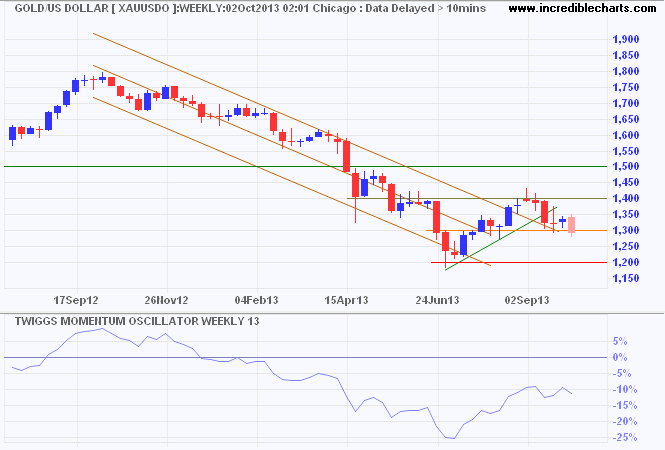

Gold breaks support

By Colin Twiggs

October 2nd, 2013 4:30 a.m. EDT (6:30 p:m AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

Spot gold broke support at $1300/ounce, indicating a test of the primary level at $1200/ounce. Follow-through below $1270 would confirm. Completion of a 13-week Twiggs Momentum peak below zero would be a strong bear signal.

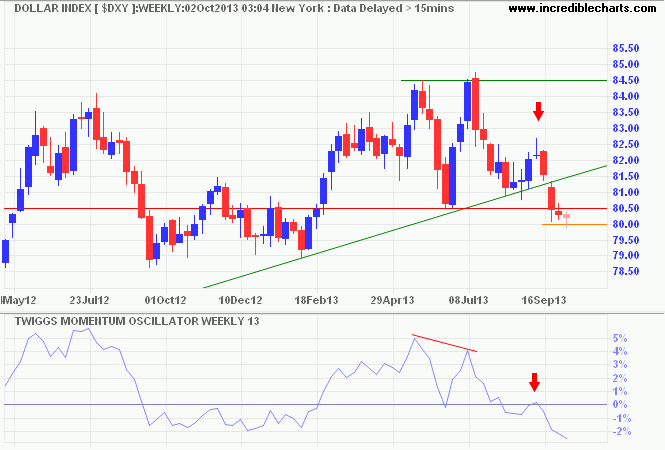

Dollar Index

The Dollar Index is consolidating below the recent primary support level of 80.50. Follow-through below 80 would confirm the primary down-trend. The 13-week Twiggs Momentum peak at zero also signals a down-trend. Recovery above 81 is most unlikely, but would warn of a bear trap.

A falling dollar would boost gold prices.

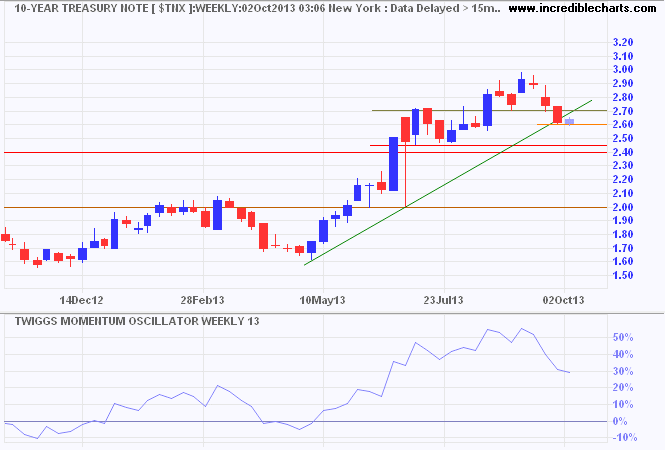

The yield on ten-year Treasury Notes found short-term support at 2.60 percent. Recovery above 2.70 would signal an advance to 3.40 percent. Failure of support, however, would warn of a test of 2.40 percent.

Rising treasury yields would raise the opportunity cost of holding precious metals, exerting downward pressure on prices.

* Target calculation: 3.00 + ( 3.00 - 2.60 ) = 3.40

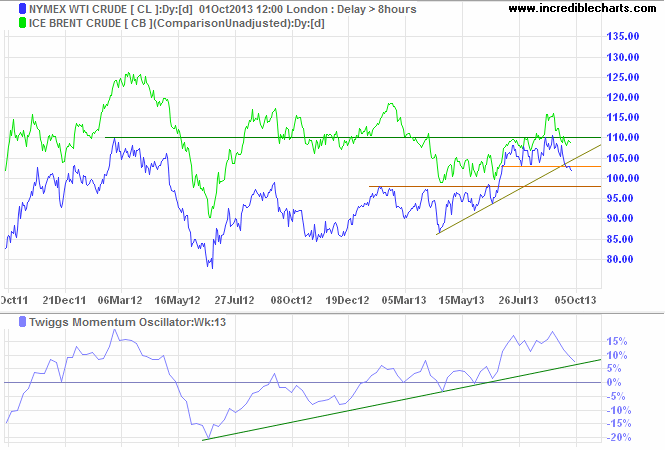

Crude Oil

Nymex light crude broke support at $103/barrel and its rising trendline, warning of a test of medium-term support at $98/barrel. The wider spread with Brent Crude is an indication of continuing tensions over Syria which threaten supply.

Commodities

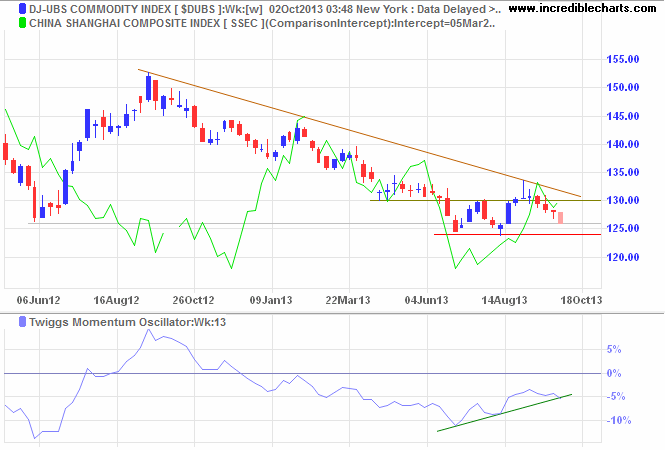

Commodity prices continue to fall, with the Dow Jones-UBS Commodity Index headed for another test of primary support at 124 despite a resilient Shanghai Composite Index. Recovery above 130 is unlikely at present, but would confirm the earlier double-bottom reversal and a primary up-trend.

* Target calculation: 130 + ( 130 - 125 ) = 135

Markets are fundamentally volatile. No way around it. Your problem is not in the math. There is no math to get you out of having to experience uncertainty.

~ Ed Seykota