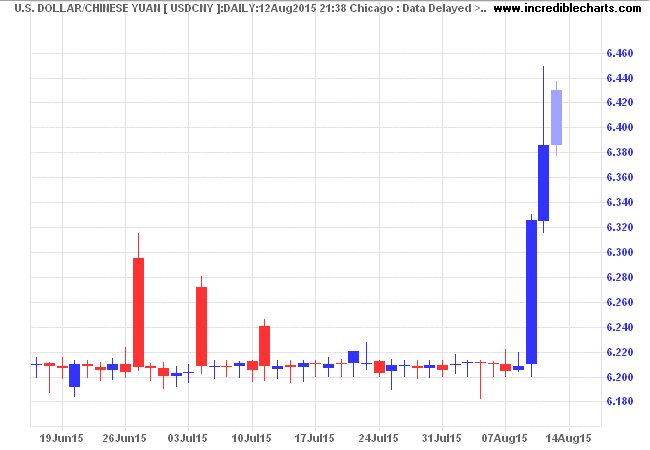

China was considered immune because of its persistent current account surplus and $4 Trillion in foreign reserves. But the recent sharp contraction in Chinese exports to the EU suggest otherwise.

The People's Bank of China (PBOC) responded by effectively devaluing the Yuan. So far the "one-off adjustment" has been repeated on three consecutive days.

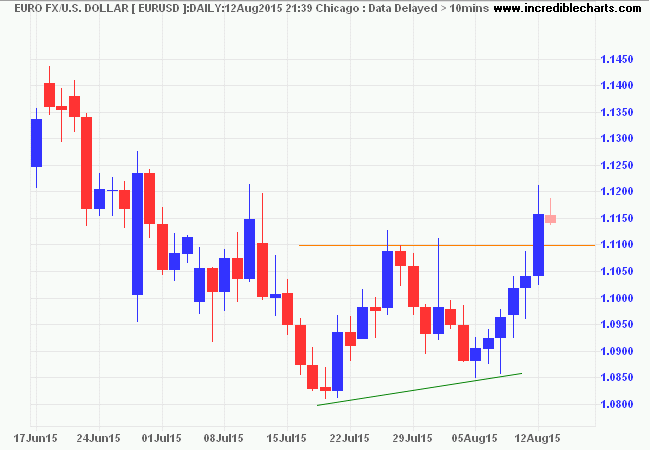

The Euro appreciated considerably against the US dollar as CNY carry trades are unwound.

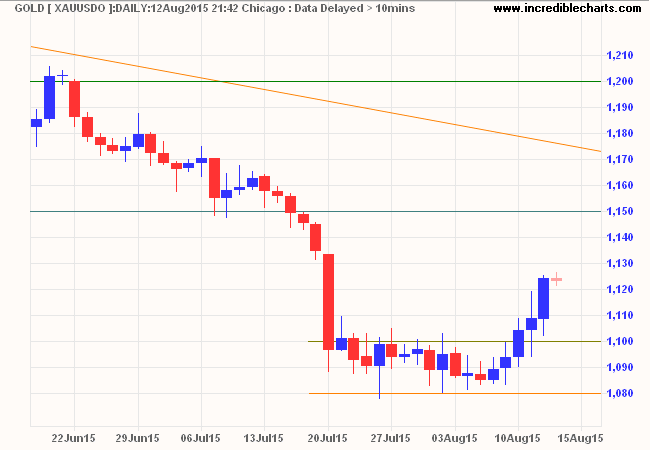

Gold broke out of its narrow rectangle between $1080 and $1100 per ounce as investors scuttled to the safety of bullion.

* Target calculation: 1100 - ( 1200 - 1100 ) = 1000

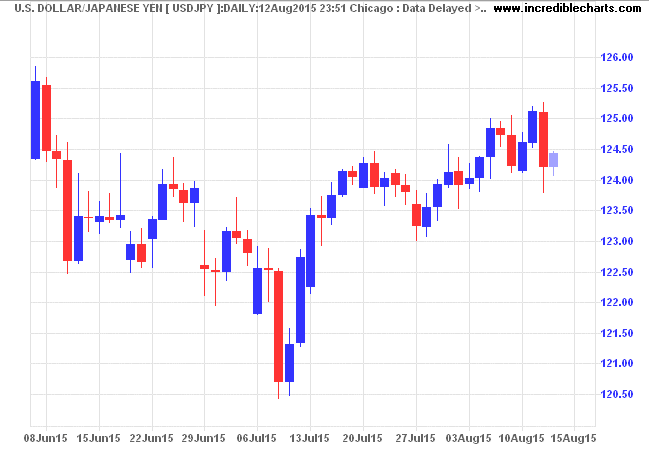

The Yen displays little net gain or loss.

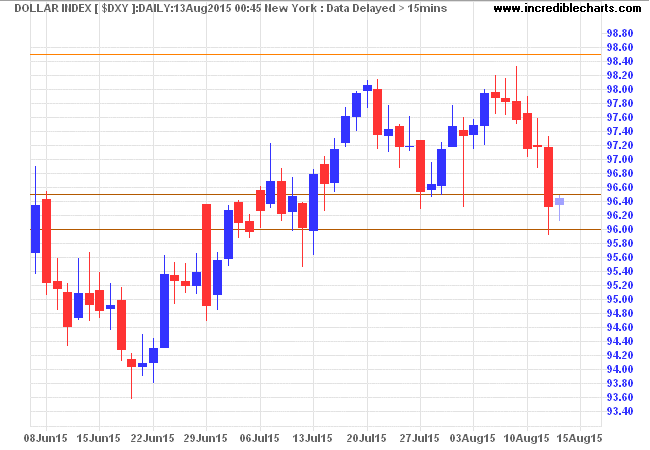

The Dollar Index does not include China's Yuan and is falling primarily because of the Euro. The Broad Trade-Weighted Index which includes the Yuan is calculated weekly; so it will take a few days before we can assess the impact.

Competing devaluations are likely to continue as each state (or trading block) attempts to maintain an export surplus. This is a zero sum game, so each action will inevitably elicit an equivalent response from major trading partners. Currency markets are awash with vast sums of liquid capital and an estimated $9 Trillion in carry trades (where hedge funds borrow in a low-interest-rate currency and invest in another at higher rates). Any beggar-thy-neighbor escalation is likely to destabilize financial markets and the precarious balance may prove difficult to restore.

During the 1997 Asian Financial Crisis George Soros called for international regulation of financial markets to prevent a reoccurrence.

It is time to recognize that financial markets are inherently unstable. Imposing market discipline means imposing instability, and how much instability can society take? .... To put it bluntly, the choice confronting us is whether we will regulate global financial markets internationally or leave it to each individual state to protect its interests as best it can. The latter course will surely lead to the breakdown of the gigantic circulatory system, which goes under the name of global capitalism.

~ George Soros: The Crisis of Global Capitalism (1998)

Disclaimer

Research & Investment Pty Ltd is a Corporate Authorized Representative (AR Number 384 397) of Andika Pty Ltd which holds an Australian Financial Services Licence (AFSL 297069).

The information on this web site and in the newsletters is general in nature and does not consider your personal circumstances. Please contact your professional financial adviser for advice tailored to your needs.

Research & Investment Pty Ltd ("R&I") has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites and newsletters. Our research is based upon information known to us or which was obtained from sources which we believe to be reliable and accurate.

No guarantee as to the capital value of investments, nor future returns are made by R&I. Neither R&I nor its employees make any representation, warranty or guarantee that the information provided is complete, accurate, current or reliable.

You are under no obligation to use these services and should always compare financial services/products to find one which best meets your personal objectives, financial situation or needs.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information. If the law prohibits the exclusion of such liability, such liability shall be limited, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Important Warning About Simulated Results

Research & Investment (R&I) specialise in developing, testing and researching investment strategies and systems. Within the R&I web site and newsletters, you will find information about investment strategies and their performance. It is important that you understand that results from R&I research are simulated and not actual results.

No representation is made that any investor will or is likely to achieve profits or losses similar to those shown.

Simulated performance results are generally prepared with the benefit of hindsight and do not involve financial risk. No modeling can completely account for the impact of financial risk in actual investment. Account size, brokerage and slippage may also diverge from simulated results. Numerous other factors related to the markets in general or to the implementation of any specific investment system cannot be fully accounted for in the preparation of simulated performance results and may adversely affect actual investment results.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information offered by R&I whether or not caused by any negligent act or omission.