US GDP, Chinese Cement Production and Concentrated Portfolios

By Colin Twiggs

May 14th, 2015 11:30 p.m. AET (9:30 p.m. EDT)

Advice herein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no reader should act on the basis of any information contained herein without first having consulted a suitably qualified financial advisor.

US GDP: Where is it headed?

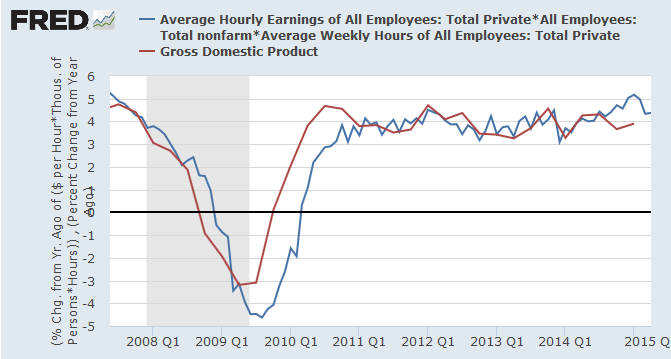

I originally got this from Matt Busigin (I think). Average Hourly Earnings multiplied by Average Weekly Hours (Total Private: Nonfarm) gives a pretty good indication of where GDP is headed, well ahead of the BEA accounts.

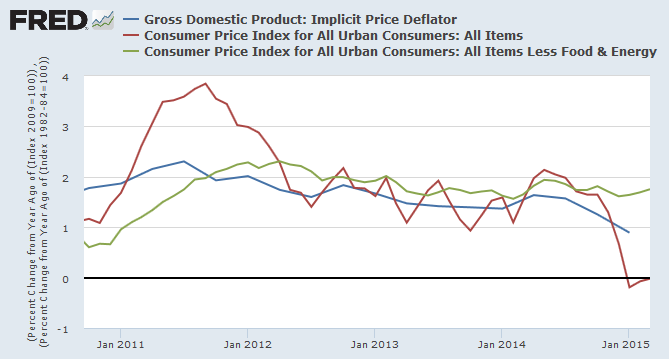

Remember this is nominal GDP, so the latest (April 2015) figure of 4.38% would need to be adjusted for inflation. Inflation is somewhere between 0.5% and 1.75% depending on how you measure it. The GDP deflator looks like it will come in below 1.0% which would leave us with real GDP of at least 3.38% p.a.

China: Cement Production

Chinese cement production. (From Capital Economics this AM) pic.twitter.com/k5W7pdRR2c

— A Evans-Pritchard (@AmbroseEP) May 13, 2015Lowest cement production in more than 10 years reflects the decline in infrastructure investment. Not good news for Australian resources stocks. Where cement production goes, iron ore and coal are likely to follow.

Concentrated Portfolios: Do they enhance performance?

I mentioned last week that concentrated portfolios tend to outperform widely diversified portfolios in the long-term. This 2013 article from Money Management offers support:

Fund managers who invest in concentrated portfolios are able to outperform those who invest in diversified portfolios by 400 basis points, according to research coming out of the United Kingdom.

Investment skills consultancy firm Inalytics examined nearly 600 equity portfolios in its database and found that portfolios with the lowest quartile of holdings performed over 400 basis points better than the highest quartile of holdings.

Inalytics chief executive Rick Di Mascio said there were a number of explanations for the research findings including manager skill set, survival bias and greater attention being given to smaller equity sets.

"One possible rationale is that only the most skilful managers are given the punchier portfolios to run. A good analogy is that only the very best racing drivers get to drive Formula 1 cars."

"Another explanation is that the database may be biased towards successful managers who were given the opportunity and 'survived'. Once again there is a parallel with the Formula 1 drivers, but at least in the case of fund managers it isn't dangerous," Di Mascio said.

"Third, from a behavioural finance perspective, the literature suggests that the lower the number of holdings in the portfolio, the more attention each one receives."

"Whatever the explanation, the data is clear — the more concentrated the portfolio, the more likely the performance is going to be good," he says.

Our own research with momentum portfolios overwhelmingly indicates that greater concentration leads to improved performance. But this is no free lunch. With increased performance comes increased volatility. Which is why you need a long investment horizon when investing in concentrated portfolios.

More....

There can be no economy where there is no efficiency.

~ Benjamin Disraeli

Disclaimer

Research & Investment Pty Ltd is a Corporate Authorized Representative (AR Number 384 397) of Andika Pty Ltd which holds an Australian Financial Services Licence (AFSL 297069).

The information on this web site and in the newsletters is general in nature and does not consider your personal circumstances. Please contact your professional financial adviser for advice tailored to your needs.

Research & Investment Pty Ltd ("R&I") has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites and newsletters. Our research is based upon information known to us or which was obtained from sources which we believe to be reliable and accurate.

No guarantee as to the capital value of investments, nor future returns are made by R&I. Neither R&I nor its employees make any representation, warranty or guarantee that the information provided is complete, accurate, current or reliable.

You are under no obligation to use these services and should always compare financial services/products to find one which best meets your personal objectives, financial situation or needs.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information. If the law prohibits the exclusion of such liability, such liability shall be limited, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Important Warning About Simulated Results

Research & Investment (R&I) specialise in developing, testing and researching investment strategies and systems. Within the R&I web site and newsletters, you will find information about investment strategies and their performance. It is important that you understand that results from R&I research are simulated and not actual results.

No representation is made that any investor will or is likely to achieve profits or losses similar to those shown.

Simulated performance results are generally prepared with the benefit of hindsight and do not involve financial risk. No modeling can completely account for the impact of financial risk in actual investment. Account size, brokerage and slippage may also diverge from simulated results. Numerous other factors related to the markets in general or to the implementation of any specific investment system cannot be fully accounted for in the preparation of simulated performance results and may adversely affect actual investment results.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information offered by R&I whether or not caused by any negligent act or omission.