Rising interest rates drive gold through support

By Colin Twiggs

November 21st, 2013 1:30 a.m. ET (5:30 p:m AEDT)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

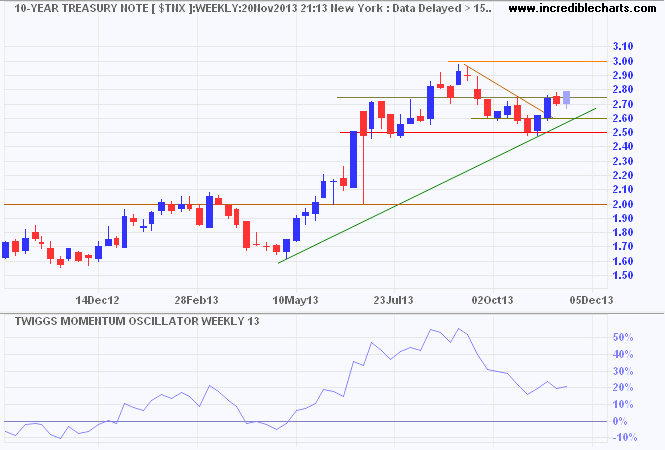

The yield on ten-year Treasury Notes followed through above 2.75, indicating a fresh primary advance, with a target of 3.50 percent*. Breakout above 3.00 percent would confirm. Completion of a 13-week Twiggs Momentum trough above zero (recovery above say 30%) would strengthen the signal. Reversal below the rising trendline is unlikely, but would warn of another test of 2.50.

* Target calculation: 3.00 + ( 3.00 - 2.50 ) = 3.50

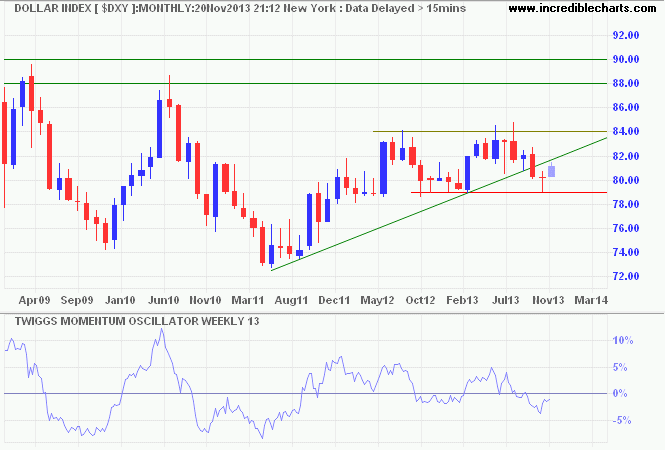

Dollar Index

Rising interest rates would strengthen the dollar. The Dollar Index rallied off support at 79 on the monthly chart, suggesting a test of 84. Breach of the rising trendline, however, still warns of trend weakness, and 13-week Twiggs Momentum respect of the zero line (from below) would strengthen the signal.

* Target calculation: 79 - ( 84 - 79 ) = 74 or 84 + ( 84 - 79 ) = 89

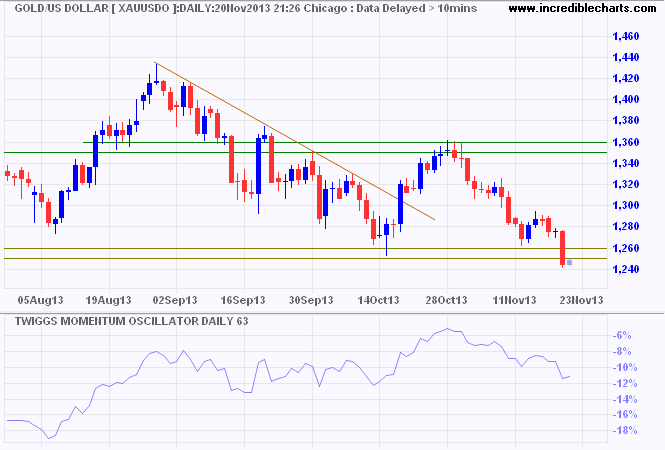

Gold

Rising interest rates and a stronger dollar weaken gold. Spot gold broke support at $1250/ounce, signaling a primary down-trend. A 63-day Twiggs Momentum peak below zero strengthens the signal. Follow-through below the next support level, the June low of $1200, would confirm. Recovery above $1260 is unlikely, but would warn of a bear trap.

* Target calculation: 1250 - ( 1350 - 1250 ) = 1150

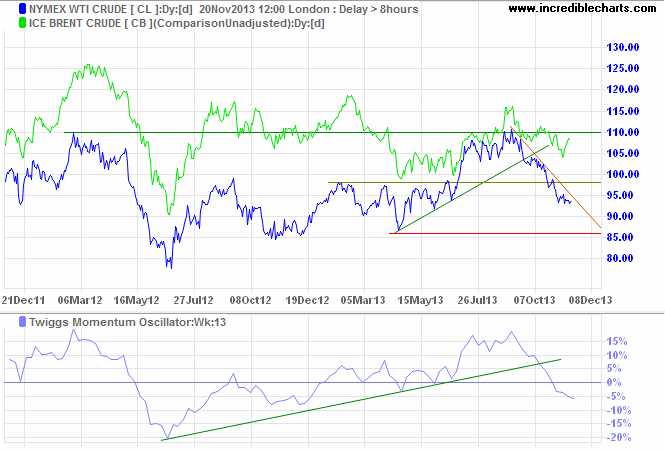

Crude Oil

Nymex crude is undergoing a strong correction. 13-Week Twiggs Momentum crossing to below zero warns of reversal to a primary down-trend; a peak below the zero line would strengthen the signal. Expect strong support at $85/$86 per barrel. Respect of support would mean that Nymex remains in a primary (albeit weak) up-trend. Diverging Brent crude reflects both a strengthening European recovery and continued supply threats in the Middle East.

Commodity Prices

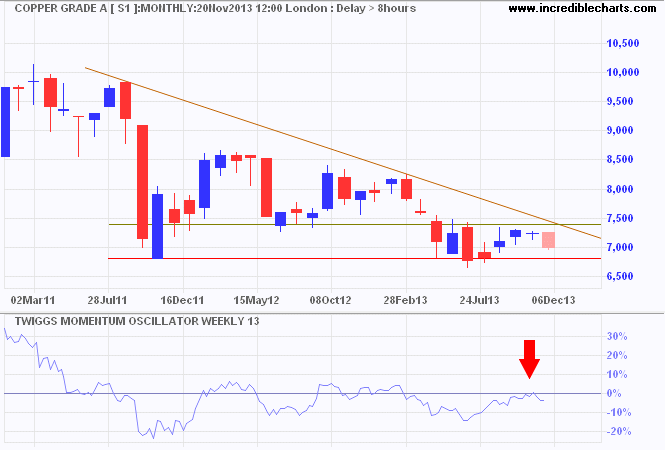

Copper prices, bellwether for the global economy, respected resistance at $7400/$7500 per tonne and are heading for another test of the 2011 lows at $6800/tonne. Downward breakout would signal a primary down-trend, as would completion of a 13-week Twiggs Momentum peak below zero. Recovery above the descending trendline would be a bullish sign for the global economy, while breach of support at $6800 would be bearish.

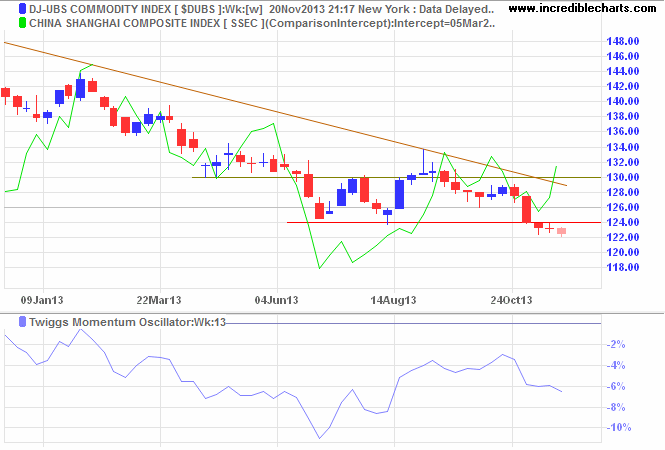

China is a primary driver of commodity prices and a strengthening Shanghai Composite Index has slowed the fall in commodity prices. Dow Jones-UBS Commodity Index broke primary support at 124, but is consolidating in a narrow range below the former support level. Recovery above 124 would be a bullish sign, while follow-through below 122 would indicate a decline to 114*. Completion of a 13-week Twiggs Momentum peak below zero would also suggest a continuing down-trend.

* Target calculation: 124 - ( 134 - 124 ) = 114

When you want to help people, you tell them the truth. When you want to help yourself, you tell them what they want to hear.

~ Thomas Sowell