Gold falls as the dollar rallies

By Colin Twiggs

April 5th, 2012 1:00 a.m. ET (3:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

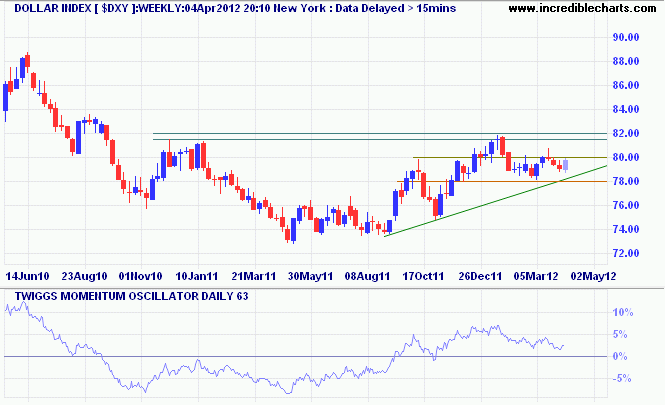

The Dollar Index rallied to test resistance at 80.00. Breakout would indicate respect of the rising trendline and another primary advance. Recovery above 82 would confirm the target of 86*. Respect of the zero line by 63-day Twiggs Momentum would also strengthen the signal.

* Target calculation: 82 + ( 82 - 78 ) = 86

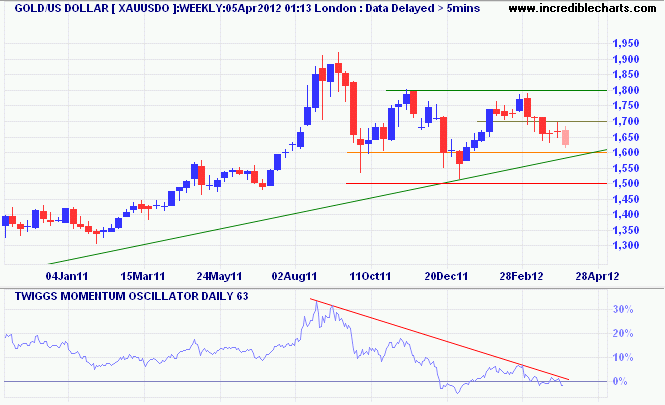

Spot gold responded by testing support at $1600/ounce. Breach of the rising trendline would indicate that the long-term up-trend is weakening. Reversal of 63-day Twiggs Momentum below zero already warns of a primary down-trend. Recovery above $1700 is unlikely but would indicate respect of the rising trendline and continuation of the long-term up-trend.

* Target calculation: 1550 - ( 1800 - 1550 ) = 1300

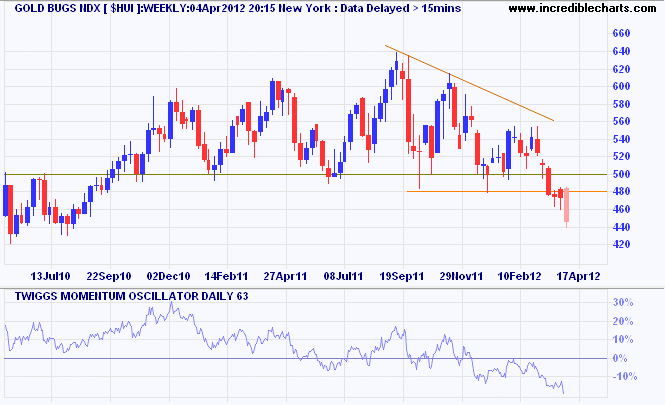

Gold Bugs Index, representing un-hedged gold stocks, is in a clear primary down-trend since breaking support at 500. Peaks below zero on 63-day Twiggs Momentum also signal a strong down-trend. Spot gold is likely to follow unless the Fed changes course and announces further quantitative easing.

When the people fear their government, there is tyranny;

when the government fears the people, there is liberty.

~ Thomas Jefferson