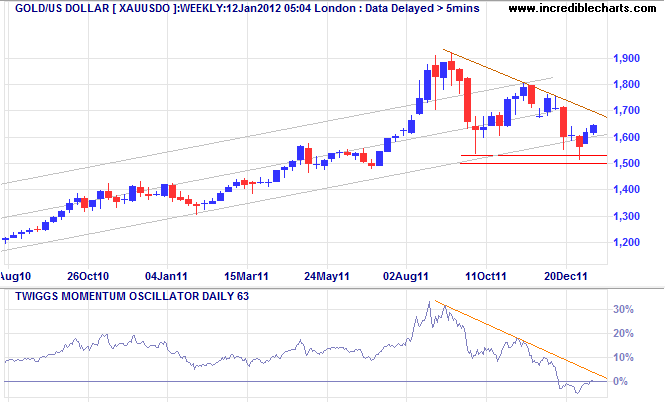

Spot gold finds support

By Colin Twiggs

January 12th, 2011 2:00 a.m. ET (6:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Spot gold found support at $1500/ounce. Failure of this level would confirm a primary down-trend. Breach of the descending trendline would indicate that a base is forming, while recovery above $1800 would indicate a fresh primary advance to $2300*. We are unlikely to witness another bull-trend, however, unless the Fed introduces QE3.

* Target calculations: 1900 + ( 1900 - 1500 ) = 2300

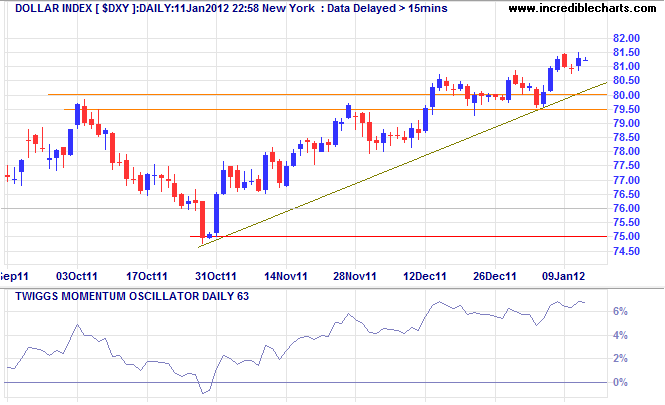

US Dollar Index

The Dollar Index continues in a primary up-trend after twice successfully testing support at 79.50/80.00. Target for the advance is 85.00*.

* Target calculations: 80 + ( 80 - 75 ) = 85

Don't be afraid of missing opportunities. Behind every failure is an opportunity somebody wishes they had missed.

~ Lily Tomlin