Forex: Euro and Aussie rise as Dollar weakens

By Colin Twiggs

October 3rd, 2012 3:30 a.m. EDT (5:30 p:m AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

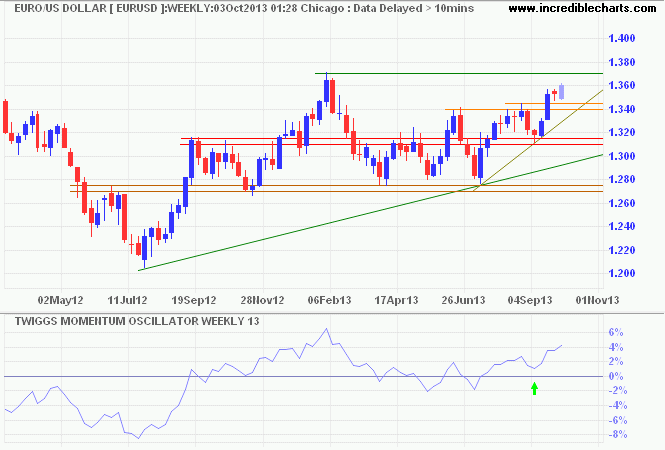

The Euro respected support, on a brief retracement to $1.34/$1.3450, before following through above the last two week's high — signaling a test of the February high at $1.37. Breakout would offer a long-term target of $1.46*. The trough above zero on 13-week Twiggs Momentum indicates a healthy up-trend. Respect of resistance is unlikely, but would warn of another correction.

* Target calculation: 1.37 + ( 1.37 - 1.28 ) = 1.46

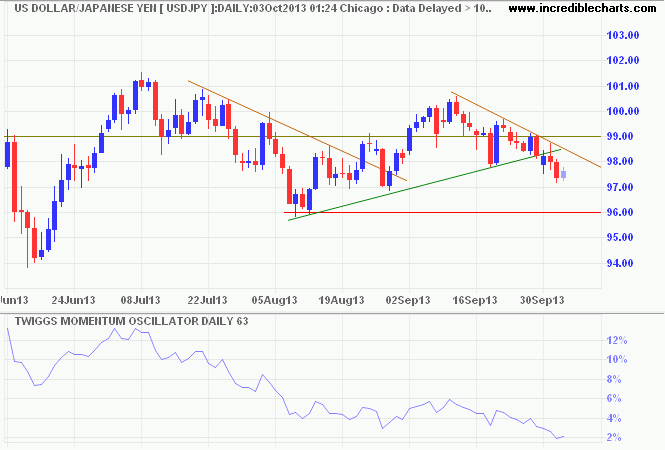

The greenback is heading for a test of primary support at ¥96 after breaking short-term support at ¥98 on the daily chart. Failure of support would offer a target of ¥92*. Reversal of 13-week Twiggs Momentum below zero would also warn of a primary down-trend. Recovery above the descending trendline is unlikely at present, but would indicate a rally to ¥100.50.

* Target calculation: 96 - ( 100 - 96 ) = 92

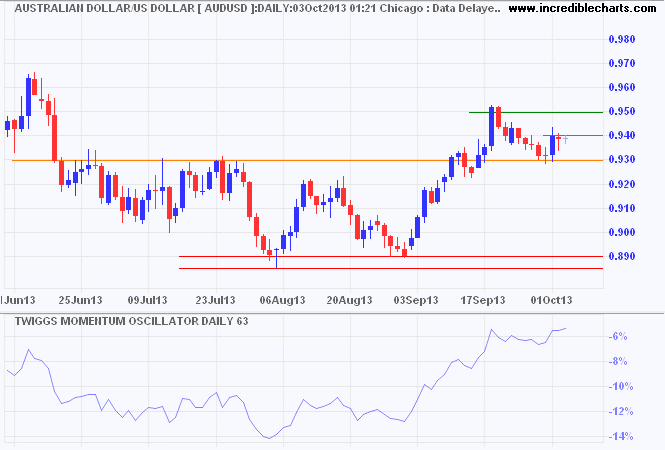

The Aussie Dollar has so far respected support at $0.93 against the greenback. Follow-through above $0.94 would suggest an advance to $0.97; confirmed if resistance at $0.95 is broken. Reversal below $0.93, however, would warn of a correction to primary support at $0.89.

* Target calculations: 0.95 + ( 0.95 - 0.93 ) = 0.97

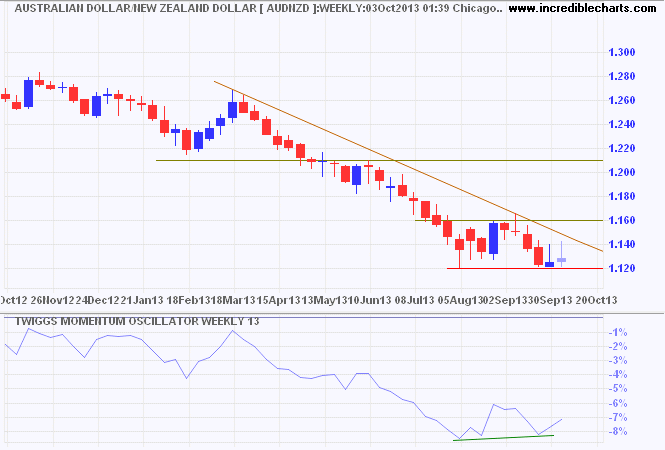

The Aussie continues to test support at $1.12 against its Kiwi neighbour. Tall shadows (wicks) for the last two weeks indicate selling pressure. Failure of support would offer a target of $1.08*. Recovery above the descending trendline is less likely, but would suggest an advance to $1.20; breakout above $1.16 would confirm, completing a double-bottom reversal.

* Target calculations: 1.12 - ( 1.16 - 1.12 ) = 1.08

There are few talents more richly rewarded with both wealth and power, in countries around the world, than the ability to convince backward people that their problems are caused by other people who are more advanced.

~ Thomas Sowell