Nasdaq leads market higher

By Colin Twiggs

February 17th, 2014 3:30 am ET (7:30 pm AEDT)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

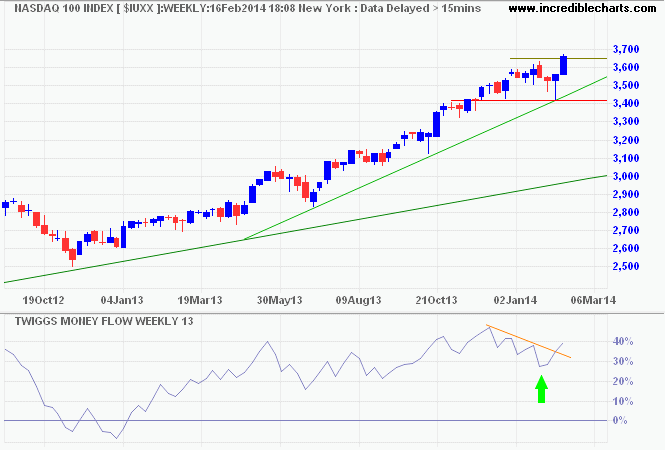

The Nasdaq 100 broke through its January high, signaling an advance to 3800*. Retreat below the (secondary) rising trendline is unlikely, but would test primary support at 3400. Another 13-week Twiggs Money Flow trough high above zero indicates strong buying pressure.

* Target calculation: 3600 + ( 3600 - 3400 ) = 3800

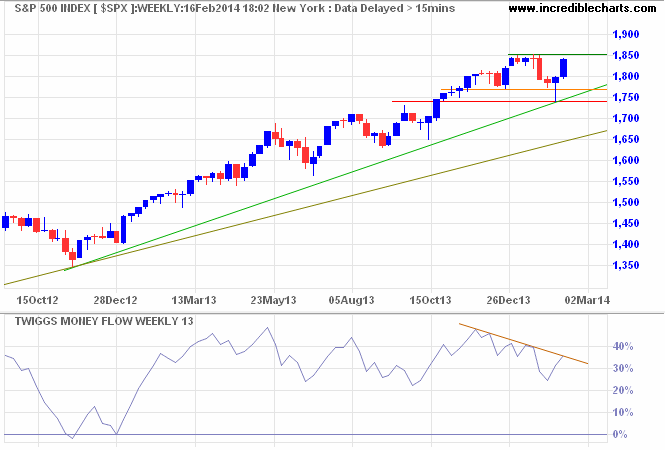

The S&P 500 is testing similar resistance at 1850. Breakout would signal an advance to 1950*. Respect is unlikely, given the Nasdaq breakout, but would warn of another correction. Completion of a 13-week Twiggs Money Flow trough above zero would be a bullish sign.

* Target calculation: 1850 + ( 1850 - 1750 ) = 1950

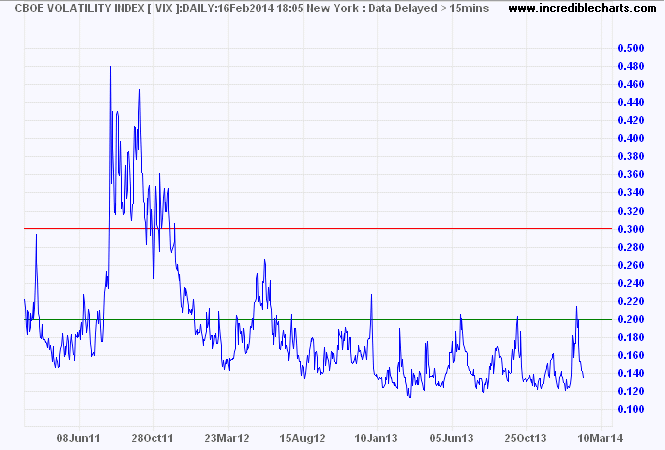

CBOE Volatility Index (VIX) below 20 suggests low risk typical of a bull market.

The truth about that 1929 Dow chart that everyone is passing around | Business Insider

While legislation can stimulate and encourage, the real creative ability which builds up and develops the country, and in general makes human existence more tolerable and life more complete, has to be supplied by the genius of the people themselves. The Government can supply no substitute for enterprise.

~ Calvin Coolidge