S&P500 healthy up-trend

By Colin Twiggs

August 12th, 2013 9:00 pm EDT (11:00 am AET)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

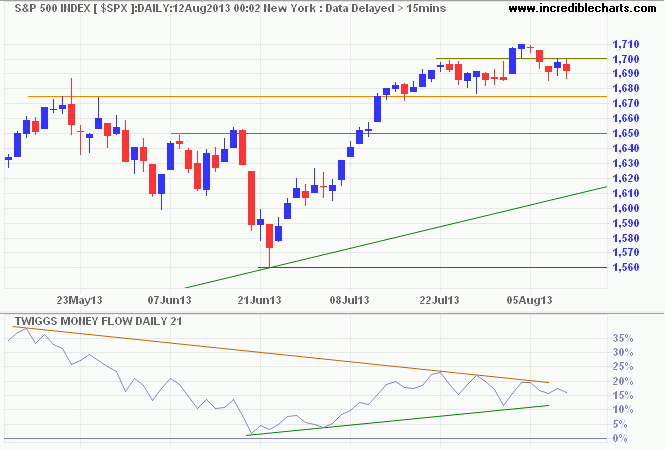

The S&P 500 is again testing resistance at 1700 after a short retracement. Bearish divergence on 21-day Twiggs Money Flow continues to warn of selling pressure, but breakout above 1700 would signal an advance to 1800*. Reversal below 1675 would test support at 1650.

* Target calculation: 1680 + ( 1680 - 1560 ) = 1800

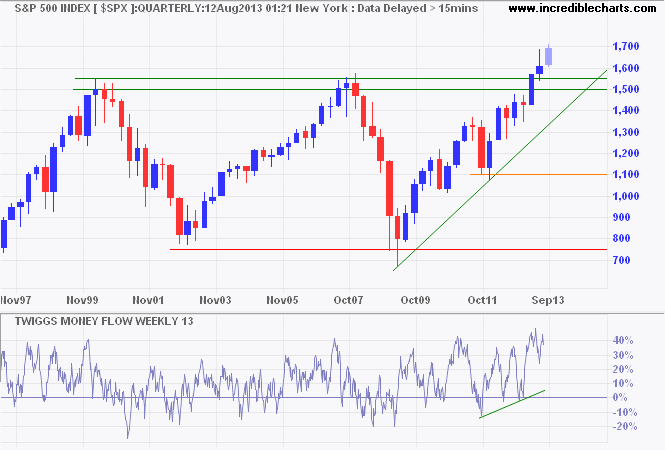

But the primary up-trend shown on the quarterly chart is healthy and, while correction to the rising trendline would be reasonable, trend reversal is unlikely.

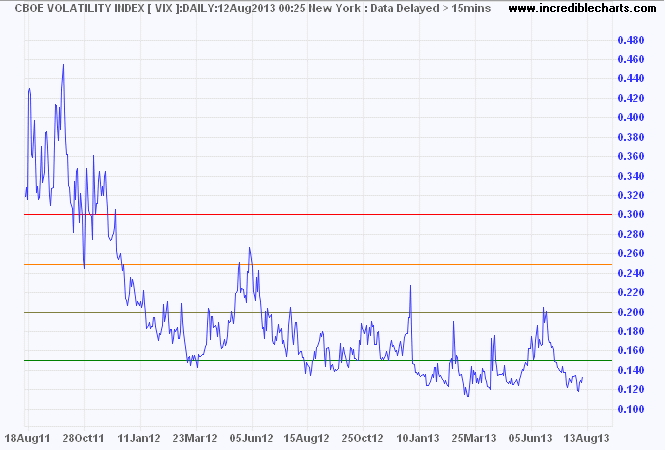

The VIX below 15 indicates low market risk.

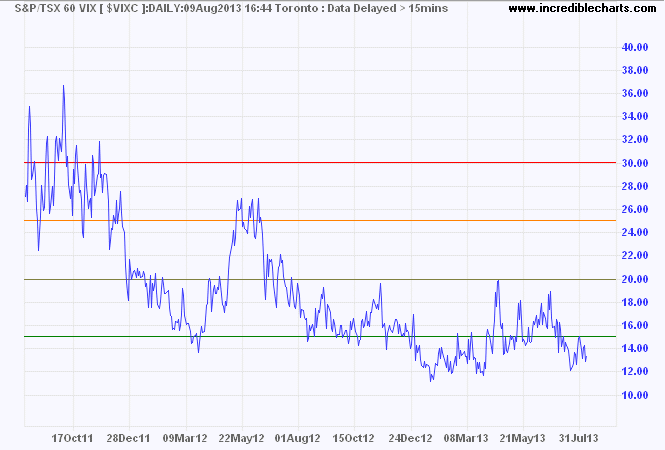

Canada's TSX 60 VIX is similarly bullish.

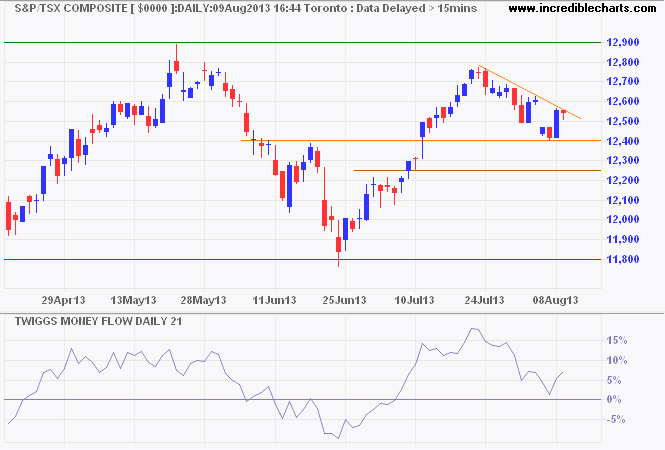

The TSX Composite Index is testing support at 12400. Penetration of the declining trendline would indicate the correction is over and advance to 12900/13000 likely. A 21-day Twiggs Money Flow trough above zero would suggest a healthy up-trend. Breach of support remains as likely, however, and would test 12250. In the long-term, breakout above 12900/13000 would offer a long-term target of 14000*.

* Target calculation: 13000 + ( 13000 - 12000 ) = 14000

The highest stage in moral culture at which we can arrive, is when we recognise that we ought to control our thoughts.

~ Charles Darwin