Muted ASX response to Asian bulls

By Colin Twiggs

November 26th, 2013 1:00 a.m. ET (5:00 p.m. AEDT)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

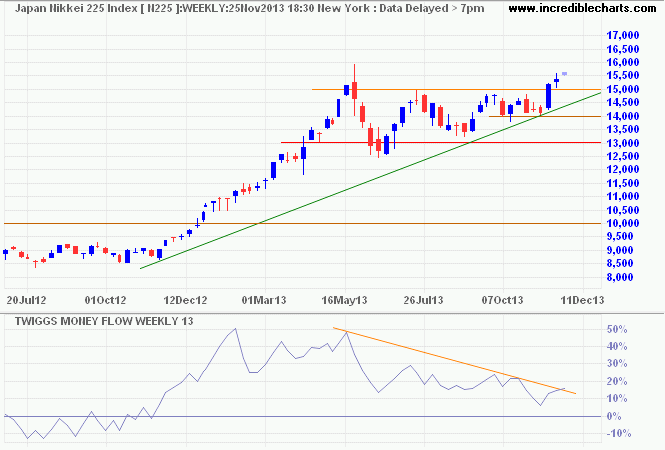

Japan's Nikkei 225 is likely to retrace to test its new support level at 15000. Respect would negate the bearish divergence on 13-week Twiggs Money Flow and confirm the long-term target of 17500*. Reversal below the rising trendline, however, would warn of a correction to 12500/13000.

* Target calculation: 15000 + ( 15000 - 12500 ) = 17500

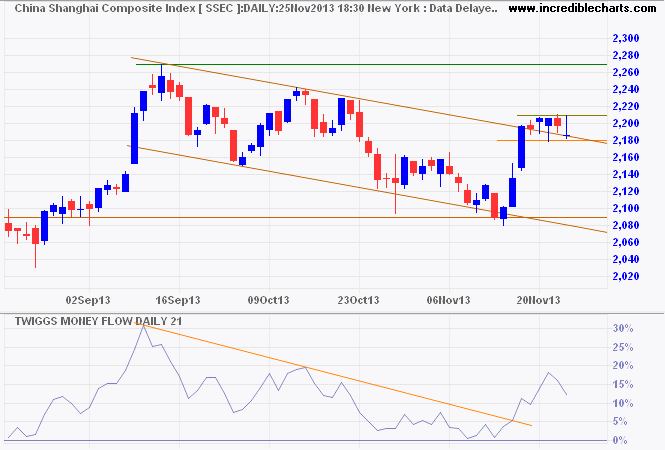

Narrow consolidation at China's Shanghai Composite upper trend channel suggests continuation of the rally. Follow-through above 2210 would signal a test of 2270. Reversal below 2180 is less likely, but would indicate a down-swing to the lower channel. The 21-day Twiggs Money Flow trough above zero suggests medium-term buying pressure. Breakout above 2270 would signal a primary up-trend.

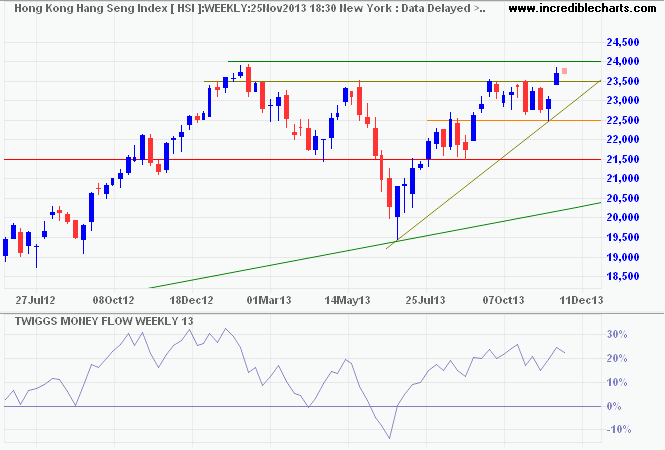

Hong Kong's Hang Seng is likely to retrace to test the new support level at 23500. Respect would confirm an advance to 25500*, signaling a primary up-trend. Follow-through above 24000 would confirm. Rising 13-week Twiggs Money Flow indicates medium-term buying pressure. Reversal below 23500 is unlikely, but would warn of another test of 22500.

* Target calculation: 23500 + ( 23500 - 21500 ) = 25500

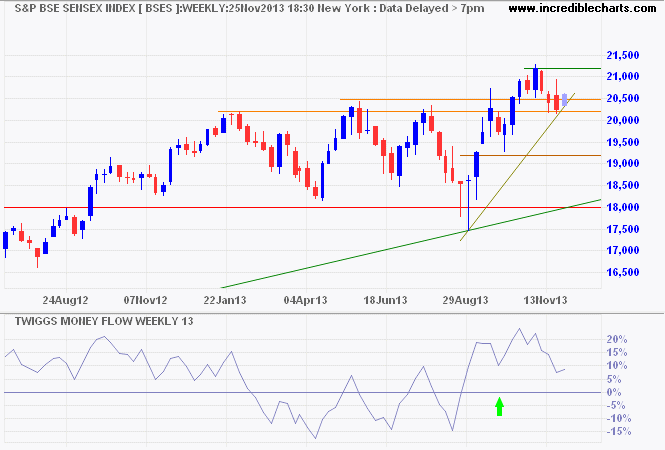

India's Sensex is again rallying after testing support at 20200. Breakout above its 2007/2010 highs at 21000 would confirm the primary advance, offering a target of 24000*. Another 13-week Twiggs Money Flow trough above zero would strengthen the signal. Reversal below 20200 is unlikely, but would warn of a correction to the rising trendline and primary support at 18000.

* Target calculation: 21000 + ( 21000 - 18000 ) = 24000

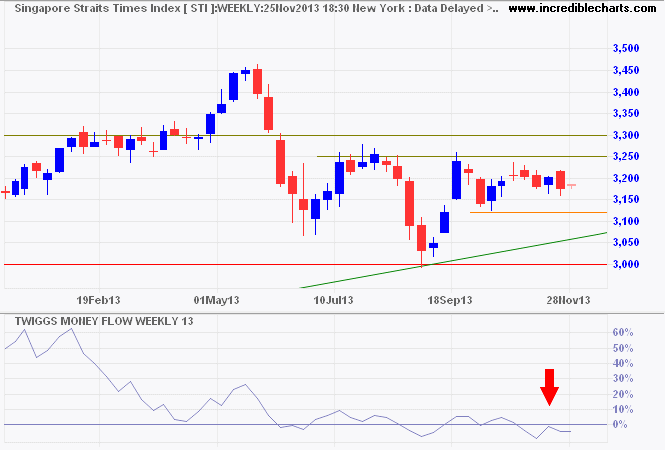

Singapore's Straits Times Index is struggling with resistance at 3250/3300. 13-Week Twiggs Money Flow below zero continues to warn of selling pressure. Breakout above 3300 is unlikely at present, but would signal a primary advance to 3600*. Reversal below 3120 would warn of another correction to primary support at 3000.

* Target calculation: 3300 + ( 3300 - 3000 ) = 3600

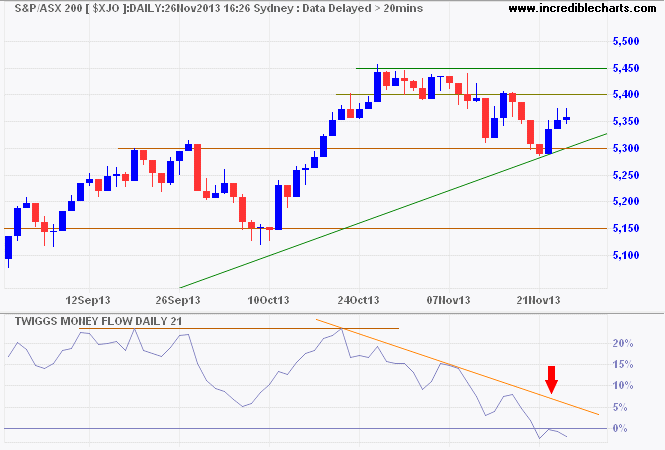

The ASX 200 continues to encounter selling pressure, with 21-day Twiggs Money Flow below zero. Reversal below the rising trendline and short-term support at 5290 would signal a correction. Breakout above 5400 is less likely, but would suggest an advance to 5600*. Follow-through above 5450 would confirm.

* Target calculation: 5450 + ( 5450 - 5300 ) = 5600

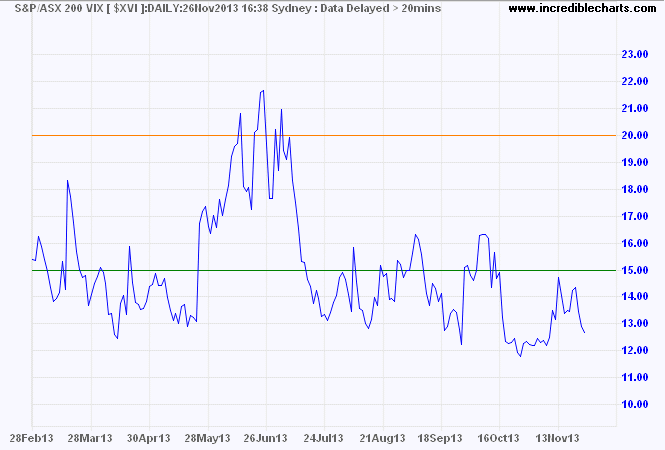

Readings on the ASX 200 VIX index are more bullish, suggesting relatively low market risk.

Moral excellence is concerned with pleasure and pain; because of pleasure we do bad things and for fear of pain we avoid noble ones. For this reason we ought to be trained from youth, as Plato says: to find pleasure and pain where we ought; this is the purpose of education.

~ Aristotle