Dollar surge continues

By Colin Twiggs

November 17th, 2011 4:00 a.m. ET (8:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

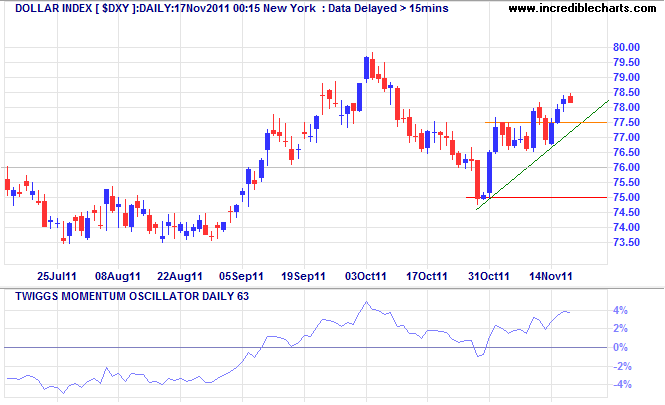

The Dollar Index is headed for a test of resistance at 80* after respecting support at 76.50. The brief dip of 63-day Twiggs Momentum below zero also suggests a primary up-trend. In the long term, breakout above 80 would signal an advance to 85*.

* Target calculations: 77.5 + ( 77.5 - 75.0 ) = 80.0 and 80 + ( 80 - 75 ) = 85

Gold unsettled by stronger dollar

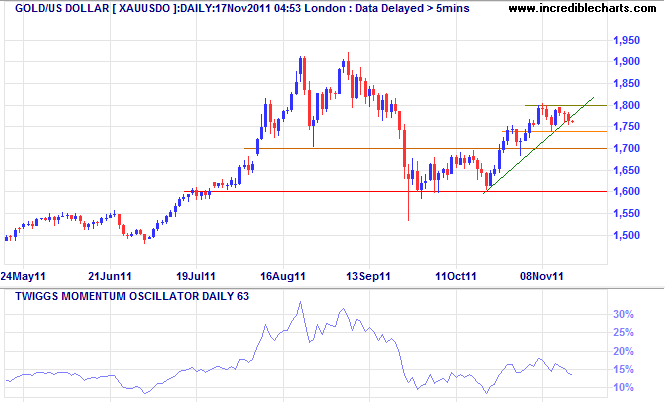

Spot Gold is consolidating between $1740 and $1800, with the rising dollar halting its advance. Penetration of the rising trendline warns that momentum is slowing and breach of support at $1740 would signal another test of $1700.

* Target calculation: 1900 + ( 1900 - 1600 ) = 2200

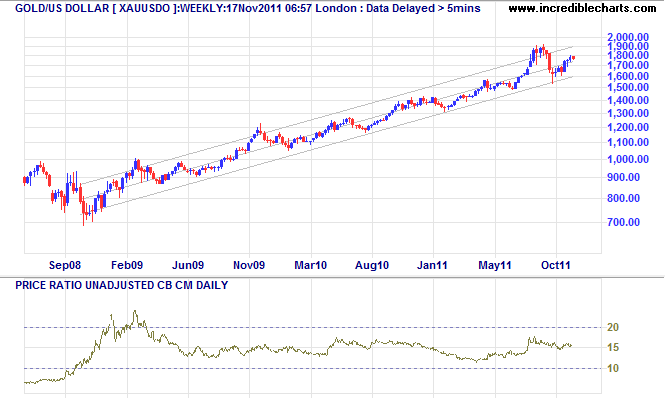

The weekly chart shows gold continuing its long-term ascent in a narrow trend channel. Breakout below $1600 would warn of a reversal.

The gold-oil ratio has fluctuated in a far narrower range since mid-2009 and it may take some years before we see another overbought/oversold signal.

There are two ways to build a successful company. One is to work very, very hard to convince customers to pay high margins. The other is to work very, very hard to be able to afford to offer customers low margins. They both work. We're firmly in the second camp. It's difficult—you have to eliminate defects and be very efficient. But it's also a point of view. We'd rather have a very large customer base and low margins than a smaller customer base and higher margins.

~ Jeff Bezos, CEO of Amazon