Selling pressure continues but the primary trend is up

By Colin Twiggs

April 23rd, 2014 9:00 p.m. EDT (11:00 a:m AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

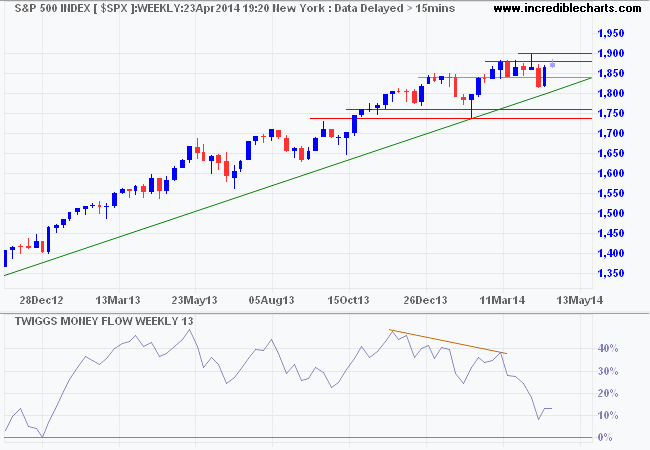

The S&P 500 is testing resistance at 1880 and follow-through above 1900 would signal another primary advance. Bearish divergence on 13-week Twiggs Money, however, continues to warn of selling pressure and another secondary correction remains likely. But the primary trend is up.

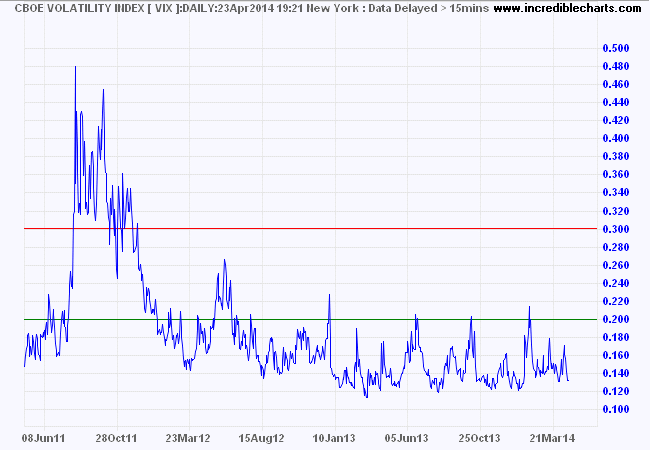

VIX below 14 suggests low risk typical of a bull market.

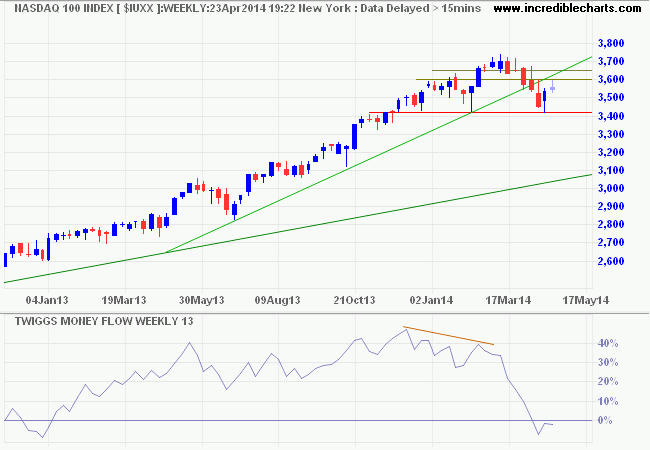

The Nasdaq 100 is testing resistance at 3600/3650. Breakout would suggest another advance, while respect would be cause for concern. Reversal below 3400 would complete a head and shoulders reversal with a target of 3100* at the primary trendline. 13-Week Twiggs Money Flow below zero indicates strong selling pressure.

* Target calculation: 3400 + ( 3700 - 3400 ) = 3100

I would suggest that even a Nasdaq fall to 3100 would not disrupt the bull market. Penetration of the primary trendline at 3100, however, would be cause for concern.

The quality of a person's life is in direct proportion to their commitment to excellence, regardless of their chosen field of endeavor.

~ Vince Lombardi