Flight to safety

By Colin Twiggs

August 2nd, 2011 11:00 p.m. ET (1:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

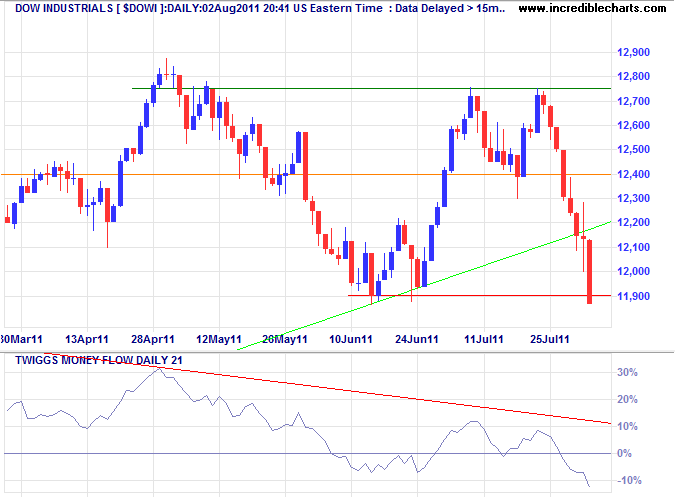

The Dow Jones Industrial Average closed below support at 11900, warning of a primary down-trend. Bearish divergence on 21-day Money Flow has indicated this for some time. The S&P 500 displays a similar breach and follow-through below 1250 would confirm.

* Target calculation: 12000 - ( 12800 - 12000 ) = 11200

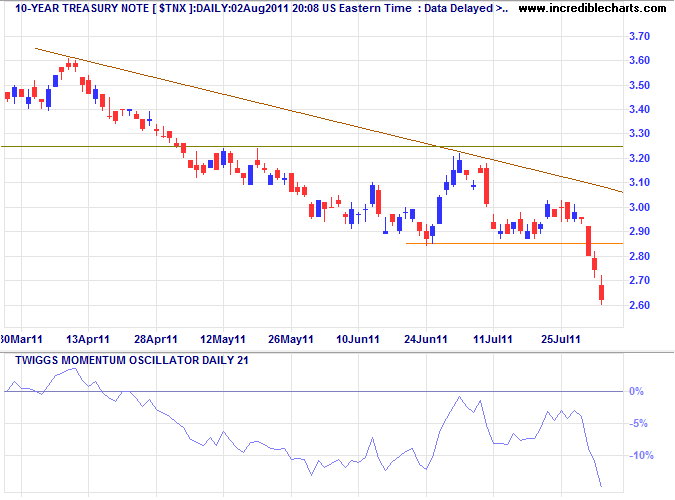

Investor flight to safety is clearly signaled by the sharp fall in 10-year treasury yields. Other safe havens such as gold and the Swiss franc display a corresponding spike over the last few days.

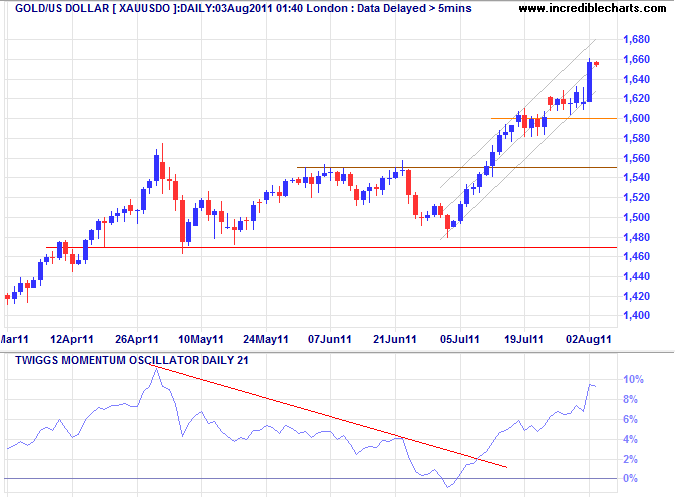

Gold

Spot gold broke through its target of $1650/ounce*. Expect a test of the upper trend channel.

* Target calculation: 1550 + ( 1575 - 1475 ) = 1650

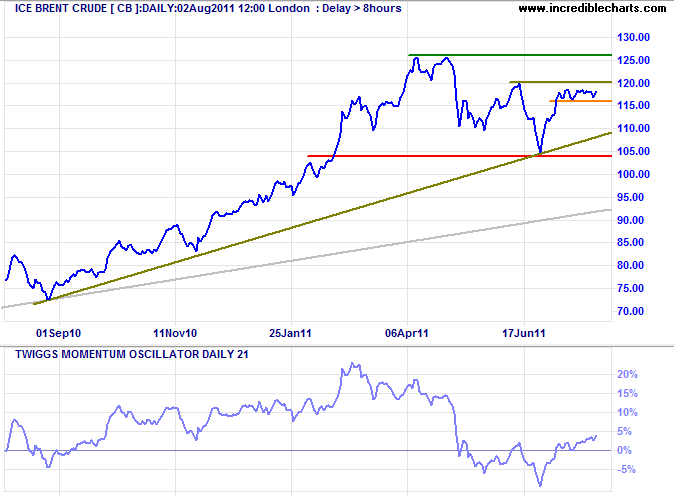

Crude Oil

Brent crude remains in a narrow range between $116 and $120/barrel. Negative outlook on the global economy is likely to weaken demand for crude and another test of primary support at $104 is likely.

* Target calculation: 105 - ( 120 - 105 ) = 90

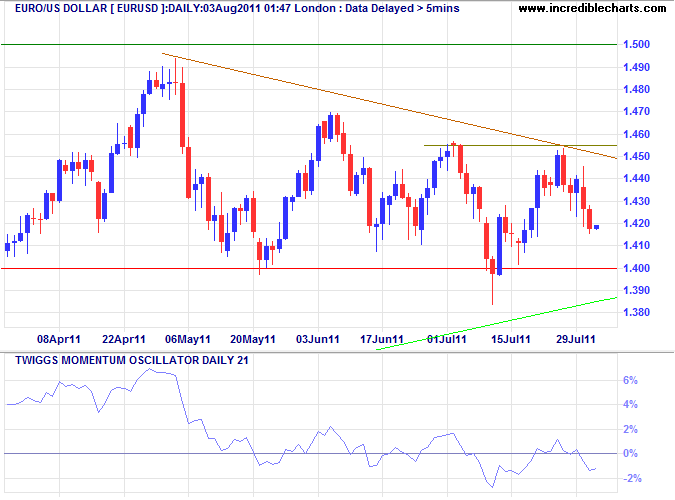

Euro

The euro is headed for another test of primary support at $1.40, but 21-day Momentum oscillating in a narrow range around zero indicates no clear trend. In the long term, breakout below $1.40 would offer a target of $1.30*.

* Target calculation: 1.40 - ( 1.50 - 1.40 ) = 1.30

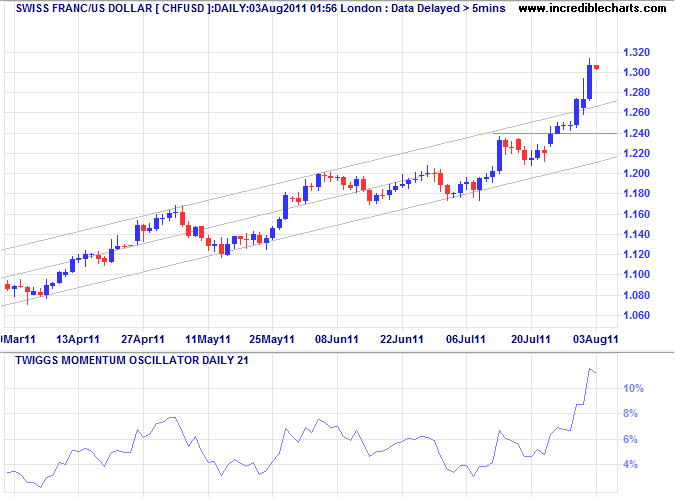

Swiss Franc

The Swiss franc spiked through its upper trend channel against the dollar. Short retracement of 2 to 3 days would indicate an accelerating (exponential) up-trend.

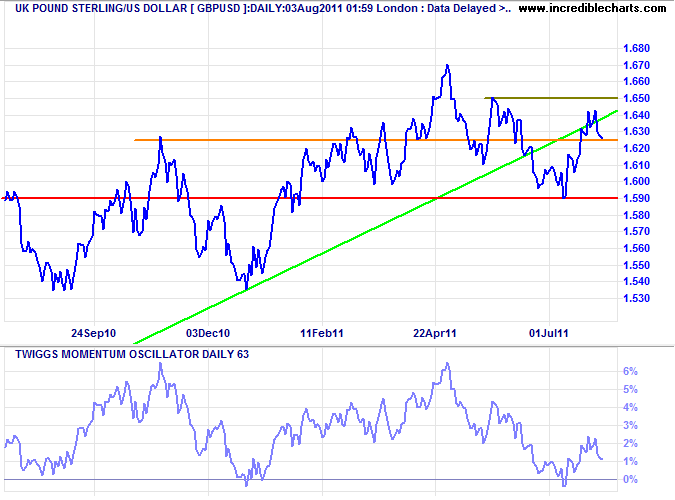

UK Pound Sterling

The pound is testing support at $1.625; failure would signal a correction to primary support at $1.59. Long term, penetration of the rising trendline and bearish divergence on 63-day Momentum both warn of reversal to a down-trend.

* Target calculation: 1.60 - ( 1.67 - 1.60 ) = 1.53

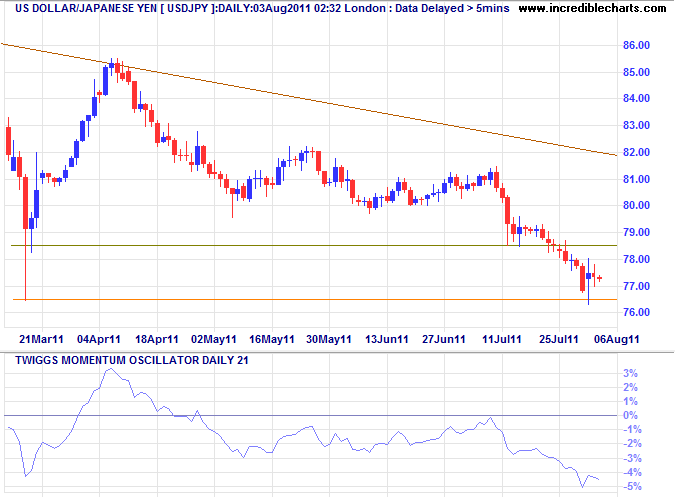

Japanese Yen

The dollar is consolidating above medium-term support at ¥76.50. Failure of support would indicate a test of ¥75*. Declining 21-day Momentum, while below zero, confirms the strong down-trend.

* Target calculation: 80 - ( 85 - 80 ) = 75

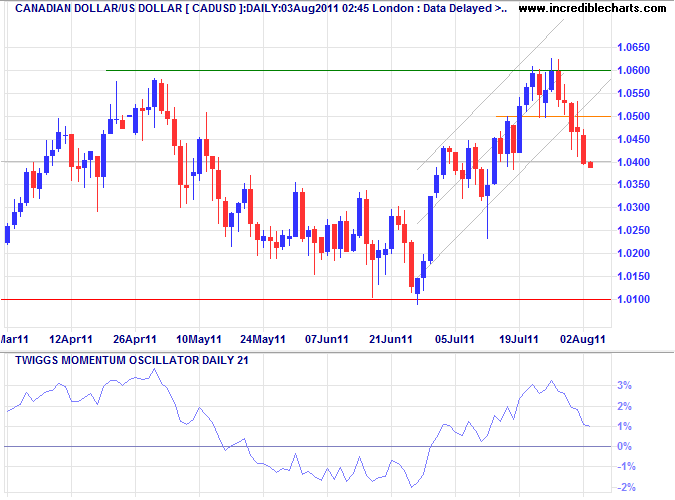

Canadian Dollar

The Loonie broke below its trend channel against the greenback. Follow-through below $1.04 would confirm another test of primary support at $1.01.

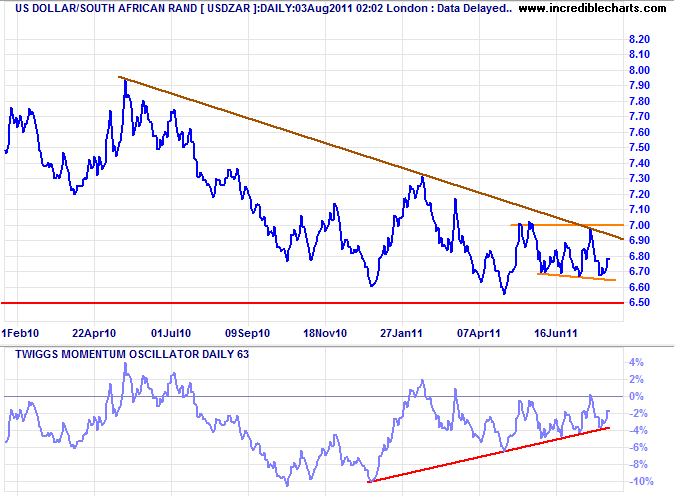

South African Rand

The dollar is consolidating in a broadening wedge against the Rand. The long-term trend is down, but strong support at R6.50 and rising 63-day Momentum suggest reversal to an up-trend. Breakout above R7.00 would confirm.

* Target calculation: 7.00 + ( 7.00 - 6.50 ) = 7.50 or 6.50 - ( 7.00 - 6.50 ) = 6.00

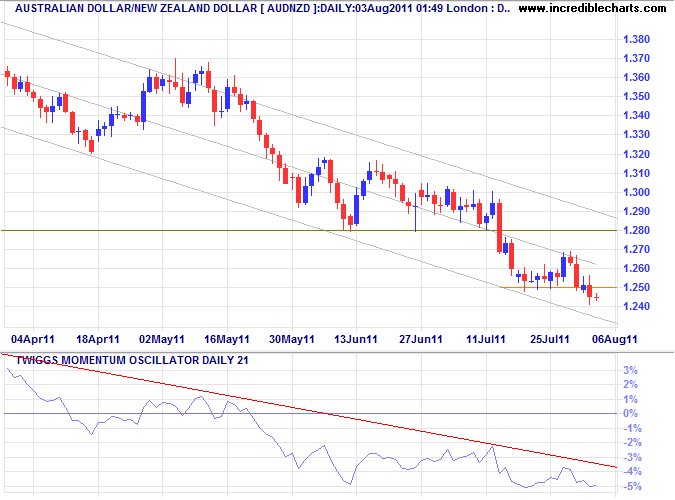

New Zealand Dollar

The Aussie dollar broke support at $1.25 against its Kiwi counterpart, continuing the decline towards its target of $1.22*. Falling 21-day Momentum strengthens the signal.

* Target calculation: 1.30 - ( 1.38 - 1.30 ) = 1.22

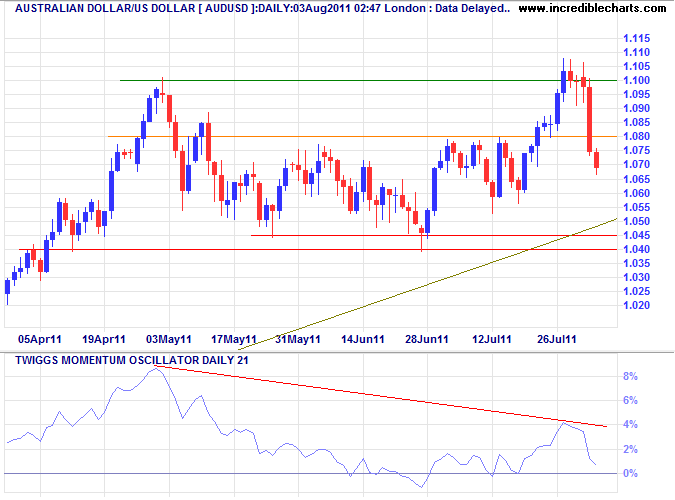

Australian Dollar

The Aussie dollar reversed below $1.10, falling sharply as investors retreated to safer havens. Breach of support at $1.08 indicates a test of primary support at $1.04 against the greenback.

* Target calculation: 1.10 + ( 1.10 - 1.05 ) = 1.15

Essentially, the structure announced today allows both political parties to talk about reform without actually changing anything. To underscore that point, the deal involves less than $25 billion in immediate cuts! This is less than a rounding error in a $3.8 trillion dollar budget. This is politics as usual.

~

Peter Schiff commenting on the latest debt deal