Dow breaks 17000

By Colin Twiggs

July 8th, 2014 3:00 am EDT (5:00 pm AEST)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

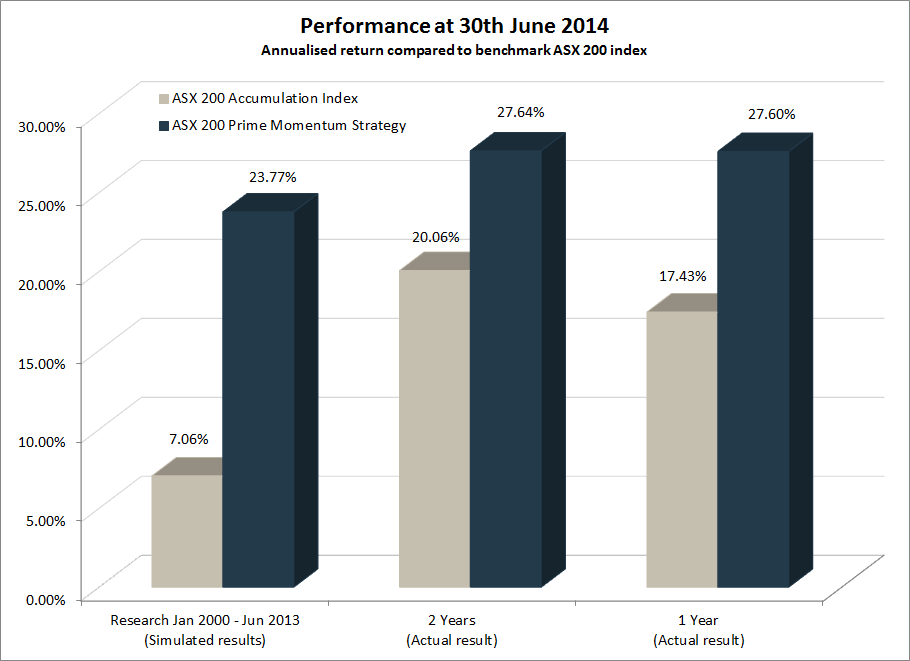

Research & Investment: Performance update

ASX200 Prime Momentum strategy returned +27.60%* for the 12 months ended 30th June 2014, outperforming the benchmark ASX200 Accumulation Index by +10.17%.

The S&P 500 Prime Momentum strategy has been running eight months, since November 2013, and returned 13.41%* for the period, compared to 13.06% for the S&P 500 Total Return Index. A sell-off of momentum stocks affected performance in April, but macroeconomic and volatility filters indicate low risk typical of a bull market and we maintain full exposure to equities.

* Results are unaudited and subject to revision.

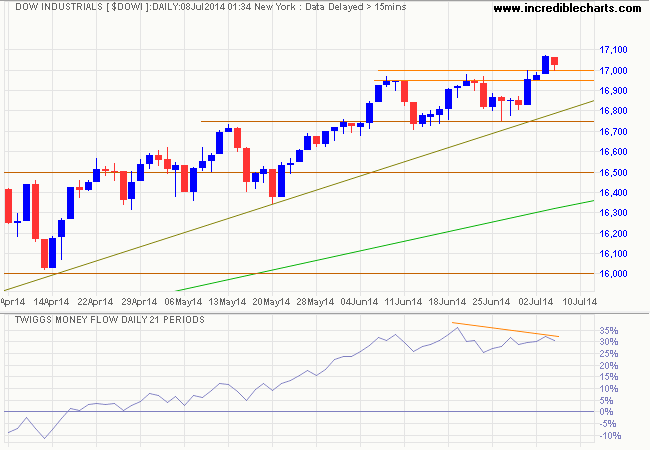

Dow breakout

Dow Jones Industrial Average broke medium-term resistance at 17000 — after reaching 16000 in November last year. Expect retracement to test the new support level at 16950/17000. Mild divergence on 21-day Twiggs Money Flow warns of weak selling pressure. Reversal below 16750 is unlikely, but would indicate a correction.

* Target calculation: 16500 + ( 16500 - 15500 ) = 17500

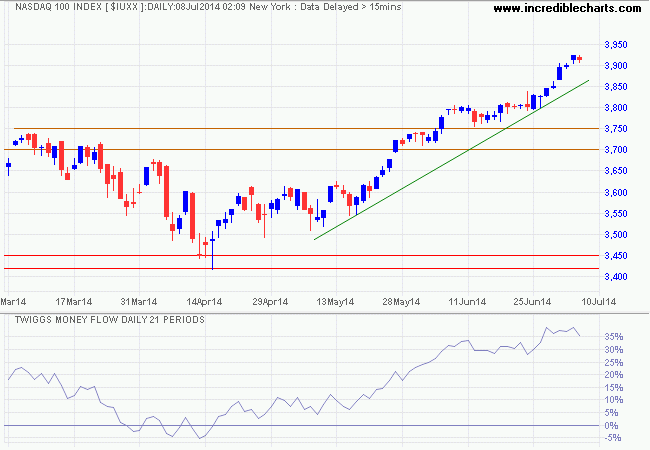

The Nasdaq 100 is on a bit of a tear, with rising 21-day Twiggs Money Flow indicating medium-term buying pressure. Respect of the rising trendline would suggest a rally to 4000*. Penetration of the trendline is unlikely, but would warn of a correction.

* Target calculation: 3700 + ( 3700 - 3400 ) = 4000

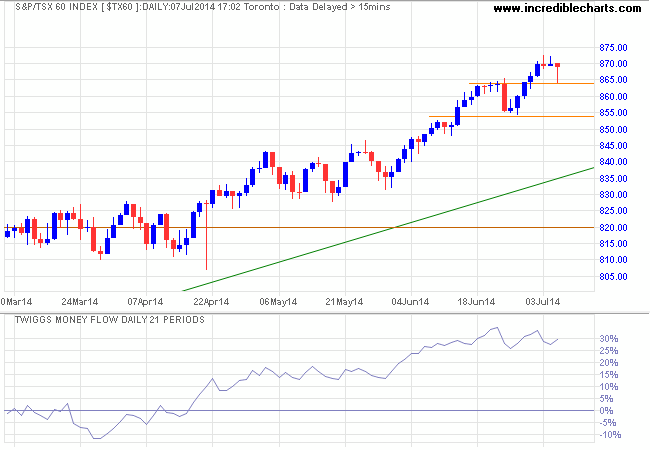

Canada's TSX 60 is also performing strongly, with 21-day Twiggs Money Flow indicating medium-term buying pressure. Expect a test of the 2008 high at 900. Reversal below support at 855 is unlikely, but would warn of a correction.

Tape reading was an important part of the game; so was beginning at the right time; so was sticking to your position. But my greatest discovery was that a man must study general conditions, to size them up so as to be able to anticipate probabilities.

~ Jesse Livermore