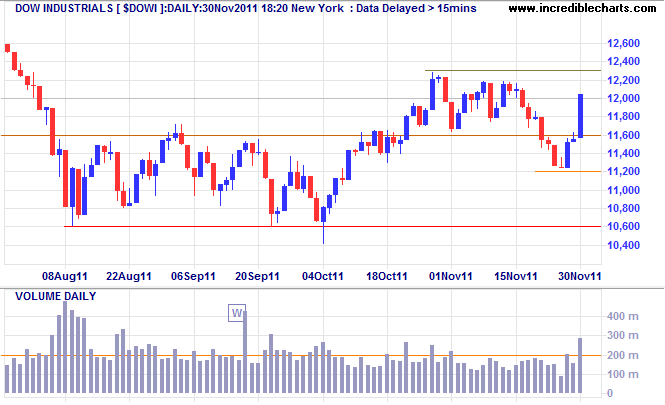

Dow in strong bear rally

By Colin Twiggs

December 1st, 2011 4:00 a.m. ET (8:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Dow Jones Industrial Average rallied strongly in response to news of a European rescue by major central banks. Sharp rallies are typical of shorts covering in a bear market. Strong volume indicates resistance — if you look back over the last few months (ignore triple-witching at [W]) volume above 200 million normally precedes a reversal. Expect selling pressure at 12000 to 12300, leading to a reversal. Breakout above 12300 is unlikely but would be a strong bull signal, indicating that buyers have overcome resistance.

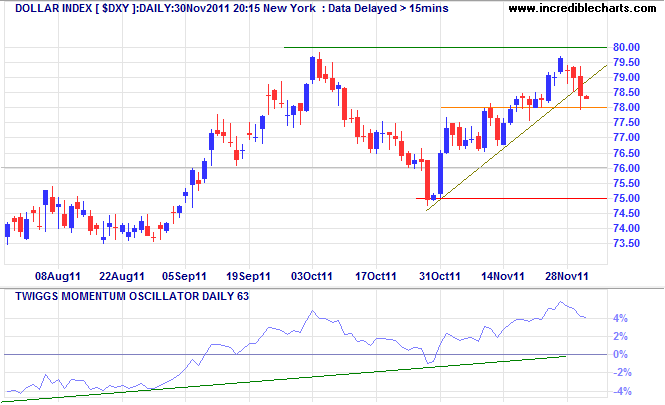

Dollar weakens on euro bank rescue

The Dollar Index is retracing after a strong rally over the last few weeks. Respect of support at 78.00 would indicate buying pressure, favoring a breakout above 80.00. Breakout would signal another primary advance — with a target of 85.00*.

* Target calculations: 80 + ( 80 - 75 ) = 85

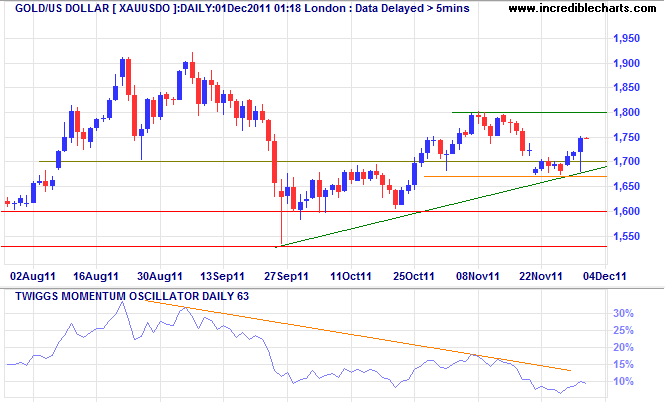

Gold

Spot gold rallied off support at $1670 as the dollar weakened. The primary trend remains upward and breakout above $1800 would signal a test of $1900*. Declining 63-day Twiggs Momentum warns that the trend may be weakening, but only a cross below zero would confirm.

* Target calculation: 1800 + ( 1800 - 1700 ) = 1900

This is a nightmare, which will pass away with the morning. For the resources of nature and men's devices are just as fertile and productive as they were. The rate of our progress towards solving the material problems of life is not less rapid. We are as capable as before of affording for everyone a high standard of life ... and will soon learn to afford a standard higher still. We were not previously deceived. But to-day we have involved ourselves in a colossal muddle, having blundered in the control of a delicate machine, the working of which we do not understand. The result is that our possibilities of wealth may run to waste for a time — perhaps for a long time.

~ John Maynard Keynes: "The Great Slump of 1930"