S&P 500 advances towards 2000

By Colin Twiggs

June 10th, 2014 4:00 am EDT (6:00 pm AEST)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

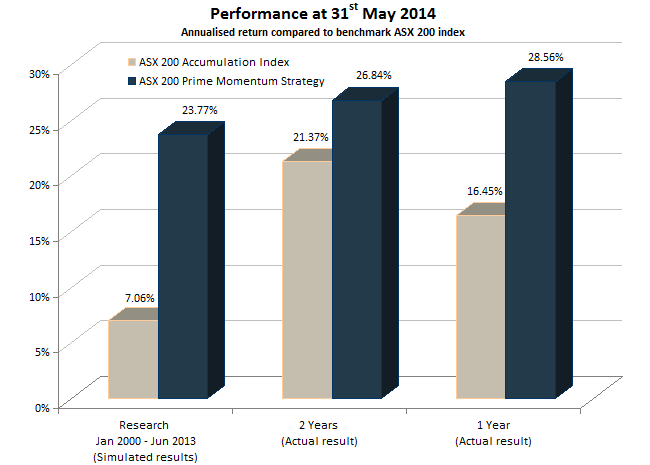

Research & Investment: Performance update

Our ASX200 Prime Momentum strategy returned +28.56%* for the 12 months ended 31st May 2014, outperforming the benchmark ASX200 Accumulation Index by +12.11%.

The S&P 500 Prime Momentum strategy has been running seven months, since November 2013, and returned 10.00%* for the period, compared to 10.77% for the S&P 500 Total Return Index.

A sell-off of momentum stocks affected performance in April, but macroeconomic and volatility filters indicate low risk typical of a bull market and we maintain full exposure to equities.

* Results are unaudited and subject to revision.

S&P 500

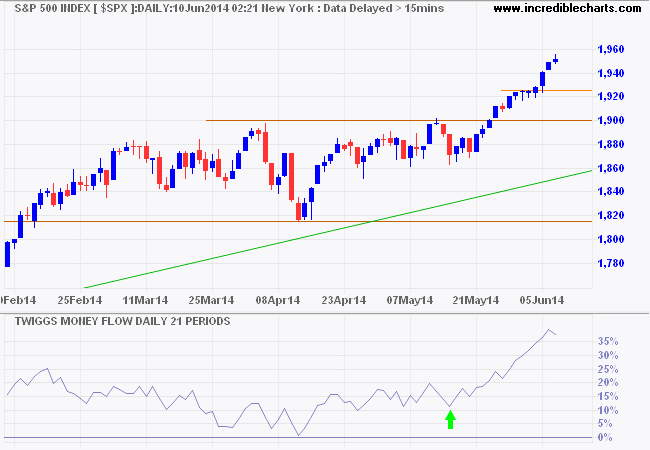

The S&P 500 has reached its initial target of 1950*. Steeply rising 21-day Twiggs Money Flow indicates strong medium-term buying pressure. Retracement to test support at 1925 is expected. Respect of 1920 would suggest a strong up-trend and an advance to 2000.

* Target calculation: 1850 + ( 1850 - 1750 ) = 1950

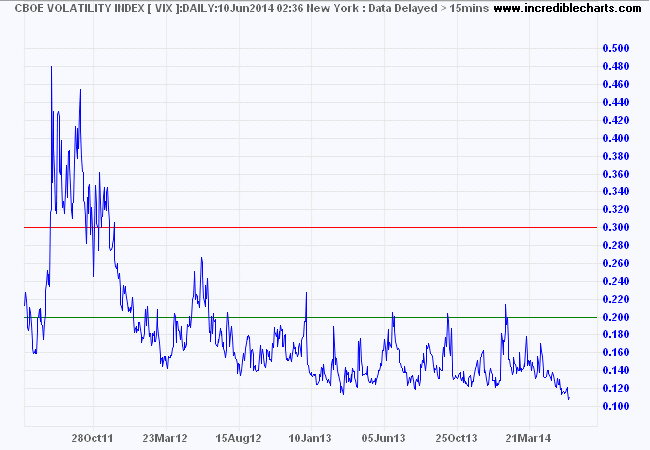

CBOE Volatility Index (VIX) below 12 indicates low risk typical of a bull market.

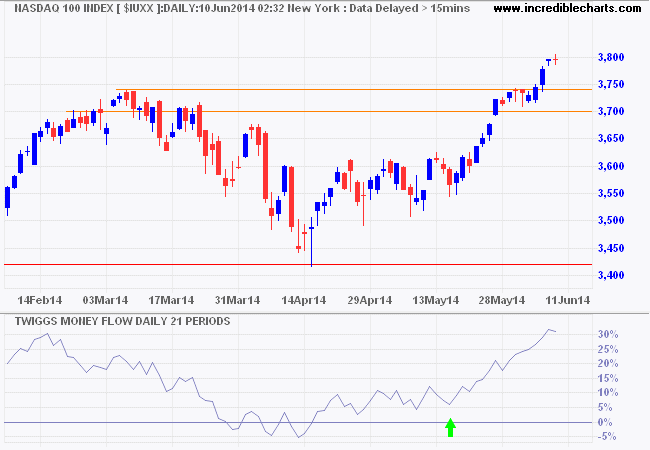

The Nasdaq 100 broke resistance at 3700/3750, signaling an advance to 4000*. Rising 21-day Twiggs Money Flow again indicates strong medium-term buying pressure. Reversal below 3700 is unlikely, but would warn of another correction.

* Target calculation: 3700 + ( 3700 - 3400 ) = 4000

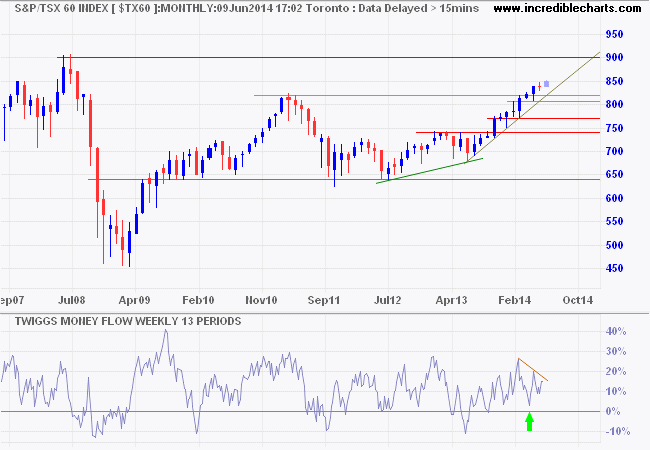

A monthly chart shows Canada's TSX 60 headed for its 2008 high of 900 after breaking resistance at 820. Bearish divergence on 13-week Twiggs Money Flow appears secondary, in line with the medium-term consolidation, but a further decline would warn of a correction. Reversal below support at 830 and the rising trendline is unlikely, but would indicate that the primary trend is slowing.

Everyone is prone to cognitive errors. Some more than others, but no one is exempt. Coming to terms with the idea that you are your own worst enemy is the single most important thing you can do to become a better investor.

~ Morgan Housel: 15 Biases That Make You Do Dumb Things With Your Money