Dollar bounce, gold and copper retrace

By Colin Twiggs

September 27th, 2012 12:30 a.m. ET (2:30 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

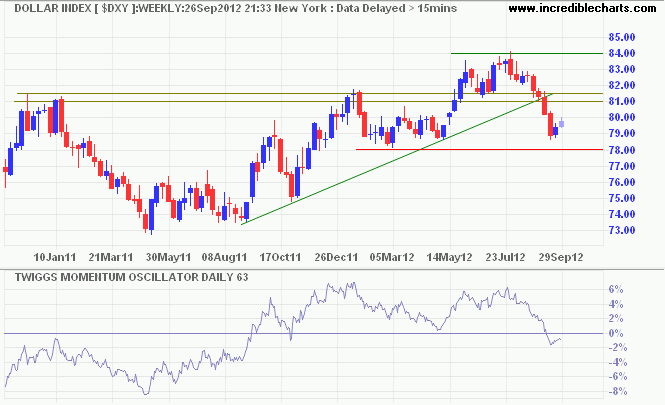

The Dollar Index is retracing to test resistance at 81.00/81.50. Respect would confirm the primary down-trend, as indicated by 63-day Twiggs Momentum below zero.

* Target calculation: 81 - ( 84 - 81 ) = 78

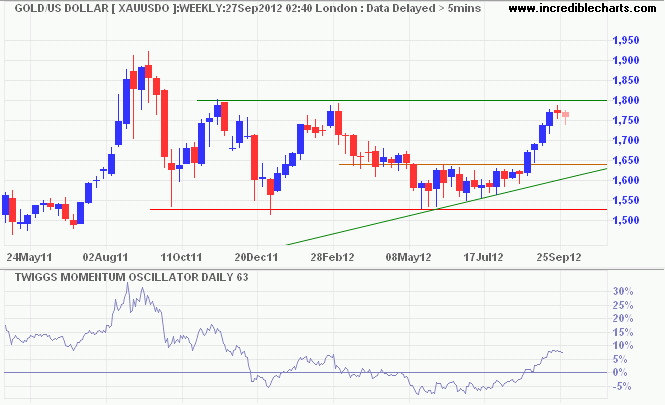

Spot Gold is retracing below resistance at $1800 per ounce*. A 63-day Twiggs Momentum trough above zero would signal a primary up-trend. Breakout above $1800 would confirm, indicating rising inflation expectations in response to QE3.

* Target calculation: 1650 + ( 1650 - 1500 ) = 1800

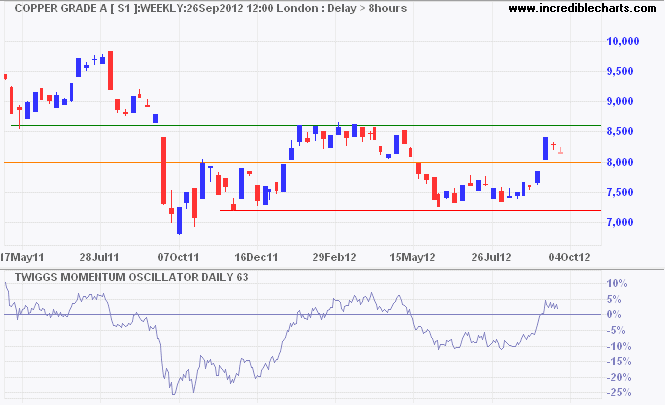

Copper is also retracing. Respect of 8000 would be a bullish sign. Again, a 63-day Twiggs Momentum trough above zero would indicate a primary up-trend. Breakout above 8600 would confirm, indicating that global economic activity is reviving. Failure of support at 8000 would suggest the opposite.

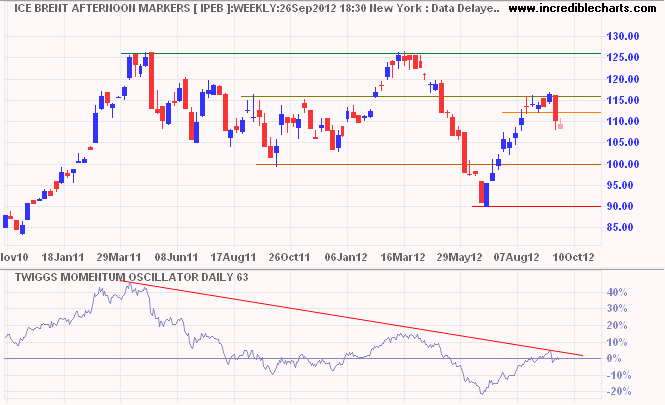

Brent Crude is falling after breaking support at $112 per barrel. 63-Day Twiggs Momentum below zero warns of a primary down-trend. The fall, despite increased inflation expectations, reflects slowing economic activity rather than increased security. Syria and Iran remain concerns in the Middle East. Test of support at $100 would warn of another down-turn.

Government does not solve problems; it subsidizes them.

~ Ronald Reagan