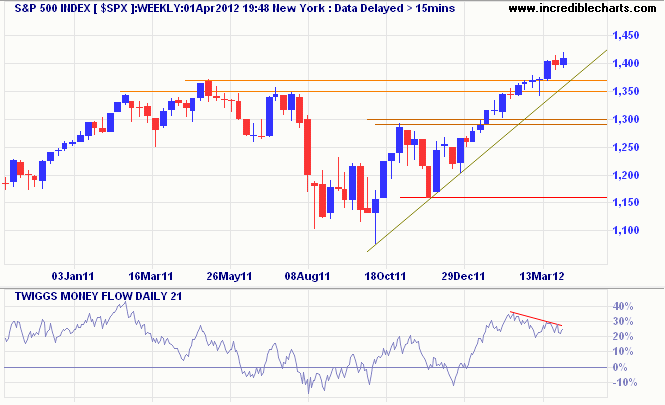

Bearish divergence for US indices

By Colin Twiggs

April 1st, 2012 9:00 p.m. ET (11:00 a.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Bearish divergence on 21-day Twiggs Money Flow warns of medium-term selling pressure on the S&P 500 index. Expect a correction to test support at 1350/1370 unless we see 21-day Twiggs Money Flow recovering above 30%.

* Target calculation: 1300 + (1300 - 1150) = 1450

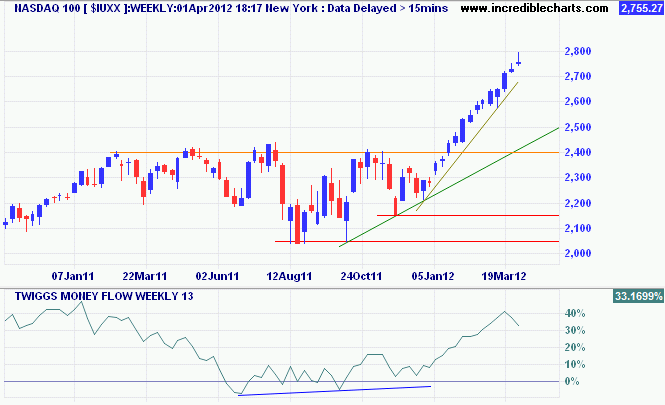

The Nasdaq 100 index encountered resistance at 2800. Bearish divergence on 13-week Twiggs Money Flow over the last two weeks warns of a correction. Breach of the secondary, rising trendline would indicate a correction to the long-term trendline at 2500.

* Target calculation: 2400 + (2400 - 2050) = 2750

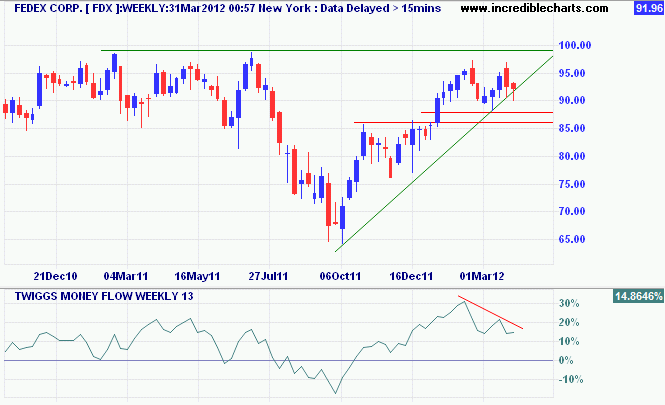

Bellwether transport stock Fedex warns of a double-top reversal. Longer-term bearish divergence on 13-week Twiggs Money Flow warns of strong selling pressure. Breach of support at 88 would signal a primary down-trend — and declining activity in the broader economy.

* Target calculation: 88 - (98 - 88) = 78

My generation of radicals and breakers-down never found anything to take the place of the old virtues of work and courage and the old graces of courtesy and politeness.

~ F. Scott Fitzgerald (1938)