Week ends on a bullish note

By Colin Twiggs

September 6th, 2014 1:00 p.m. AEST (11:00 p:m EDT)

Advice herein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no reader should act on the basis of any information contained herein without first having consulted a suitably qualified financial advisor.

Performance update

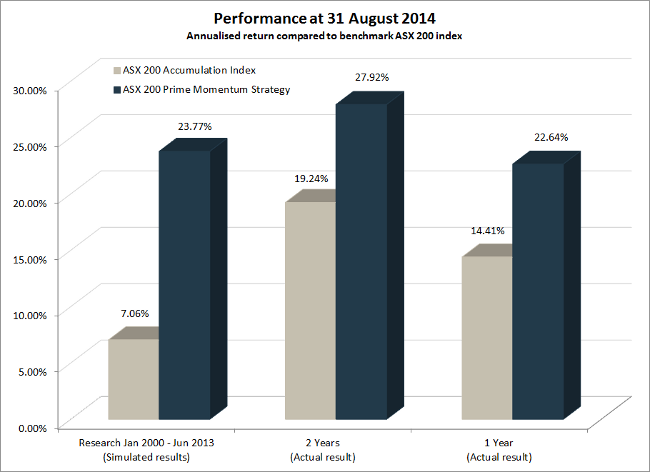

ASX200 Prime Momentum strategy returned +22.64%* for the 12 months ended 31st August 2014 compared to +14.41% for the benchmark ASX200 Accumulation Index.

The S&P 500 Prime Momentum strategy had a good month, gaining 5.98% in August. The strategy has been running live for ten months, since November 2013, and returned 15.46%* for the period, compared to 15.96% for the S&P 500 Total Return Index. A sell-off of momentum stocks affected performance since April, but macroeconomic and volatility filters indicate low risk typical of a bull market and we maintain full exposure to equities.

* Results are unaudited and subject to revision.

European ceasefire

Neil MacFarquhar reports in The New York Times:

After five months of intensifying combat that threatened to rip Ukraine apart and to reignite the Cold War, the Ukrainian government and separatist forces signed a cease-fire agreement on Friday that analysts considered highly tenuous in a country that remains a tinderbox....

The agreement resembles, almost verbatim, a proposal for a truce issued by President Petro O. Poroshenko in June.

It includes amnesty for those who disarm and who did not commit serious crimes, and the exchange of all prisoners. Militias will be disbanded, and a 10-kilometer buffer zone — about six miles — will be established along the Russian-Ukrainian border. The area will be subject to joint patrols. The separatists have agreed to leave the administrative buildings they control and to allow broadcasts from Ukraine to resume on local television....

There appears plenty of skepticism as to whether the ceasefire will hold... and whether Russian forces will withdraw, but markets welcomed the announcement.

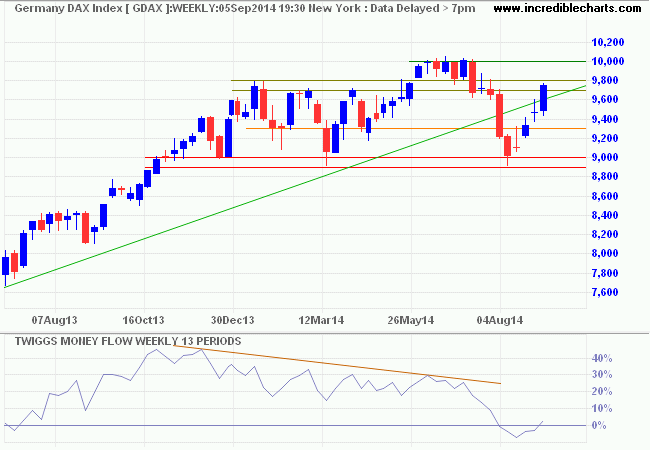

Germany's DAX is testing resistance at 9700/9800. Breakout would indicate a fresh advance, while follow-through above 10000 would confirm a target of 11000. Recovery of 13-week Twiggs Money Flow above zero suggests selling pressure is easing. Retreat below 9250, however, would warn of another test of primary support at 9000.

* Target calculation: 10000 + ( 10000 - 9000 ) = 11000

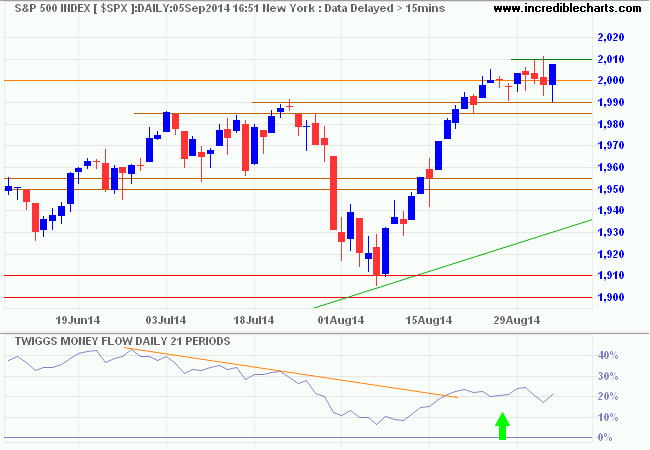

The S&P 500 rallied above 2000. Follow-through above 2010 would confirm an advance to 2100*. Sideways movement on 21-day Twiggs Money Flow, however, suggests further consolidation. Reversal below 1990 is unlikely, but would warn of another correction.

* Target calculation: 2000 + ( 2000 - 1900 ) = 2100

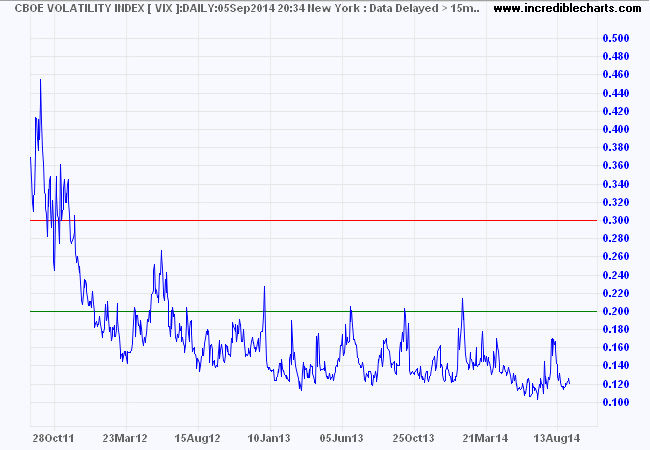

CBOE Volatility Index (VIX) remains low, typical of a bull market.

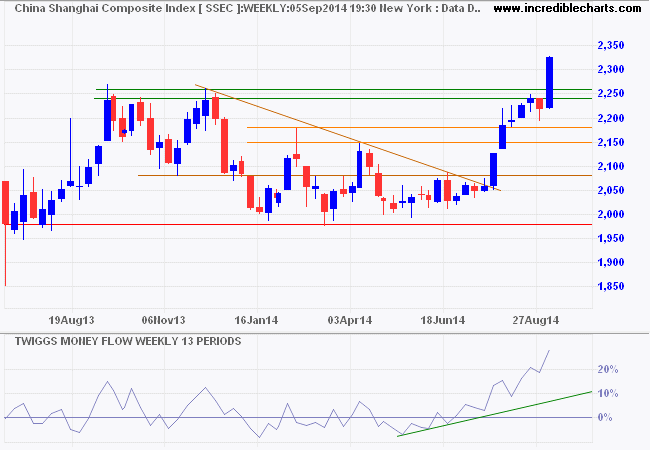

Shanghai Composite Index, responding to PBOC stimulus, broke resistance at 2250 to signal a primary up-trend. Rising 13-week Twiggs Money Flow indicates accelerating buying pressure. Target for the advance is 2500*. Reversal below 2250 is unlikely, but would suggest further consolidation between 2000 and 2250.

* Target calculation: 2250 + ( 2250 - 2000 ) = 2500

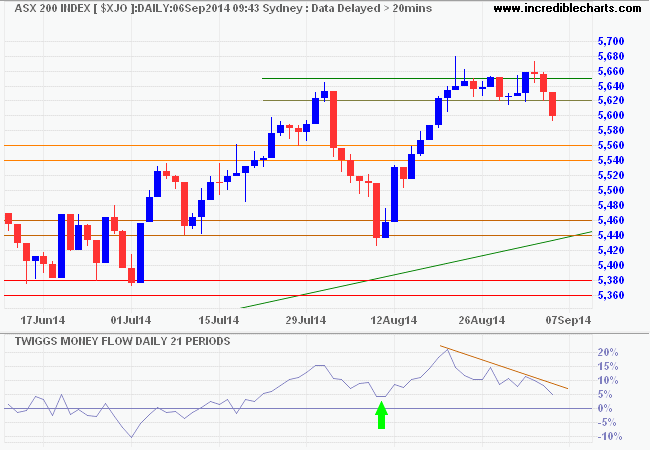

The ASX 200 broke short-term support at 5620, but with both US and Chinese markets entering a bull phase retracement is likely to be short-lived. Breakout above 5680 would confirm an advance to 5850*. Bearish divergence on 21-day Twiggs Money Flow warns of medium-term selling pressure, but a trough above zero would indicate that buyers are back in control. Reversal below 5540 is unlikely, but would warn of a test of primary support.

* Target calculation: 5650 + ( 5650 - 5450 ) = 5850

Recent events

Challenger Ltd [CGF] announced a share purchase offer to shareholders. We feel that the discount to the current price is insufficient to warrant any changes to the portfolio and do not intend to take up the offer.

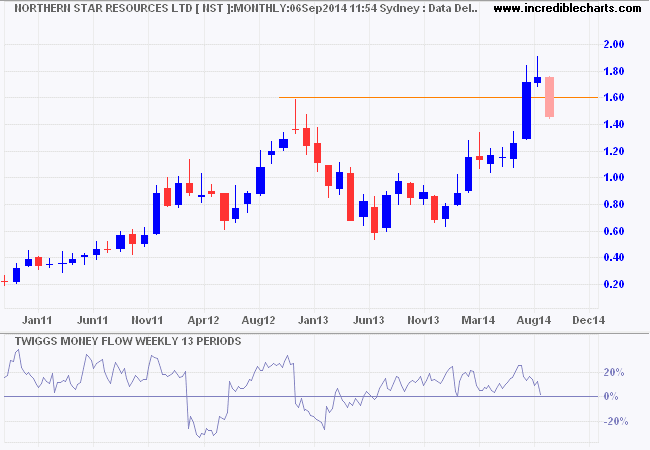

Northern Star Resources Ltd [NST] is retracing sharply, losing much of the gains of the last few months. We are focused on the long-term time horizon and tend to ignore secondary movements. Our research with more responsive systems shows that reacting to secondary movements erodes rather than enhances long-term performance. Savings from early exits is outweighed by increased brokerage, slippage and lost opportunities, where the trend resumes after the stock is exited.

To err is human

From Miles Udland at Business Insider:

[James O’Shaughnessy of O’Shaughnessy Asset Management] relays one anecdote from an employee who recently joined his firm....

O’Shaughnessy: “Fidelity had done a study as to which accounts had done the best at Fidelity....They were the accounts [of] people who forgot they had an account at Fidelity.”

There are numerous studies that explain why this happens. And they almost always come down to the fact that our minds work against us. Due to our behavioural biases, we often find ourselves buying high and selling low.

I have always called this “the Siemens effect” from an example I came across, in a completely different field, about 30 years ago. German electronics giant Siemens built a telecommunications exchange in a sealed container, with no human access and all maintenance conducted from an outside control panel. The exchange experienced only a small fraction of the equipment failures experienced in a normal telecommunications exchange, leading to the conclusion that human intervention by maintenance staff caused most of the faults.

Likewise in investment, if you build the equivalent of a sealed system. Where there is no direct human intervention, you are likely to experience better performance than if there is constant tinkering to “improve” the system.

The caveat is, during an electrical storm it may be advisable to shut down the telecommunications exchange from the control panel. Likewise, with stocks, when macroeconomic and volatility filters warn of elevated risk, the system should move to cash — or assets, like government bonds, with low or negative correlation to stocks.

That's all from me for today. Take care.

Politics is the ability to foretell what is going to happen tomorrow, next week, next month and next year. And to have the ability afterwards to explain why it didn't happen.

~ Winston Churchill

Disclaimer

Research & Investment Pty Ltd is a Corporate Authorized Representative (AR Number 384 397) of Andika Pty Ltd which holds an Australian Financial Services Licence (AFSL 297069).

The information on this web site and in the newsletters is general in nature and does not consider your personal circumstances. Please contact your professional financial adviser for advice tailored to your needs.

Research & Investment Pty Ltd ("R&I") has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites and newsletters. Our research is based upon information known to us or which was obtained from sources which we believe to be reliable and accurate.

No guarantee as to the capital value of investments, nor future returns are made by R&I. Neither R&I nor its employees make any representation, warranty or guarantee that the information provided is complete, accurate, current or reliable.

You are under no obligation to use these services and should always compare financial services/products to find one which best meets your personal objectives, financial situation or needs.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information. If the law prohibits the exclusion of such liability, such liability shall be limited, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Important Warning About Simulated Results

Research & Investment (R&I) specialise in developing, testing and researching investment strategies and systems. Within the R&I web site and newsletters, you will find information about investment strategies and their performance. It is important that you understand that results from R&I research are simulated and not actual results.

No representation is made that any investor will or is likely to achieve profits or losses similar to those shown.

Simulated performance results are generally prepared with the benefit of hindsight and do not involve financial risk. No modeling can completely account for the impact of financial risk in actual investment. Account size, brokerage and slippage may also diverge from simulated results. Numerous other factors related to the markets in general or to the implementation of any specific investment system cannot be fully accounted for in the preparation of simulated performance results and may adversely affect actual investment results.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information offered by R&I whether or not caused by any negligent act or omission.