Forex Update

By Colin Twiggs

August 2nd, 2012 2:30 a.m. ET (4:30 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

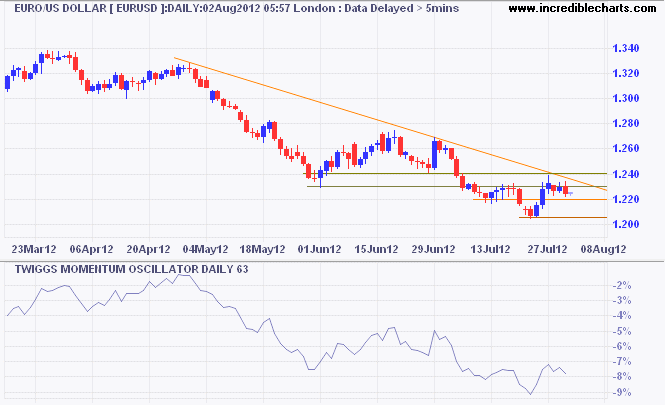

The Euro retreated from resistance at $1.24 to test support at $1.22. Downward breakout would test the 2010 low of $1.19. Declining 63-day Twiggs Momentum continues to indicate a strong down-trend.

* Target calculation: 1.23 - ( 1.27 - 1.23 ) = 1.19

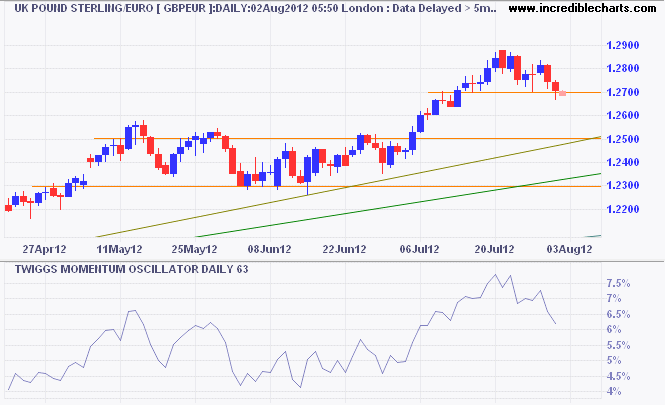

Pound Sterling broke short-term support at €1.27 against the Euro, warning of a correction to €1.25. Respect of support at €1.25, however, would suggest a healthy up-trend.

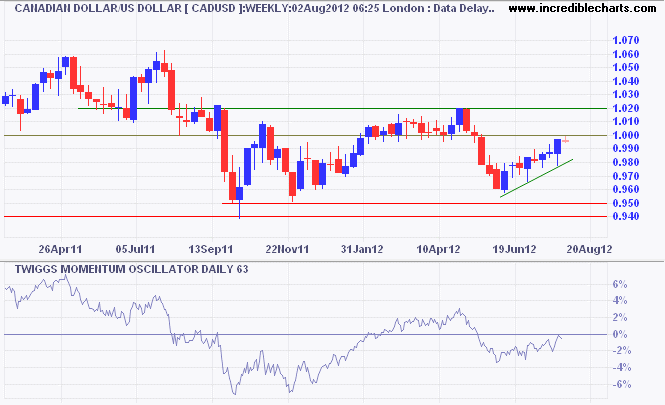

Canada's Loonie is testing parity against the greenback. Breakout would advance to $1.02. Recovery of 63-day Twiggs Momentum above zero would indicate a primary up-trend, while a break above $1.02 would confirm.

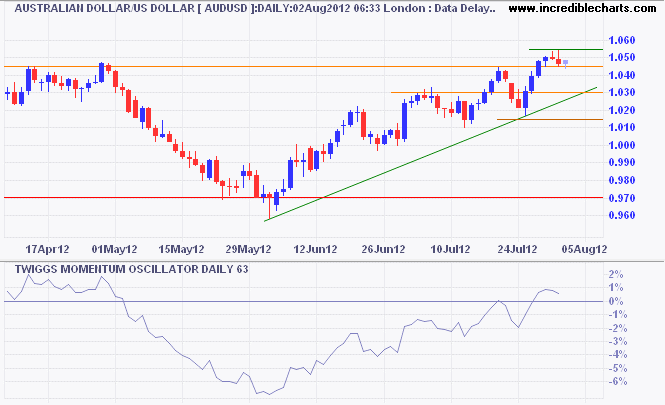

The Aussie Dollar retreated from resistance at $1.05*. Reversal below $1.045 would test the rising trendline but penetration below $1.03 is unlikely. Recovery of 63-day Twiggs Momentum above zero suggests a primary up-trend.

* Target calculation: 1.05 + ( 1.05 - 1.02 ) = 1.08

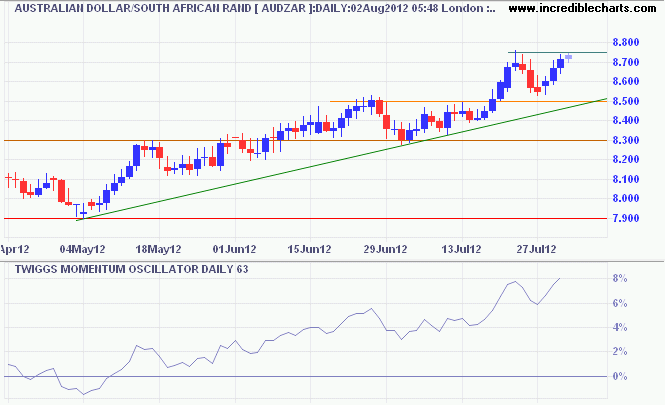

The Aussie Dollar respected support at R8.50 South African Rand before rallying to R8.75. Breakout is likely and would offer a target of R9.00*.

* Target calculation: 8.75 + ( 8.75 - 8.50 ) = 9.00

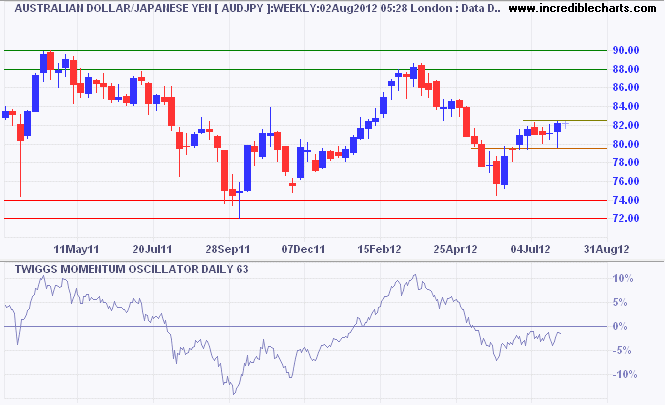

The Australian Dollar is consolidating mid-range (between ¥72 and ¥90) against the Japanese Yen. Breakout above ¥82.50 is likely and would test the upper range border, while reversal below ¥79.50 would test primary support. Recovery of 63-Day Twiggs Momentum above zero would strengthen the bull signal.

There is a strong irony in developing simple methodologies. Certainly, in my experience, the simpler a strategy is, the more robust it is, and the more robust, the better. The irony is that usually the simpler the methodology, the rougher its equity curve. The rougher the equity curve, the harder it is to trade!

~ Brent Penfold: The Universal Principles of Successful Trading