Gold tests $1350, Crude bullish

By Colin Twiggs

August 14th, 2013 3:30 a.m. EDT (5:30 p:m AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

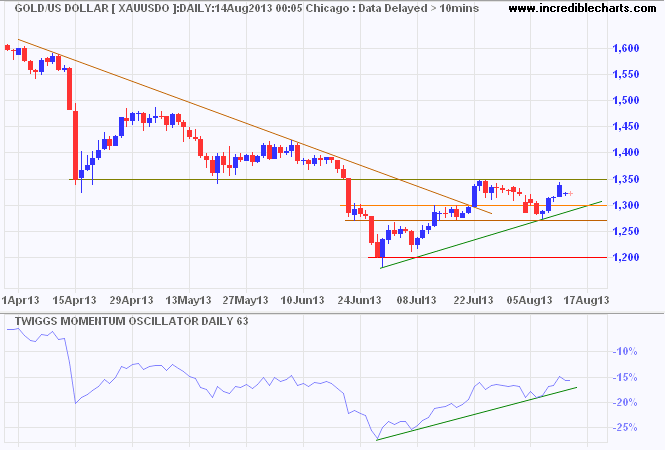

Gold found support at $1270/ounce before rallying to test $1350. Breakout would offer a target of $1430*, but reversal below $1270 is as likely and would signal a re-test of primary support at $1200.

* Target calculation: 1350 + ( 1350 - 1270 ) = 1430

We have switched to a new data supplier for Forex & Precious Metals after recent problems with data reliability. Data is now 10-minute delayed and time-stamped US Central Time (Chicago).

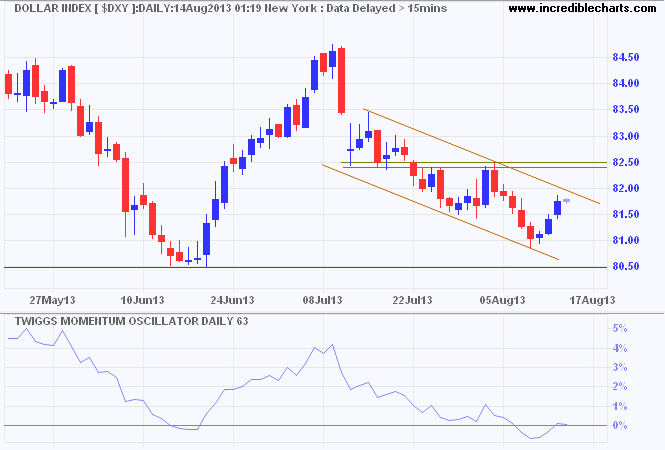

Dollar Index

The Dollar Index remains in a downward trend channel, headed for a test of primary support at 80.50. Bearish divergence on weekly Twiggs Momentum warns of selling pressure. Respect of the upper channel would warn of a down-swing to 80.50. Upward breakout is less likely, but would suggest the correction is ending. Follow-through above 82.50 would strengthen the signal.

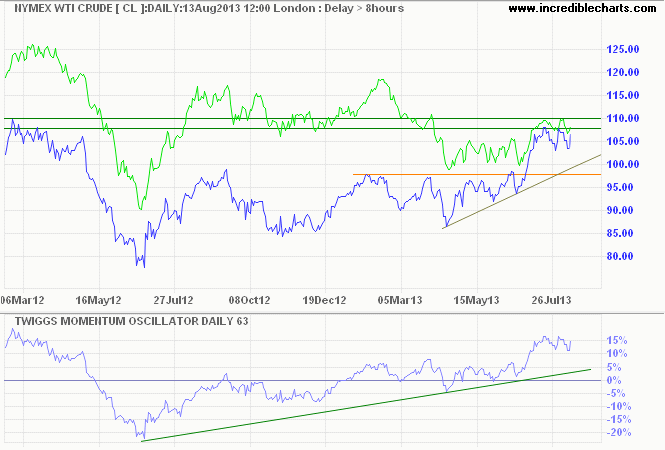

Crude Oil

Nymex WTI light crude is consolidating below resistance at $108/barrel, while Brent crude consolidates below $110. Upward breakout is likely and would signal an advance to $118* and $120 respectively.

* Target calculation: 108 + ( 108 - 98 ) = 118

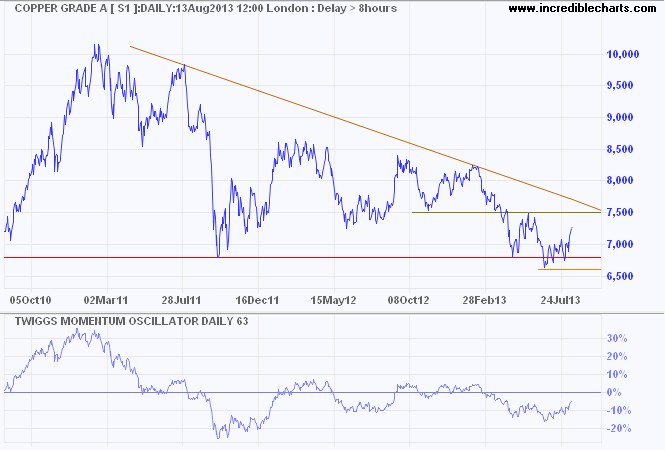

Commodities

Copper respected support at $6600/ton and is rallying to test $7500 and the descending trendline. Upward breakout would suggest that a bottom is forming, while respect would warn of another test of $6600. Momentum oscillating below zero suggests continuation of the primary down-trend. Failure of support at $6600 would confirm.

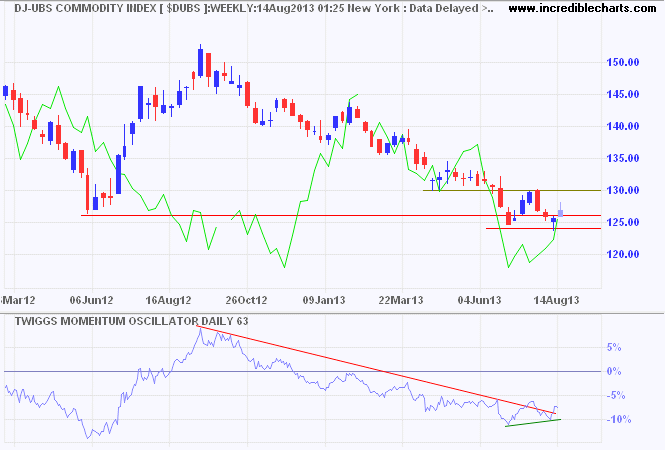

A bear rally on Shanghai Composite Index [lime green] caused a lift in commodity prices. Dow Jones-UBS Commodity Index recovered above long-term support at 126, suggesting a rally to 130. Breakout is unlikely, but would offer a target of 136*. The primary trend is down and reversal below 124 would suggest a long-term decline to the 2009 low at 100*.

* Target calculation: 125 - ( 150 - 125 ) = 100

The average teacher explains complexity; the gifted teacher reveals simplicity.

~ Robert Brault