Gold threatens four-year low

By Colin Twiggs

September 25th, 2014 5:00 a.m. EDT (7:00 p.m. AEST)

Advice herein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no reader should act on the basis of any information contained herein without first having consulted a suitably qualified financial advisor.

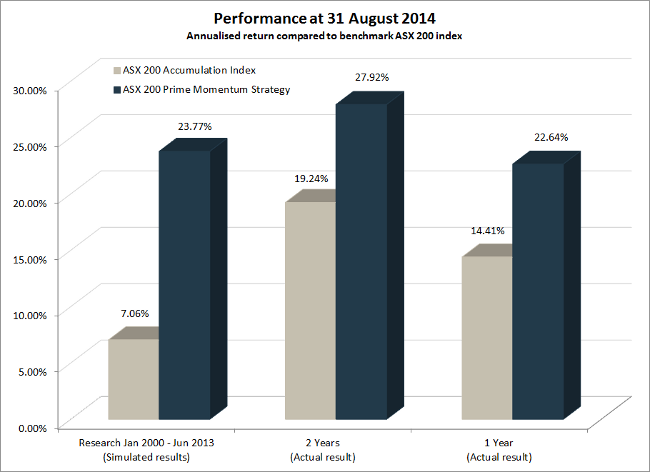

Research & Investment: Performance

ASX200 Prime Momentum strategy returned +22.64%* for the 12 months ended 31st August 2014 compared to +14.41% for the benchmark ASX200 Accumulation Index.

The S&P 500 Prime Momentum strategy had a good month, gaining 5.98% in August. The strategy has been running live for ten months, since November 2013, and returned 15.46%* for the period, compared to 15.96% for the S&P 500 Total Return Index. A sell-off of momentum stocks affected performance since April, but macroeconomic and volatility filters indicate low risk typical of a bull market and we maintain full exposure to equities.

* Results are unaudited and subject to revision.

Gold & Silver

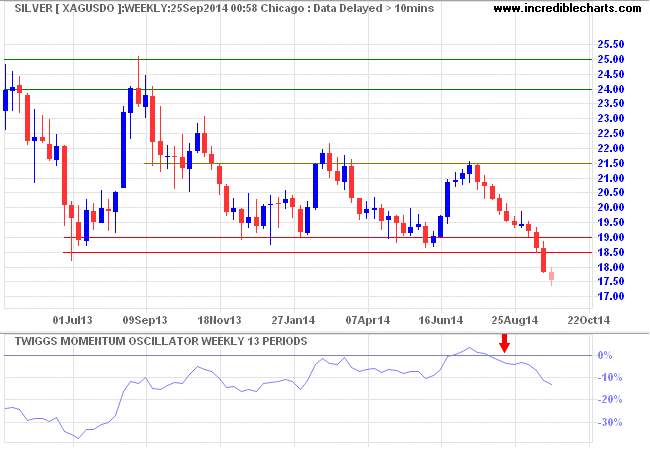

Silver broke long-term support at $18.50 per ounce, offering a target of $15.50/ounce*. First, expect retracement to respect the new resistance level. Gold is likely to follow Silver to a new four-year low.

* Target calculation: 18.5 - ( 21.5 - 18.5 ) = 15.5

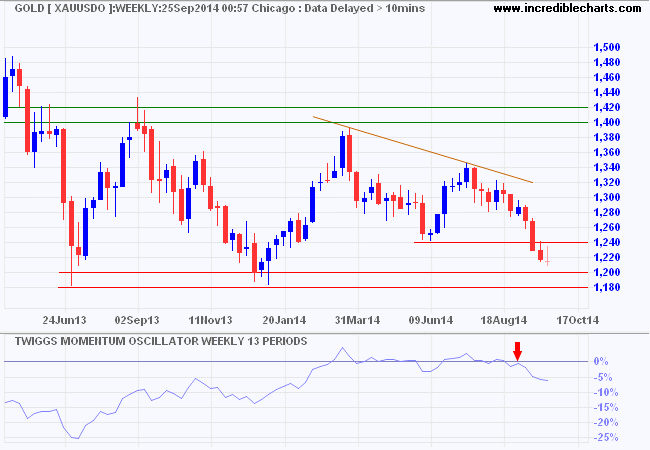

Gold respected the new resistance level at $1240/ounce and is now testing $1200. Follow-through below $1180 would offer a long-term target of $1000*, while respect would suggest another rally to $1240. Declining 13-week Twiggs Momentum, below zero, further strengthens the bear signal.

* Target calculation: 1200 - ( 1400 - 1200 ) = 1000

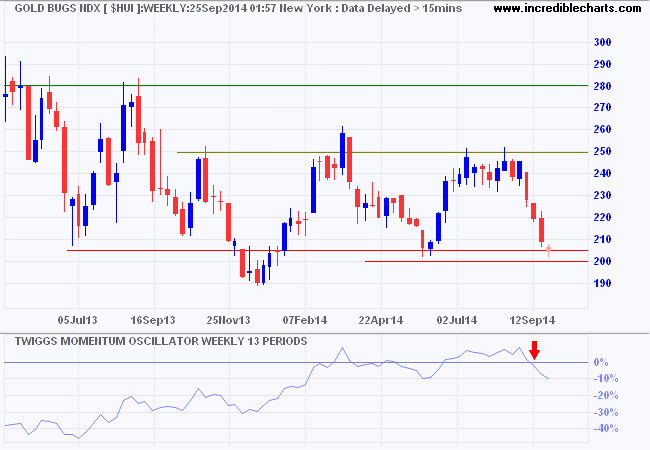

Gold Bugs Index (representing un-hedged gold stocks) is also testing long-term support. Breach of support at 200 would strengthen the bear signal for Gold.

Interest Rates and the Dollar

Rising Treasury yields and a stronger Dollar both add downward pressure to Gold. Higher interest rates increase the carrying cost of gold, while the Dollar competes with Gold both as a safe haven and as an appreciating asset (against other currencies).

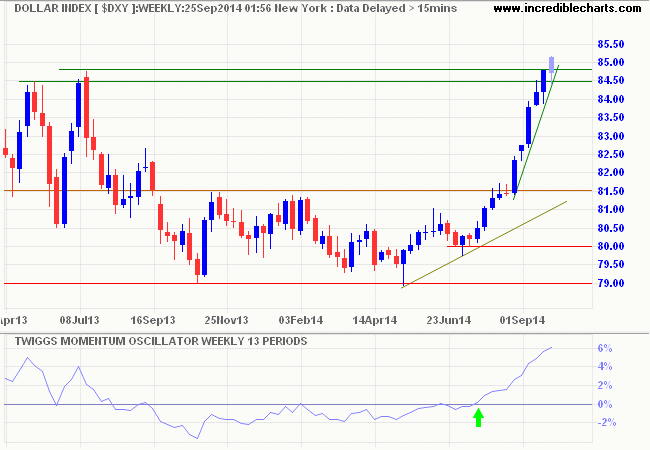

The Dollar Index broke through resistance at the 2013 high of 84.75. Rising 13-week Twiggs Momentum, above zero, signals a primary up-trend. Expect retracement to test the new support level. Respect is likely and would offer a long-term target of 89*. Reversal below 84.50 is unlikely, but would warn of a correction.

* Target calculation: 84 + ( 84 - 79 ) = 89.00

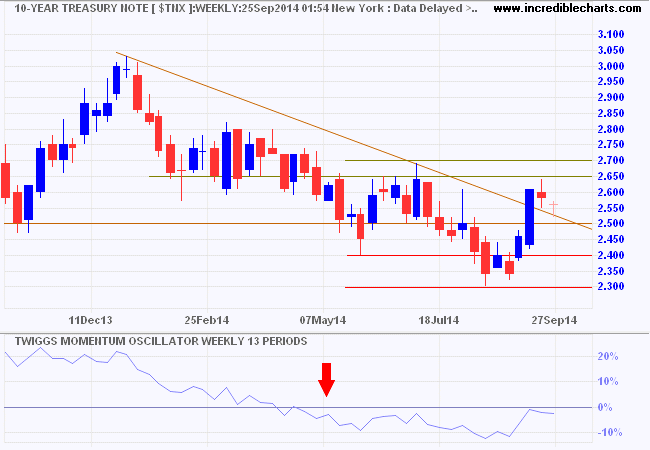

The yield on ten-year Treasury Notes respected resistance at 2.65 percent and is retracing to test support at 2.50. Follow-through above 2.70 would signal an advance to 3.00, but 13-week Twiggs Momentum below zero continues to suggest a primary down-trend. Failure of support at 2.50 would indicate another test of primary support at 2.30.

* Target calculation: 2.30 - ( 2.60 - 2.30 ) = 2.00

The habit of ubiquitous interventionism, combining pinprick strikes by precision weapons with pious invocations of high principle, would lead us into endless difficulties. Interventions must be limited in number and overwhelming in their impact.

~ Margaret Thatcher, Statecraft: Strategies for a Changing World (2002)

Disclaimer

Research & Investment Pty Ltd is a Corporate Authorized Representative (AR Number 384 397) of Andika Pty Ltd which holds an Australian Financial Services Licence (AFSL 297069).

The information on this web site and in the newsletters is general in nature and does not consider your personal circumstances. Please contact your professional financial adviser for advice tailored to your needs.

Research & Investment Pty Ltd ("R&I") has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites and newsletters. Our research is based upon information known to us or which was obtained from sources which we believe to be reliable and accurate.

No guarantee as to the capital value of investments, nor future returns are made by R&I. Neither R&I nor its employees make any representation, warranty or guarantee that the information provided is complete, accurate, current or reliable.

You are under no obligation to use these services and should always compare financial services/products to find one which best meets your personal objectives, financial situation or needs.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information. If the law prohibits the exclusion of such liability, such liability shall be limited, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Important Warning About Simulated Results

Research & Investment (R&I) specialise in developing, testing and researching investment strategies and systems. Within the R&I web site and newsletters, you will find information about investment strategies and their performance. It is important that you understand that results from R&I research are simulated and not actual results.

No representation is made that any investor will or is likely to achieve profits or losses similar to those shown.

Simulated performance results are generally prepared with the benefit of hindsight and do not involve financial risk. No modeling can completely account for the impact of financial risk in actual investment. Account size, brokerage and slippage may also diverge from simulated results. Numerous other factors related to the markets in general or to the implementation of any specific investment system cannot be fully accounted for in the preparation of simulated performance results and may adversely affect actual investment results.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information offered by R&I whether or not caused by any negligent act or omission.